AstraZeneca (LSE: AZN) is a UK stock on fine form. It recently notched a 52-week high of 13,290p not long after the pharmaceutical giant hit the milestone of becoming the FTSE 100‘s first £200bn company.

Over five years, it’s up around 81%, demolishing the Footsie’s return. Across a decade, it’s almost trebled, leaving underwhelming peer GSK in the dust.

I find this impressive considering the company isn’t playing in the high-growth GLP-1 weight-loss sandbox (at least not yet). Plus, unlike Covid vaccine peers Moderna and Pfizer, it’s managed to navigate and overcome the post-pandemic slump in vaccine sales.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

But this relentless rise higher has also made the share more expensive. Does it still offer any value today? Let’s take a look.

Taking stock

AstraZeneca trades on a forward price-to-earnings (P/E) ratio of 21. Is that expensive? Well, compared to the FTSE 100 (around 12) and GSK (10.3), it most certainly is.

But the company is truly global and looks cheap versus the forward P/E multiples of Novo Nordisk (39.7) and Eli Lilly (57.8). That said, those stocks are arguably a bit frothy right now due to investor excitement around the GLP-1 boom. Merck is trading on a forward P/E of 19.7.

Based on this metric, I’d say the stock is fairly valued. It broadly aligns with large healthcare firms in the S&P 500.

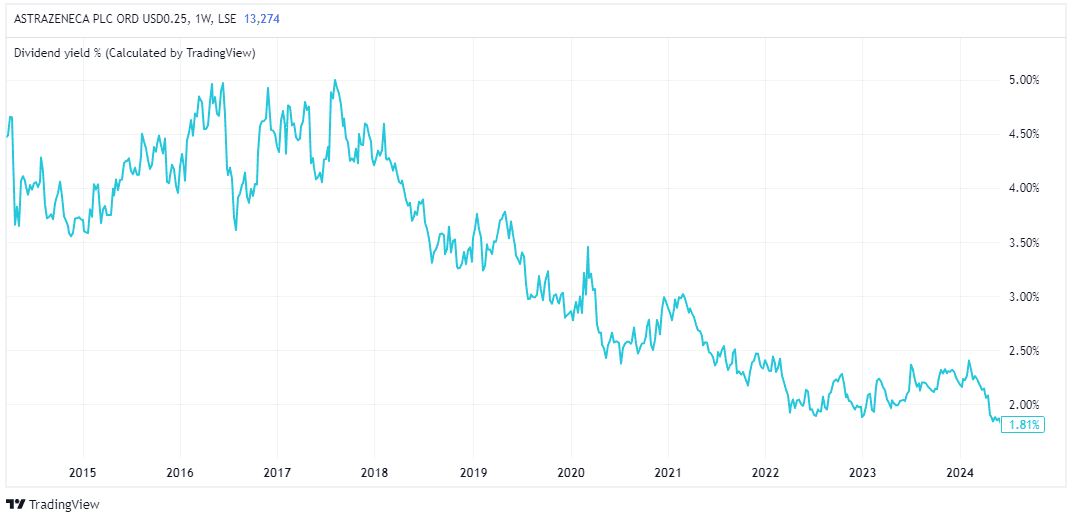

The dividend yield is also often used by investors to compare the attractiveness of different stocks. On this front, AstraZeneca doesn’t offer tasty income prospects, with a pretty low dividend yield of 1.8%.

Oncology pioneer

In H1, total revenue increased 18% year on year to $25.6bn. Double-digit growth was recorded across all four of its divisions.

- Oncology: up 22%

- Cardiovascular, Renal & Metabolism: 22%

- Respiratory & Immunology: 22%

- Rare Disease: 15%

AstraZeneca’s ambition is to transform cancer treatment for patients by replacing chemotherapy and radiotherapy with more targeted treatments.

In line with this, it recently acquired cancer company Fusion Pharma, which specialises in radioconjugates (a more precise mechanism of cancer cell killing compared with traditional radiation therapy).

Additionally, it aims to enter the lucrative global obesity market. It has licenced Eccogene’s ECC5004, a once-daily weight management pill that the company believes could ultimately prove more popular than the current once-weekly injections (including Wegovy).

Of course, there’s a possibility these disruptive new treatments don’t work out. Meanwhile, the firm is exposed to regulatory risk and the high probability of some late-stage clinical trial failures.

My Foolish takeaway

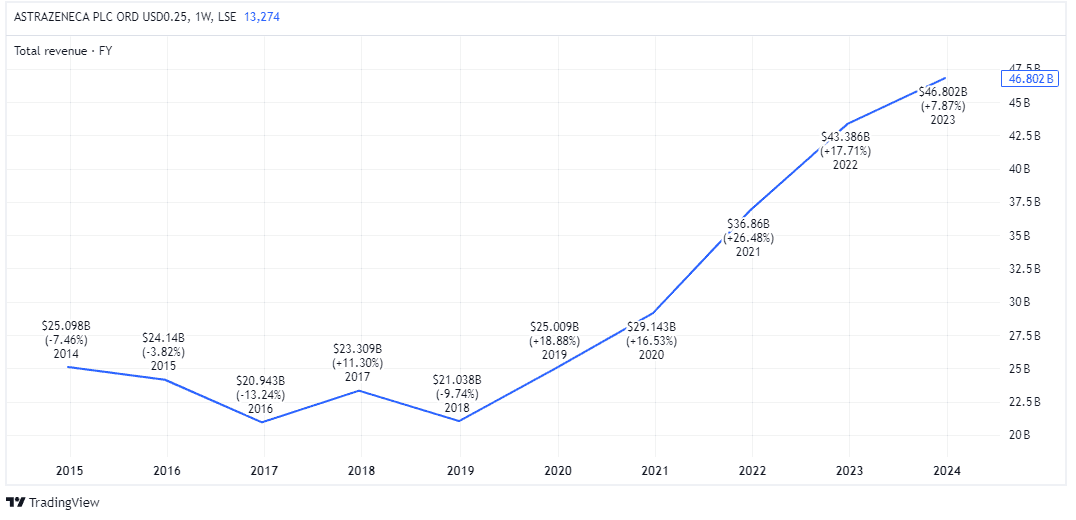

AstraZeneca has grown its revenue rapidly in recent years, from $25bn in 2020 to $46bn in 2023.

By 2030, it’s aiming for $80bn in annual revenue. This will be driven by the expected launch of 20 new medicines, many with the potential to generate $5bn+ in peak annual sales.

CEO Pascal Soriot has called this a “new era of growth”. This is no slow-moving pharma giant.

Assuming the same profit margin is maintained, its earnings could exceed $10bn by then, up from just under $6bn in 2023.

This is why I became a shareholder earlier this year. But if I didn’t already own the stock, I’d still consider buying it today to hold for at least the next five years.