Diageo (LSE: DGE) shares might not be top of mind for dividend investors looking for a second income. After all, the FTSE 100 is packed with monster dividend yields, with some almost topping 10%.

However, due to its weak share price, the Diageo yield has crept up to levels that I consider attractive as a long-term investor. So much so in fact that I recently topped up my holding. Here’s why I did that.

Multi-year lows

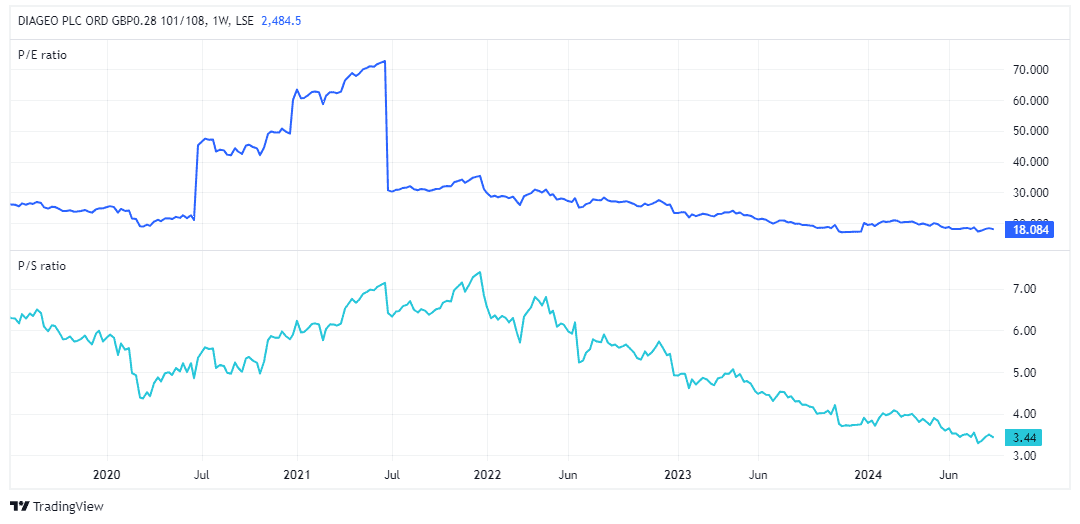

As we can see above, the Diageo share price has been on a downward path for the past two and a half years. It’s fallen 38% since revellers welcomed in the new year of 2022, likely with a Diageo-branded drink in hand.

This has left the stock trading on a price-to-sales (P/S) ratio of 3.4 and a price-to-earnings (P/E) multiple around 18. These are at or near multi-year lows, which I find attractive.

Diageo is a Dividend Aristocrat

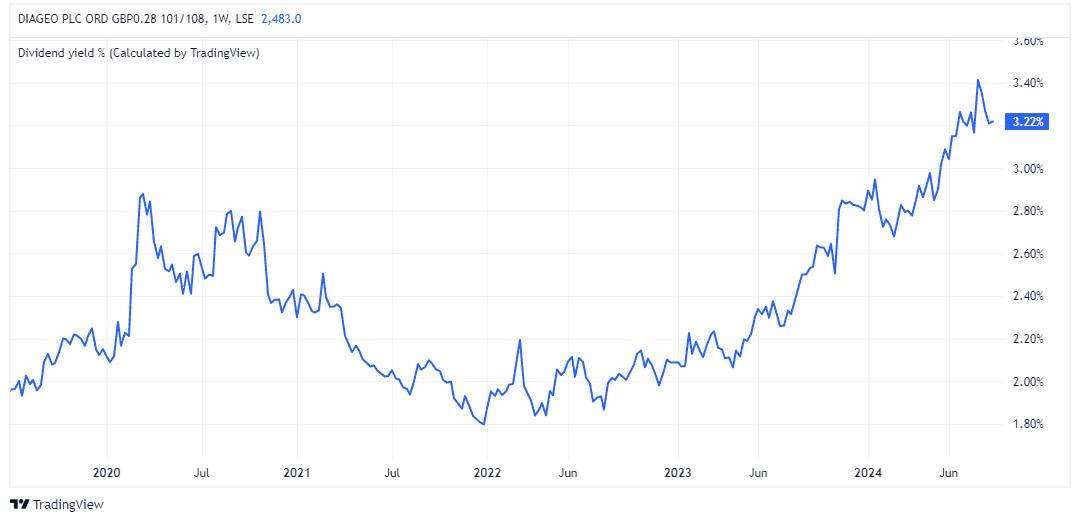

From an income perspective, it’s pushed the forward yield up to 3.2%. Granted, that’s slightly below the FTSE 100 average and is hardly breathtaking. But it’s higher than in previous years and could be a great starting yield.

I say this because Diageo is a Dividend Aristocrat, with one of the best long-term recordsfg when it comes to increasing shareholder payouts.

Of course, aristocratic status doesn’t naturally mean it will keep raising the payout every single year. No stock is immune to a dividend cut. But the company still generates healthy profits from its stable of world-class premium brands, and I expect that to continue for many more years to come.

After all, we’re talking about Johnnie Walker, Guinness, Don Julio, Smirnoff, Captain Morgan, and more. Many of these are category-leading brands and I don’t see that changing anytime soon.

Indeed, even last year when the firm suffered weak sales, it still managed to increase the payout by 5%. The dividend is generally covered almost two times over by earnings, providing a solid margin of safety.

Diageo is truly global

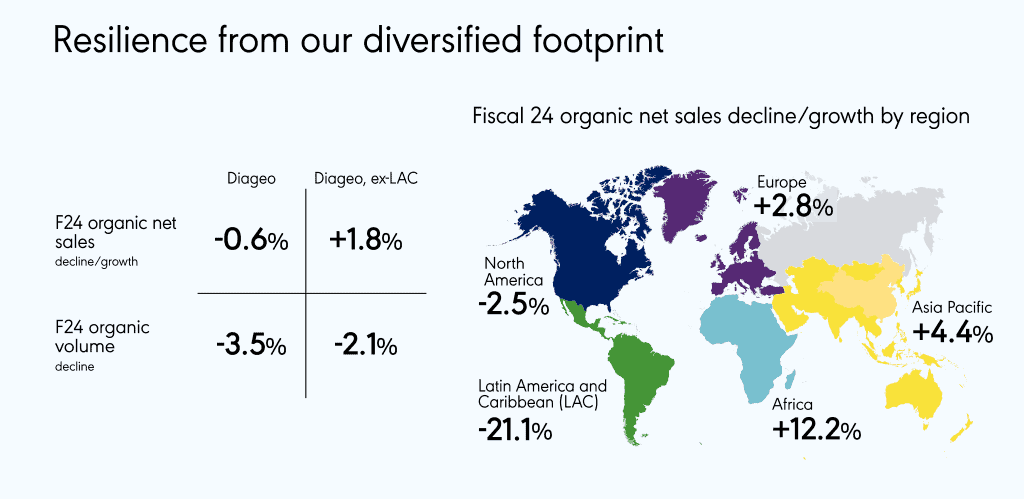

Still, there’s no getting away from the fact that last year was a poor one for the firm. Sales fell off a cliff in Latin America and were weak in its key US market. This year could also be challenging, or even worse, as some cash-strapped drinkers seek out bargain booze.

However, I’d note that the whole sprits sector is in a downturn, not just Diageo. And weak consumer spending is being seen across multiple industries, including luxury goods.

Stepping back, I’m reassured by the company’s truly global footprint. We saw this in action last year, as strength in Asia Pacific and Africa went some way to offsetting the weakness in the Americas.

Why I own the stock

Let’s assume Diageo can maintain a 5% annual increase in its dividend and that the share price returns a modest 3% on average in future. In this scenario, a £5,000 investment in the stock would grow to over £20,000 after 20 years, assuming dividends are reinvested.

I find that return attractive, which is why Diageo remains one of my largest pension holdings.