It’s been a while but holders of Rolls-Royce (LSE:RR.) shares will soon know what it’s like to receive a dividend once more. The company last made a payout in January 2020 — just before the pandemic nearly wiped out the British icon.

But earlier this month (August), the company said shareholder distributions will be reinstated in respect of the year ending 31 December (FY24).

It didn’t give a clue as to the likely level of return but the company-compiled summary of brokers’ views suggests it could be 3.2p a share. If correct, this would imply a yield of 0.6%.

This isn’t going to get income investors excited — the average for the FTSE 100‘s currently 3.8%.

However, these forecasts were prepared before the company revealed its results for the first six months of FY24. Revenue, earnings and free cash flow were all ahead of expectations. It’s now forecasting an underlying operating profit for the full year of £2.1bn-£2.3bn (previously: £1.7bn-£1.9bn).

If the expected dividend was raised by 22% — the increase in the mid-point of these two ranges — the payout could be as high as 3.9p. But this would only lift the yield to 0.78%.

The good old days

Although disappointing, this demonstrates the impact that Covid had on the business. To survive, it had to organise a rights issue. With over 6.4bn more shares in circulation, a dividend of 3.9p will cost the company £332m.

For FY19, the same amount would have enabled it to pay 16p a share. At that time, the shares offered a double-digit yield.

I think it’s fair to say that the days of Rolls-Royce being considered an income stock are long gone. It would need all of its expected free cash flow for FY24 (£2.2bn) to be used for a dividend (25.9p) if it were to achieve a yield in excess of 5%.

Looking further ahead to FY25 — before the recent profits upgrade — analysts were anticipating a payout of ‘only’ 5.6p a share.

Seemingly unstoppable

Despite not offering any passive income, the company’s share price has taken off since the rights issue in October 2020 (up more than 1,200%).

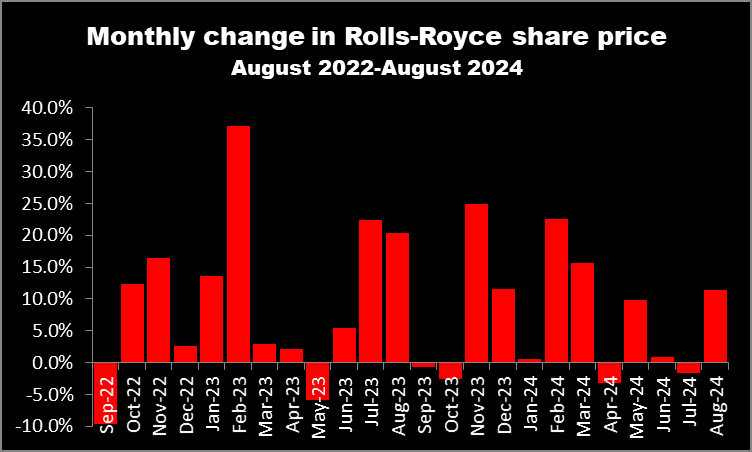

And over the past two years, it’s been remarkably consistent. As the chart below shows, it’s increased during 18 of the last 24 months.

And although I’ve convinced myself there’s no point buying the company’s stock for passive income, is there still value in the share price? I think there’s some, albeit not much.

Rolls-Royce has a forward price-to-earnings ratio of 26. That’s too rich for me.

RTX Corporation, the world’s largest aerospace and defence contractor, has a forward earnings multiple of 21.8. This makes me think that recent investors in the British equivalent might soon pause for breath and consider banking some of their profits.

Of course, I might be wrong. Rolls-Royce could continue to enjoy double-digit earnings growth. It’s a high-quality business operating in three distinct sectors – civil aviation, defence and power systems. All are doing well at the moment, so it’s certainly possible.

But I believe I’ve missed out on a bull run that’s probably coming to an end or — at least — going to slow. And in my opinion, there are better income opportunities elsewhere. I therefore don’t want to invest at the moment.