To my mind, the best way to try and create a passive income is to invest in a broad range of UK shares.

Buy-to-let? Rents are growing nicely, but high startup costs and day-to-day management are pretty off-putting for me. Setting up a side-hustle takes too much time and effort.

What about savings accounts? Well, with interest rates falling again, I’m expecting these products to start delivering mediocre returns again.

Should you invest £1,000 in British Land Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if British Land Plc made the list?

Past performance is no guarantee of future returns. But with the Stocks and Shares ISA delivering an average annual return of 9.64% (according to Moneyfarm research) in the past decade, I think building a portfolio of British stocks will be the best way to go.

But how much would I need to invest so I can stop work and live off the passive income?

Hitting a £50k income

The first thing I need to consider is how much my everyday expenses will be. I also must think about what luxuries I want to enjoy. After all, none of us want to work for decades without having some lavish living to look forward to.

It can be pretty hard to predict these figures, and especially accounting for potential inflation. However, I can get a rough idea of what I might need using research from the Pensions and Lifetime Savings Association (PLSA).

It says the average single person needs £43,100 a year to live a comfortable retirement. People in this bracket will get to enjoy regular holidays in the UK and overseas, a new car every few years, and a four-figure kitty to spend on clothes.

For this exercise, I’ll round my annual income target up to £50,000 to give me a margin of safety. So how much will I need to invest each year to reach this?

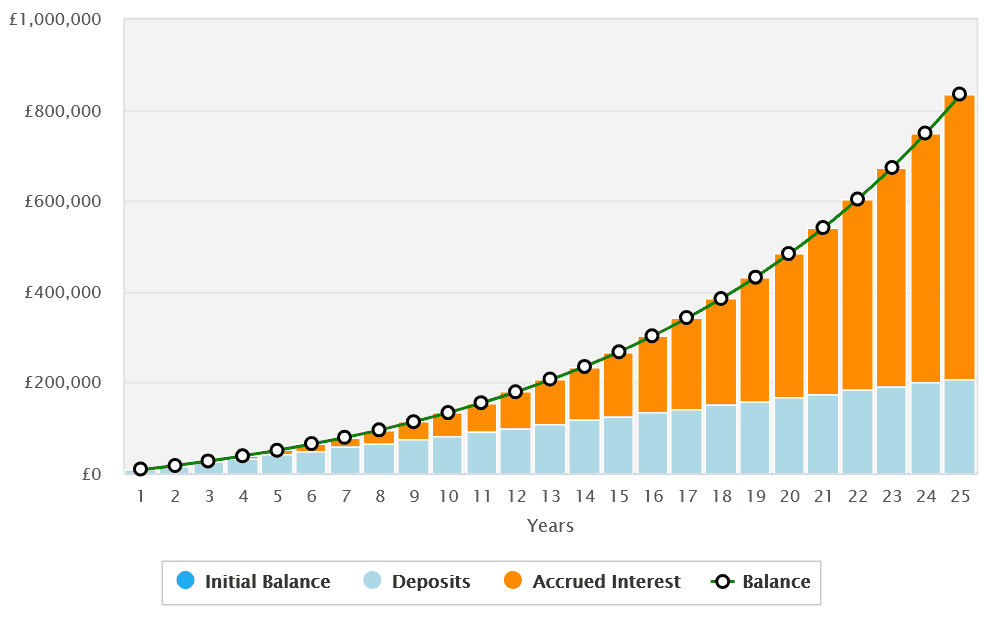

If I can manage to hit that 9.64% average return that ISA investors enjoy, I’ll need to spend £8,376 a year on UK shares for 25 years, reinvesting any dividends I receive along the way.

At this point, I’ll have built a nestegg north of £833,420.

I could then invest this in 6%-yielding dividend shares to target just over £50,000 in passive income each year. Remember, however, that dividends are never guaranteed.

A top FTSE 100 buy

To build this large retirement fund, I’d look to buy a blend of growth and income stocks. I’d also seek out undervalued shares which, over the long term, could deliver better capital appreciation than the broader market might.

FTSE 100 mining giant Rio Tinto’s (LSE:RIO) one such share I’ve already bought for my portfolio. With a forward price-to-earnings (P/E) ratio of just 8.5 times, I think it looks pretty cheap at current prices.

With a huge 6.9% dividend yield for this year alone, it could also provide me with a decent dividend income which I can reinvest to grow my portfolio.

The returns I get from my Rio shares could disappoint during economic downturns when earnings come under pressure. But over time, I believe the company will deliver large capital gains and dividends as demand for natural resources like copper and iron ore heats up.