The historic chart for BAE Systems (LSE: BA.) shares shows they went nowhere for over 20 years (between late 1998 and early 2022). Yet the FTSE 100 defence stock did reliably pay out dividends during that time.

In February 2022 though, the chart started rising almost vertically following Russia’s shocking invasion of Ukraine. This marked the largest military conflict in Europe since World War II, sparking extensive military support for Ukraine from Western nations.

BAE’s share price is now up 140% in five years, beating the FTSE 100 by around 125% in the process.

But should I should scoop up a few more shares as things stand? Let’s take a look.

Strong growth

In the first six months of 2024, the firm’s sales grew 13% year on year to £13.4bn, while underlying earnings before interest and tax (EBIT) rose 13% to £1.4bn. Underlying earnings per share (EPS) grew 7% to 31.4p.

Alongside this strong operational performance, BAE made progress in a number of key areas.

- Under the AUKUS security pact between Australia, the UK and US, it was selected to help build Australia’s new fleet of nuclear-powered submarines

- It signed a £4.6bn contract for the delivery of the first three Hunter Class frigates in Australia

- The £4.4bn acquisition of US-based Ball Aerospace was completed to form a new Space & Mission Systems business

- It finished a £1.5bn share buyback programme and started another one worth £1.5bn

Looking ahead, BAE raised its full-year sales guidance to £25.3bn, or growth of 12%-14%, up from its previous estimate of 10%-12%. Underlying EPS is projected to increase by 7%-9% to 63.2p.

Conflicts

One risk here would be an unexpected drop in Western defence spending. BAE’s government customers continue to provide a significant amount of its equipment to Ukraine. So a sudden halt to the war there would likely cause volatility in the share price.

Unfortunately, a ceasefire looks unlikely, with Russia having just launched a massive air strike across Ukraine. Moscow said all ceasefire talks have now “lost relevance“.

Meanwhile, Israel and Iran-backed Hezbollah have exchanged heavy fire in a major escalation. And we may see more sabre-rattling from the US and China during the upcoming US presidential election.

Given all this, it’s no surprise that NATO members have committed to increase their defence spend to 2%+ of gross domestic product (GDP) annually. The UK government is aiming for 2.5% of GDP.

My move

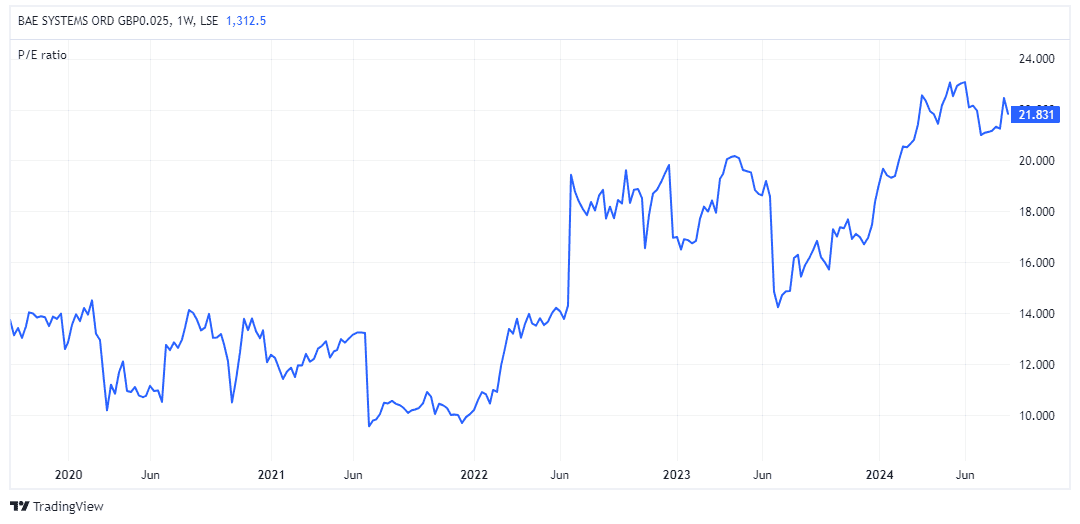

But is all this already priced into the stock today? It’s trading at almost 22 times earnings, which is a premium to its multiple over the last five years.

Then again, that’s equal to European peer Thales (22) and far cheaper than US rival Northrop Grumman (33). I don’t think the stock is overvalued considering the earnings growth potential.

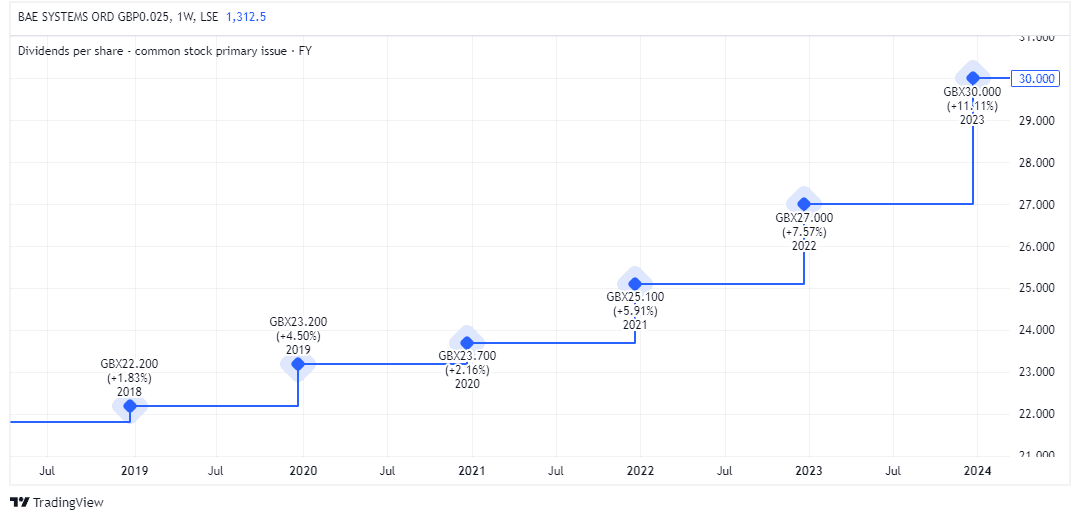

The 2.3% dividend yield is lower than previous years. Yet the payout has been growing nicely.

I reckon the BAE share price is set for further gains in the years ahead as nations sadly feel the need to bolster their defences. The company’s order backlog stood at a record £74.1bn in June.

I’m not buying more but am going to keep holding my shares. And if I didn’t already own them, I’d invest today and hold for the next few years.