Of all the stocks I own, my favourite dividend share is Persimmon (LSE:PSN).

That’s because the housebuilder has a long history of returning nearly all of its profits to shareholders. In some industries, having a payout ratio of close to 100% is probably not a good idea. But I don’t think it’s a problem when it comes to building houses.

In most sectors, retaining cash to pay for product innovation or to fund future growth would be considered best practice. But the construction industry has a simple business model. As long as there are sufficient plots of land on which to build, there’s very little additional investment required.

Should you invest £1,000 in Persimmon right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Persimmon made the list?

And in the case of Persimmon, there’s no debt on its balance sheet. Therefore, it doesn’t need to hold on to any of its cash to repay borrowings.

Different times

However, following the post-pandemic downturn in the housing market, the company decided to cut its dividend. Although disappointing, I understand the reasons. I have to accept this is one of the risks associated with investing in a business that operates in a cyclical market.

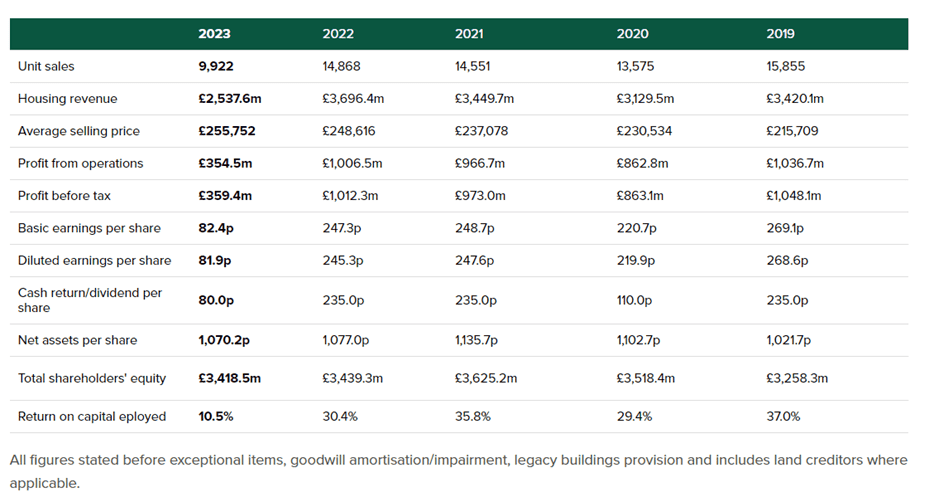

Persimmon’s return to shareholders over the past five years proves the point that dividends are never guaranteed. For the year ended 31 December 2023 (FY23) it paid 60p a share. In respect of FY21, it returned 235p.

That’s a big reduction. When I first invested, the stock was yielding around 9%.

It’s now 3.6%, just below the FTSE 100 average.

Seeing into the future

For FY24, the directors have committed to paying — “as a minimum” — 60p.

This means there’s a possibility that the dividend will be higher than for the previous year. Indeed, the average forecast of analysts is for a payout of 61.25p.

This suggests some are expecting an improvement on 60p, but not by very much.

| Financial year (31 December) | Declared dividend per share (pence) |

|---|---|

| 2019 | 110 |

| 2020 | 235 |

| 2021 | 235 |

| 2022 | 60 |

| 2023 | 60 |

But I have to be honest.

Although the company’s results for the first six months of 2024 hinted at a recovery, I think it’s going to be a while before it’s building enough houses to pay a significantly higher dividend. This year, it expects to complete 10,500 homes. That’s 29% below its 2019-2022 average of 14,712.

And while I welcome the post-election recovery in its share price — it’s up 15% since the new government took office — I must admit I’m a little puzzled.

The Prime Minister has talked a lot about reforming the planning system to get more homes built. But at the moment, I don’t think this is the fundamental problem.

At 30 June 2024, Persimmon owned 38,067 plots with detailed planning permission. The trouble is, very few people want to pay for houses to be put on them.

And until the pace of growth in the UK economy starts to pick up, the demand for new properties is unlikely to change significantly.

Reasons to be cheerful

I hope I don’t sound too gloomy.

Despite the concerns I’ve expressed, I believe Persimmon will deliver again. But I suspect it will take a few years. For FY26, analysts are forecasting earnings per share of 125.8p. That’s still 49% below the 2019-2022 average of 246p.

However, if the company returned most of this to shareholders, it would help re-establish its status — in my mind at least — as one of the best dividend shares around.