Few investors like it when a company cuts its dividend. But it is always a risk for any income share. But whereas FTSE 100 dividend cuts may generate headlines, some FTSE 250 shares slash their payouts without attracting the same sort of attention.

Yet a cut is a cut – and can be painful when it comes to the passive income streams one earns from a portfolio.

That explains why I diversify my portfolio across a range of different shares. But as an investor, it is also important to understand some of the possible signs that a dividend cut might be coming.

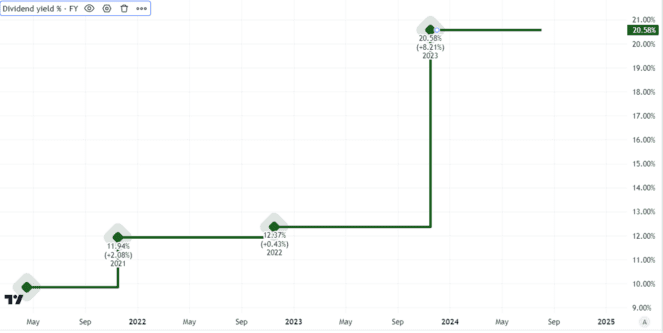

Unusually high yield

Have a look at this chart. Do we notice anything unusual?

Created using TradingView

It shows a dividend yield that stood at around 12% three years ago. But that then increased to almost 20%. In other words, for every pound I invested in this share, I would have got back 20p per year – if the dividend was maintained at that level.

Some shares have high yields and maintain or increase their payouts. But an unusually high yield – and 20% is definitely that for a FTSE 250 share – is a red flag for me. I would want to know why the yield was so high and judge what the future looked like for the dividend.

Sometimes a yield is high because a business had a particularly good year.

In other cases, it reflects the share price moving down as investor nervousness grows about the sustainability of a dividend.

That is exactly the case here. The yield chart above relates to Diversified Energy (LSE: DEC). The FTSE 250 share has fallen 62% in five years.

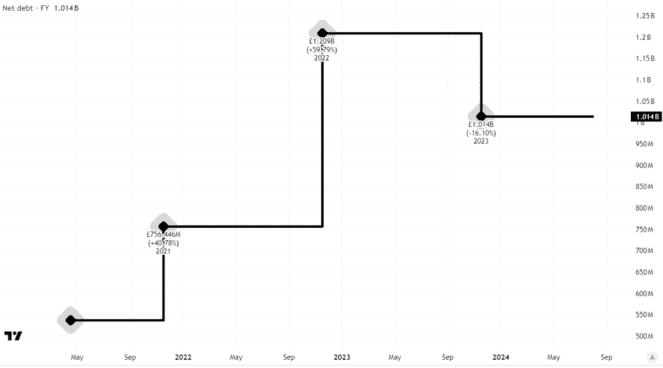

Growing debt

Diversified Energy announced a dividend cut in March, which did not surprise me at all. Partly that lack of surprise was because of the company’s balance sheet – something else I pay close attention to as an investor.

At $1.3bn, it had slightly less net debt at the end of last year than 12 months before.

Created using TradingView

Still, for a company that has a market capitalisation of around £440m (roughly $527m) at the moment, that is an uncomfortably high debt in my opinion.

Debt matters when it comes to dividends because the higher a company’s debt, the less financial flexibility a company typically has. Even if it generates large cash flows, it may need to use them to service debt, not to pay big dividends.

That is true of a FTSE 100 firm too — but a FTSE 250 company can find accessing finance more costly than a far larger company in the main index.

Looking for great companies not just high dividends

There are a host of other indicators I look at when considering what might happen to a share’s dividends in future. These are only two of them.

In short, instead of focusing on yield, I ask myself what a company’s long-term commercial prospects look like and what that might mean for shareholder payouts.