BAE Systems‘ (LSE:BA.) shares have proven to be an excellent source of passive income down the years. Like any stock, this FTSE 100 company comes with risk. But its excellent earnings visibility and strong cash flows gives it the means to consistently pay a decent dividend.

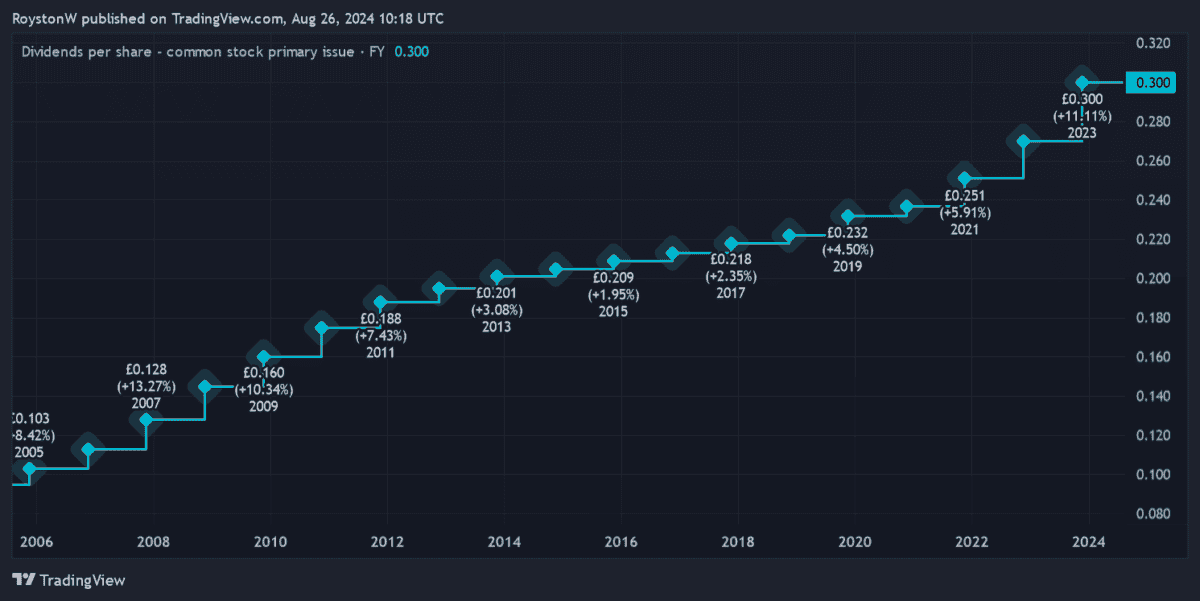

As the chart above shows, BAE Systems’ annual dividend has risen every year since the early 2000s. Payouts continued to rise even during the 2008 financial crisis and, more recently, the Covid-19 pandemic. Very few global shares have managed the same thing.

City analysts expect this trend to continue. In fact, the defence giant’s tipped to keep lifting cash rewards all the way through to 2026, at least.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 32.33p | 8% | 2.5% |

| 2025 | 35.30p | 9% | 2.7% |

| 2026 | 38.47p | 9% | 2.9% |

However, dividends are by no means guaranteed. And past performance isn’t a reliable guide to the future. With this in mind, how realistic do current dividend forecasts look? And should I buy BAE Systems’ shares for my portfolio?

In good nick

The first part of my analysis is quite encouraging. For a variety of reasons, the firm’s predicted dividends through to 2026 look highly achieveable.

To begin with, estimated payouts are covered between 2 times and 2.2 times by expected earnings over the period. Any reading above 2 times provides a wide margin for error, in the event that profits come in lower than predicted.

This is important for defence stocks. Supply chain problems remain a huge issue at the minute, threatening potential revenues. On top of this, contract timings in the arms industry can be notoriously lumpy, affecting earnings from year to year.

Great dividend cover isn’t the only reason to be optimistic over future dividends either. BAE Systems has strong cash flows it can use to keep growing rewards even if the bottom line comes under pressure.

Net debt’s grown to £6.1bn following the acquisition of Ball Aerospace in February. This will be worth keeping an eye on but right now, the balance sheet still looks pretty robust.

Buy or no buy?

Things are looking good for dividend income in the short-to-medium term then. But this alone doesn’t make BAE Systems a stock to buy.

When investing, I look for companies that might provide solid capital appreciation as well as a decent and growing passive income. And I’m seeking ones that can deliver this over the long term, say 10 years and more.

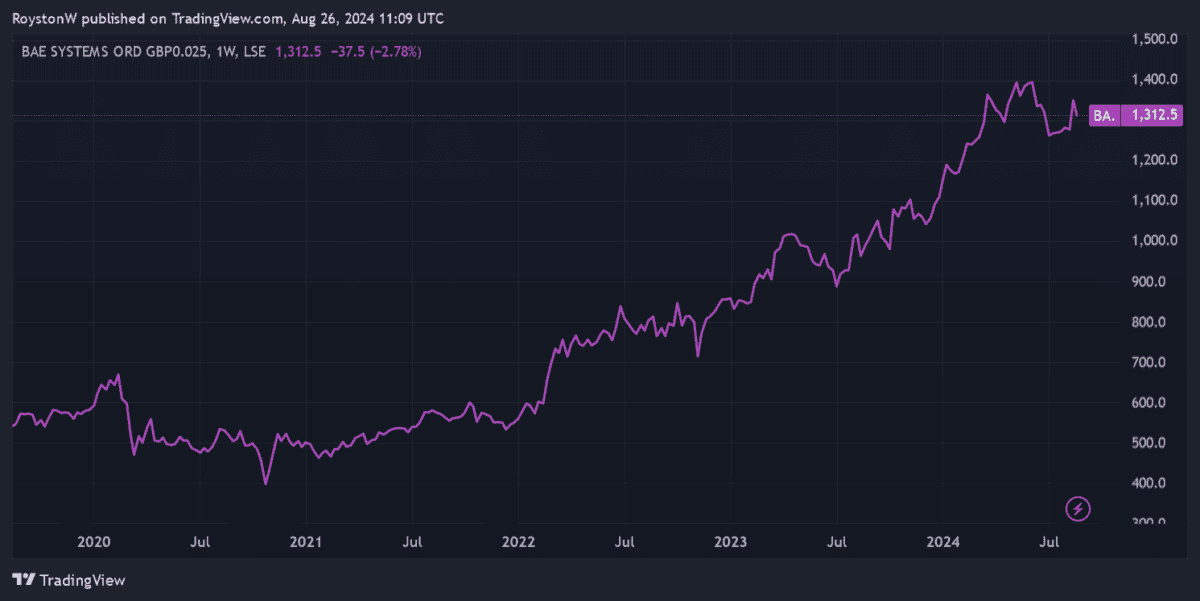

Pleasingly, I think BAE Systems looks good across all these criteria. Its share price has more than trebled during the past decade, driven by soaring arms sales following Russia’s invasion of Ukraine in 2022.

I’m expecting the share price to keep on ascending. Why? Well defence analysts expect weapons spending to continue rising too, amid growing fears in the West over Chinese and Russian expansionism, and the growing conflict in the Middle East.

Researchers at Zion Market Research, for instance, expect the aerospace and defence industry to expand at an annualised rate of 8.2% between 2023 and 2032.

With its expertise across multiple product classes, and its top supplier status with the US and UK, BAE Systems could be one of the best stocks to consider to capitalise on this opportunity.