One valuation tool many investors use is looking at a company’s price-to-earnings (P/E) ratio. The rule of thumb is that the lower it is, the cheaper a share is. So right now, IAG (LSE: IAG) looks very cheap. The IAG share price means the P/E ratio is just four.

That looks very low indeed. But I do not think the share is a bargain objectively, let alone compared to other FTSE 100 shares. I have no plans to buy – here’s why.

One valuation consideration: debt

There are a couple of key elements to consider alongside a P/E ratio when trying to value a company.

They can mean that a company with a low P/E ratio might not be as cheap as it seems. Conversely, a high P/E ratio sometimes does not necessarily mean a valuation is too high.

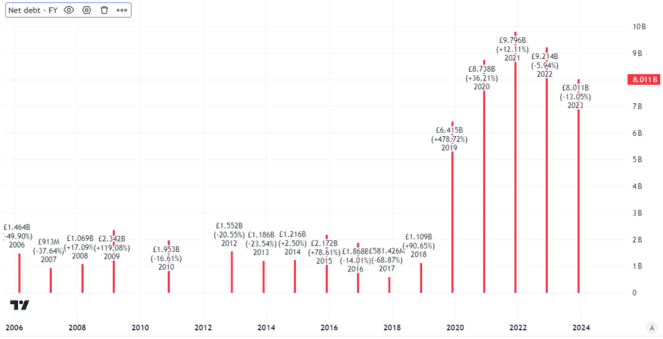

The first of these elements is how much debt a company has, set against its assets (what is known as net debt). That matters because, sooner or later, debt needs to be repaid. Until then it needs to be serviced, usually in the form of interest payments. That eats into earnings.

In its interim results this month, IAG reported that net debt was 31% lower than a year before. I see that as a positive development.

Still, the net debt remains substantial at around £5.4bn. That compares to a market capitalisation of around £9bn.

Created using TradingView

That debt is substantial — and still far above the pre-pandemic level for the company.

Another valuation consideration: future earnings

But although that debt is higher than I would ideally like, that does not in itself prevent the current IAG share price from being a bargain.

So, what about the second factor I always consider alongside net debt, on top of the P/E ratio?

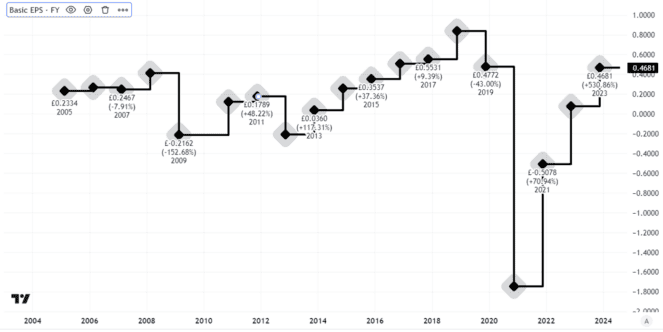

That is earnings – specifically, what I expect future earnings to be. After all, the current IAG P/E ratio of 4 is based on last year’s earnings. But will they continue at the same level?

Have a look at the company’s basic earnings per share over the past few years.

Created using TradingView

They have moved around a lot. This reflects the fact that airlines are affected by a number of factors that are largely or totally outside the group’s control.

Fuel prices can move around. Government restrictions can suddenly throttle demand for flying. A weak economy can also reduce the demand for jetting off to the sun.

That could lead to earnings per share falling, perhaps dramatically. At the interim point, IAG reinstated its dividend. It also pointed to “continuing strong demand for travel in the attractive core markets in which we operate”.

But some rivals have pointed to expected falls in ticket prices. A weak economy could curtail demand. Some think a penny-pinching approach to its passenger experience has lost the loyalty of many passengers for IAG. That could hurt long-term profitability.

On that basis I do not think the share price is a bargain. I will not be investing.