One of the more disappointing underperformers on the stock market in recent years has been Diageo (LSE: DGE). The FTSE 100 spirits giant is down 11% year to date and 37% since the start of 2022.

This stock’s already a pretty large holding in my portfolio, but now I’m wondering whether to take advantage of the dip and make it even larger. Here are my thoughts.

Consumer slowdown

On 30 July, the firm reported its preliminary results for FY24 ended 30 June. Overall revenue fell 1.4% year on year to $20.3bn, missing estimates for $21.2bn. Volumes declined by 2.1%, with demand weak in the US and dreadful demand in the Latin America and Caribbean region (a 21.1% volume decline).

Should you invest £1,000 in Bbgi Sicav S.a. right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bbgi Sicav S.a. made the list?

That massive slump was due to consumers shifting to cheaper local spirits. This was most pronounced in Brazil and Mexico, where demand for Scotch and tequila was particularly weak. Diageo’s premium brands in these respective categories include Johnnie Walker and Don Julio.

On the bottom line, organic operating profit fell 5% to $5.9bn. Earnings per share of $1.73 dipping from $1.97 in FY 23.

Looking forward, management isn’t offering an improved outlook for FY25, which it says will continue to be “challenging“.

Modest recovery expected

The US accounts for almost 40% of Diageo’s sales. Last year, the US spirits market declined for the first time in nearly 30 years, according to industry researcher IWSR.

The main risk is a further deterioration in that key market. With a US recession already a concern, it can’t be ruled out.

According to the same research from IWSR though, global beverage alcohol’s expected to begin its recovery in 2025. However, growth’s expected rise “at a compound annual growth rate of +1% between 2023 and 2028“.

It also added that the “premiumisation universe for spirits is narrowing”. That’s not great for Diageo’s own premiumisation story.

On the plus side, what forecast growth there is will largely come from India, China and the US. Diageo has a presence in all three markets, while global tequila growth should remain strong. As well as Don Julio, Diageo owns the Casamigos tequila brand.

Meanwhile, Guinness has grown globally by double digits for seven consecutive quarters. Not bad for a 265-year-old brand!

Bargain basement?

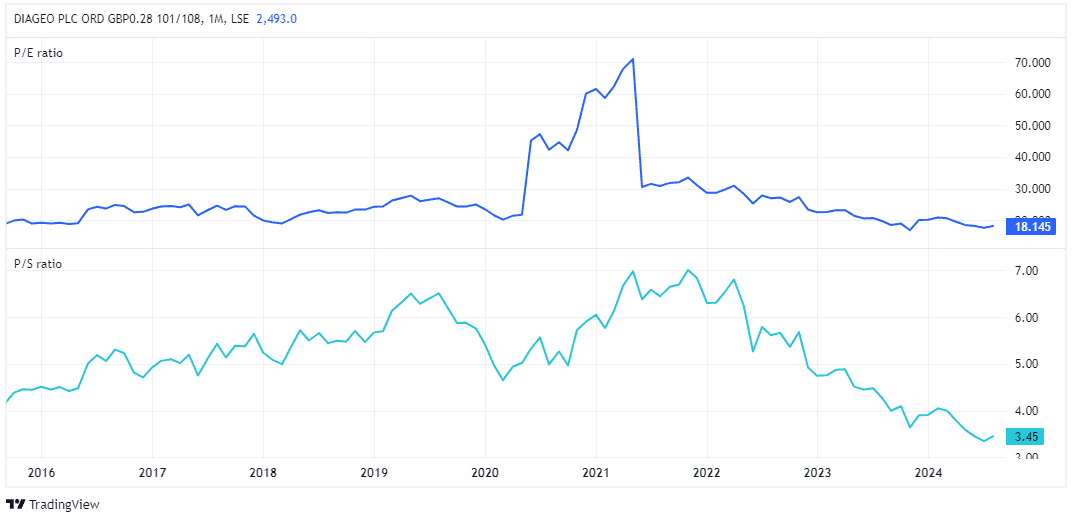

On some key metrics, the stock appears to offer great value. It’s trading on a price-to-sales (P/S) multiple of 3.5 while the forward price-to-earnings (P/E) ratio is around 18. Both are at multi-year lows.

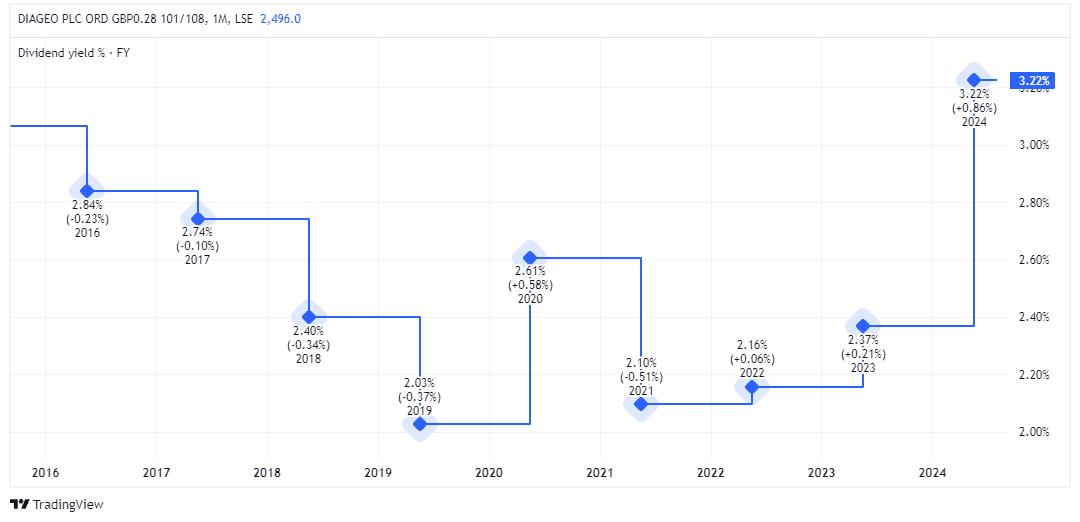

Despite the challenging environment, the company still generates meaningful free cash flow and returns it to shareholders through dividends. Last year, free cash flow increased by $400m to $2.6bn while the dividend was raised by 5%.

The yield’s climbed to 3.2%, which is 50% more income than investors were getting just two years ago. Diageo remains a blue-blooded Dividend Aristocrat.

I note that broker Citi recently reiterated its Buy recommendation on the stock, saying that it’s “time to revisit what remains an attractive compounding mid-term growth story”.

Only time will tell if the stock’s in bargain basement territory today. But I see good value here and I’m tempted to buy more Diageo shares in September.