Done well, investing in growth stocks can have spectacular results for investors. But working out which shares to buy isn’t always straightforward.

With Rolls-Royce (LSE:RR), for example, the share price is up 137% over the last 12 months. While I was bullish on the stock back in January, I now think the best opportunities are elsewhere.

Rolls-Royce

I don’t necessarily think Rolls-Royce shares have gone too far. But the main drivers of growth so far look to be in the rear-view mirror, so I’m not expecting the stock to keep going as it has.

Engine flying hours are back to their pre-pandemic levels, the company’s balance sheet looks strong again, and the firm’s set to start paying dividends again. All in all, things look pretty good.

These things are unlikely to improve indefinitely though. And that means investors should probably expect growth for Rolls-Royce to be less spectacular than it has been recently.

As I see it, there are better choices for investors looking for growth stocks. But as is often the case, the best opportunities aren’t always found in the most obvious places.

B&M European Value Retail SA

Institutional investors don’t have a particularly positive view of B&M European Value Retail SA (LSE:BME) at the moment. There’s actually significant short interest in the stock right now.

It’s maybe not that difficult to see why. As cost of living pressures ease in the UK, there’s a definite risk of consumers trading up to more premium outlets for their shopping.

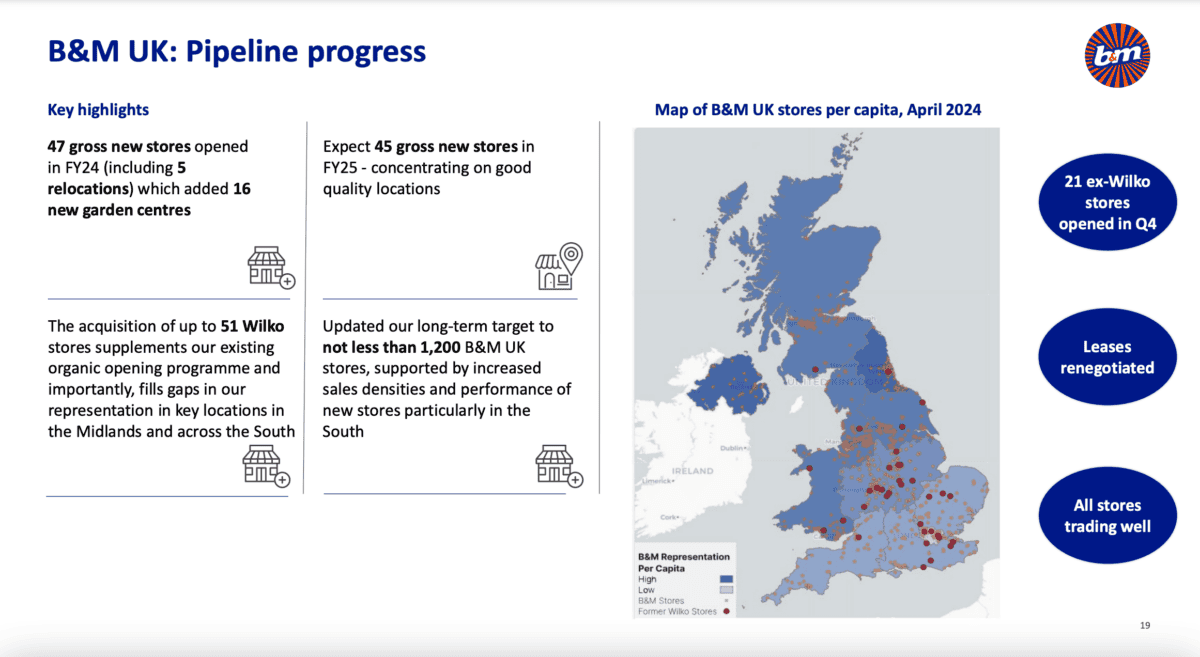

Source: B&M 2024 results presentation

Despite this, the company’s very clearly in growth mode. It’s aiming to open around 45 new outlets a year on its way to a target of at least 1,200 stores.

With the average payback period for a new store less than a year, I think this should prove profitable pretty quickly. So I can see significant revenue growth ahead for the business.

AG Barr

AG Barr (LSE:BAG) also isn’t the most obvious growth stock. But I think there’s clear scope for widening operating margins to drive higher profitability over the next couple of years.

The biggest risk to this thesis is inflation, which could slow the pace of margin expansion. As I see it though, this is likely to delay – rather than derail – the growth I’m expecting.

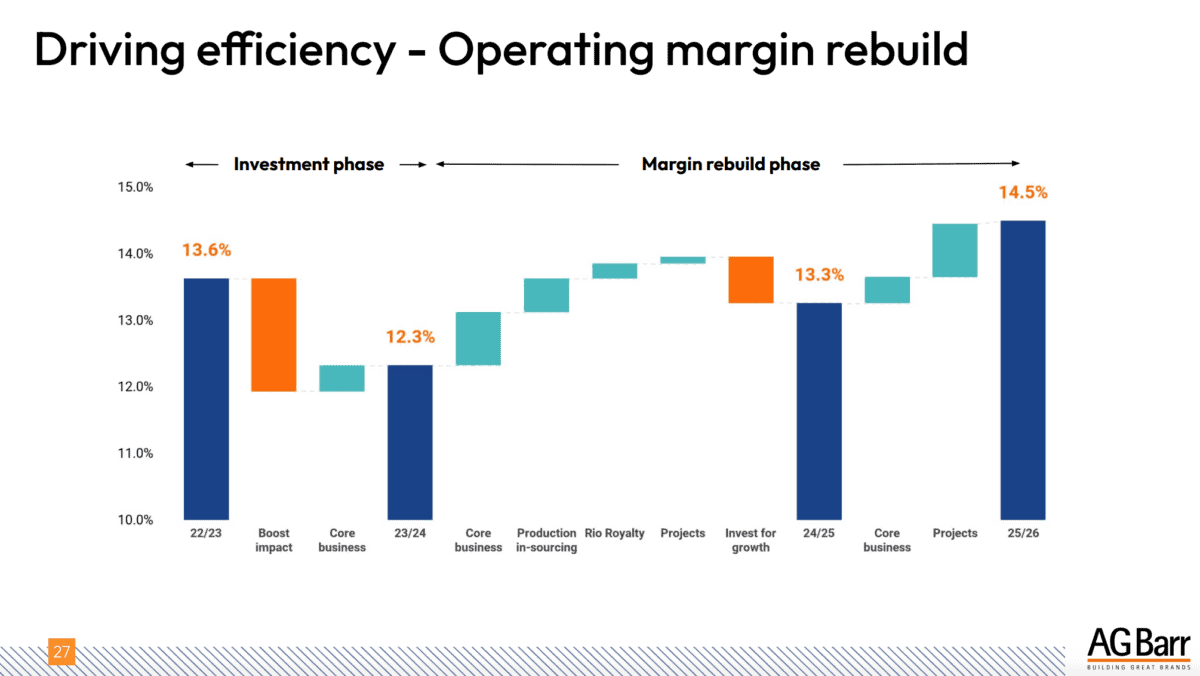

In 2022, AG Barr acquired BOOST Drinks Holdings. So far, the effects have been showing up in the firm’s revenue line, but integration costs have meant earnings haven’t increased at the same rate.

Source: A.G. Barr Investor Presentation

Importantly, the company’s expecting these costs to run off by 2026. If that happens, I think there’s clear scope for earnings to grow significantly by 2026 as margins recover.

Growth, growth, and more growth

Beyond Rolls-Royce, different businesses achieve earnings growth in different ways. For the likes of B&M, it involves increased revenues coming from opening more stores.

For others, such as AG Barr, it can be a case of cutting costs leading to expanding margins. In either case, the bottom line’s higher profits.