Buying cheap UK shares can be a great way for investors to supercharge their returns. Fortunately, the FTSE 100‘s packed with many a top value share despite it already punching healthy gains since the start of 2024.

Bargain-loving billionaire investor Warren Buffett has proved that investing in undervalued stocks can create substantial long-term wealth. Companies that are trading below their true worth can deliver significant appreciation as the market eventually corrects the mispricing over time.

Value investors may need to act quickly however, to capture these discounted stars. Demand for cheap shares has accelerated in 2024 as investors capitalise on the London stock market’s underperformance of recent years.

Should you invest £1,000 in Admiral right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Admiral made the list?

With this in mind, here’s a great Footsie bargain to consider buying today.

Banking star

At 746.6p per share, Standard Chartered (LSE:STAN) trades on a price-to-earnings (P/E) ratio of just 6.4 times. This makes it the cheapest bank on the FTSE 100 based on this metric.

Lloyds and Barclays, by comparison, trade on P/E multiples of 9 times and 7.2 times respectively. And the corresponding ratios for HSBC and NatWest stand at 6.8 times and 7.9 times.

The emerging markets bank also trades on a forward price-to-earnings growth (PEG) ratio of 0.1. Any reading below 1 suggests that a stock is undervalued.

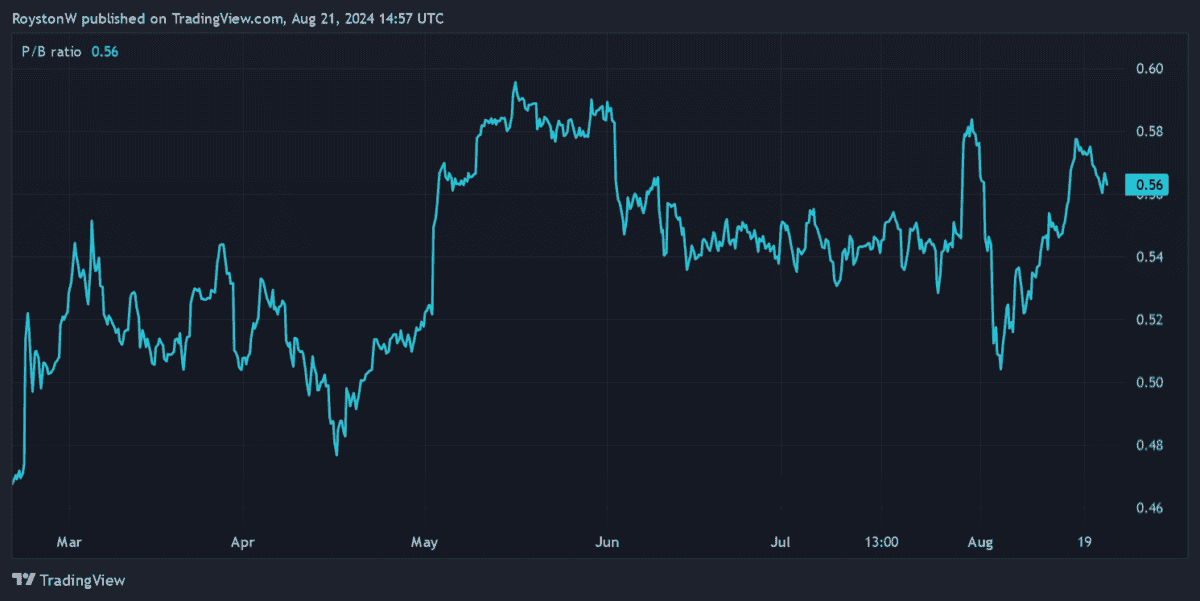

However, StanChart shares don’t just look cheap when it comes to forecasted profit. As the chart above shows, the company’s price-to-book (P/B) ratio is around 0.6.

At below 1, this shows that the bank trades at a discount to the value of its assets.

Why so cheap?

Standard Chartered’s low valuation reflects in part ongoing fears over the health of China’s economy. A 49% jump in credit impairments in the first half, to $240m, should give investors pause for thought.

Having said that, I also think the bank’s Asian troubles are more than reflected by its current share price. In fact, trading has remained largely impressive despite current macroeconomic issues.

Standard Chartered recorded a 7% increase in operating income (at constant currencies) between January and June. Strong revenues also meant pre-tax profits rose 5% to $3.5bn, which was a forecast-beating result.

This encouraged the bank to upgrade its full-year operating income growth target to above 7% too. Unsurprisingly, its share price leapt following the announcement.

So what next?

I believe StanChart has substantial long-term growth potential, driven by soaring wealth and population levels in its African and Asian marketplaces. I certainly expect it to increase earnings more sharply than Lloyds and those other more expensive UK-focused banks. If I’m right, it could deliver sector-beating share price gains.

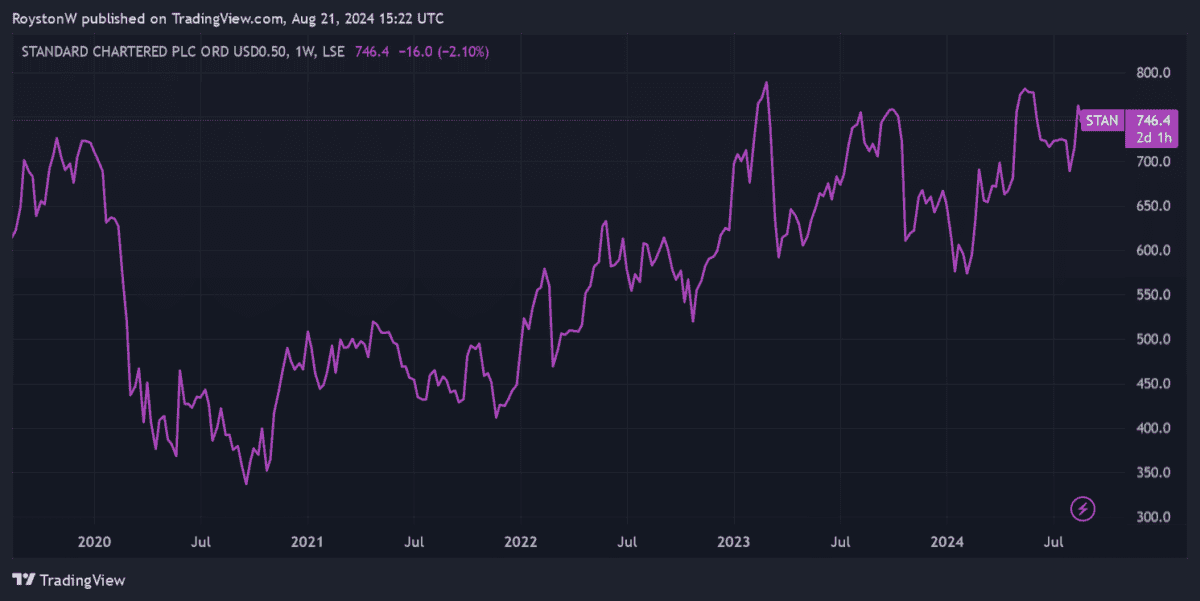

Standard Chartered’s share price has already risen 13% in value since the start of 2024. This is better than the broader FTSE 100’s 7% rise.

And City analysts think it can continue charging higher over the short term. The 16 analysts with ratings on the bank have assigned an average 12-month price target of 919.2p. That represents a 23% premium from current levels.

Forecasts can, of course, disappoint. But on the basis of all the above, I think it’s an excellent value stock to consider right now.