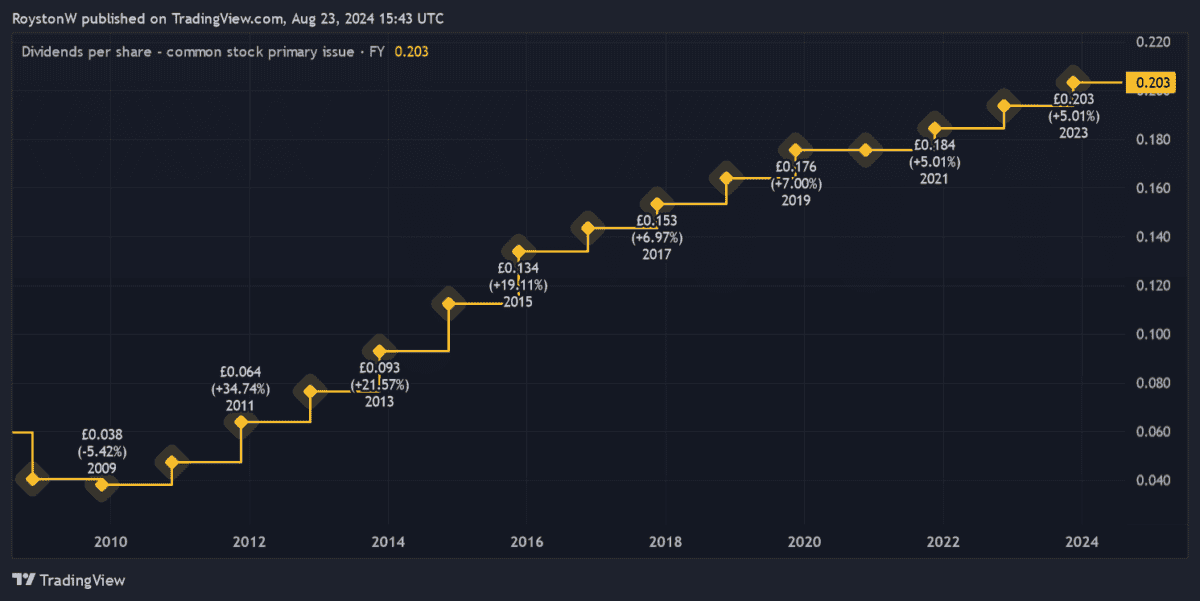

Legal & General’s (LSE:LGEN) proven to be one of the FTSE 100‘s greatest dividend stocks to buy in recent times.

As the chart shows, it’s steadily grown annual payouts since the 2008/2009 financial crisis. The only exception came in 2020. Back then, the company froze dividends in response to the global pandemic.

Its resilience is thanks in part to its diversified business model. Its presence across the life insurance, pension, and asset management sectors helps protect its earnings and supports steady cash flow that are essential for dividends. It’s also thanks to the firm’s strong financial foundations.

Pleasingly, the company’s vowed to raise dividends to 2027, at least. Based on their plans, shareholder payouts will look like this:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 21.36p | 5% | 9.5% |

| 2025 | 21.79p | 2% | 9.6% |

| 2026 | 22.23p | 2% | 9.8% |

As you can see, dividend yields move to within a whisker of double digits, which is a tantalising prospect. However, before buying any dividend share, I need to think about how realistic these forecasts are.

I also need to consider whether further share price weakness could occur that offsets more large dividends. Here’s my take on the financial services giant.

Balance sheet strength

At first glance, Legal & General doesn’t appear to be the safest dividend share out there. This is based on the simple-to-calculate dividend coverage ratio.

Any reading of 2 and above provides a wide margin of safety. Unfortunately, cover over at this Footsie share ranges at 1 times to 1.2 times through to 2026.

On paper, this leaves almost no room for error if earnings disappoint. However, Legal & General still has a rock-solid balance sheet it can call upon to help it pay large dividends.

As of June, the company’s Solvency II capital ratio was an impressive 223%. It has so much cash that the business has also announced a £200m share buyback programme, and vowed similar repurchases in the coming years.

Encouragingly, weak dividend cover is a long-running feature of Legal & General shares. But this hasn’t proved a hurdle to the company reliably growing dividends for more than a decade, as I described above.

Strong fundamentals

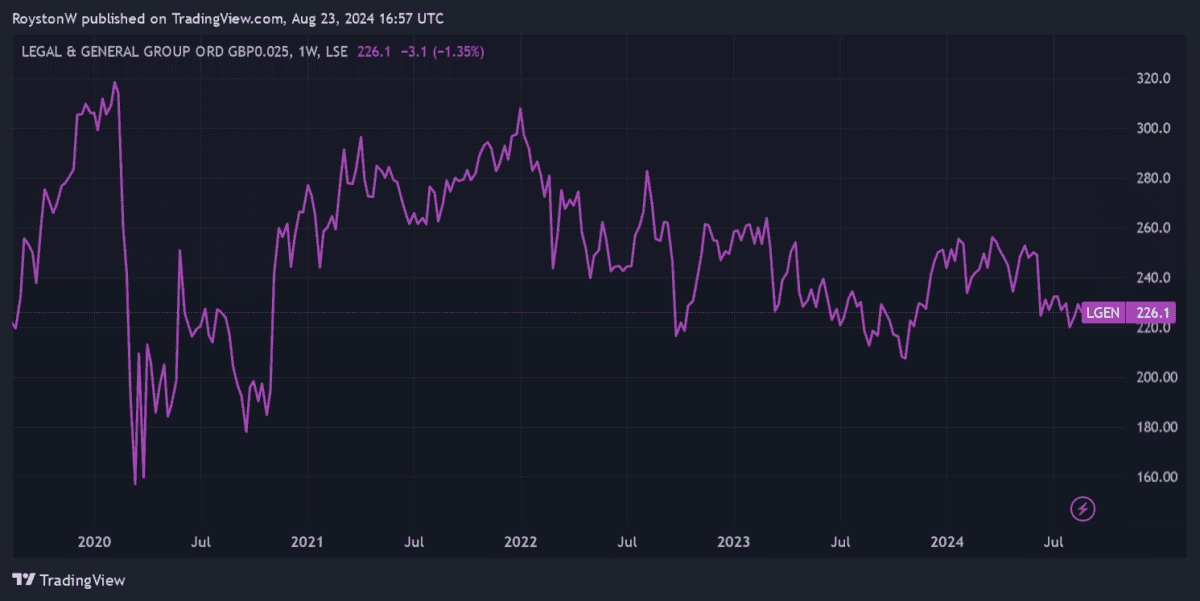

As I also mentioned, I’m also looking for stocks that can maintain or ideally grow their share price. You’ll see from the chart above that Legal & General’s share price has fallen sharply of late.

This chiefly reflects investor unhappiness over the company’s plans to grow dividends at a slower rate between 2025 and 2027. Investors are also concerned over potential execution risks as it revamps its asset management division.

But I strongly believe Legal & General’s shares will rebound strongly. This will be driven by soaring demand for its products due to demographic changes across its markets.

In particular, I’m encouraged by the firm’s ambitious goals for the fast-growing pension risk transfer (PRT) market. It plans to write between £50bn and £65bn worth of business in the UK alone by 2028.

Legal & General will have to overcome tough competition to realise its growth potential. But its status as a market leader across multiple product segments shows it knows how to thrive in a tough climate. I think this is one of the Footsie’s attractive dividend shares to consider right now.