There are some growth stocks in my portfolio that I consider indispensable. While I recognise circumstances can always change, my aim is to hold on to these two shares indefinitely.

Games Workshop

The first stock is Games Workshop (LSE: GAW). This is the creator of tabletop wargames, most famously Warhammer 40,000 and Warhammer Age of Sigmar.

Beyond games and miniature figures, the FTSE 250 firm generates licencing revenue from books and video games. Many of its customers are lifelong hobbyists and 78% of sales come from outside the UK.

The stock’s surged 1,675% over 10 years. That return doesn’t include dividends, of which there have been many along the way. The dividend yield‘s 3.6%, which is very attractive for a growth stock.

As a leader in a profitable niche market, Games Workshop enjoys strong pricing power. Importantly, it doesn’t need a lot of capital to grow and sports an incredibly high 38% operating margin.

Over the last 10 years, the company’s return on capital employed (ROCE, a key measure of profitability) has averaged around 62%. That’s phenomenal.

In FY24, which ended in May, the company delivered record sales, profits and dividends. It’s also in the process of finalising terms with Amazon to make Warhammer films and TV series. That’s exciting news.

While the business is doing great, a recession in its key US market could see consumers rein-in spending. This risk is magnified with the stock trading at 22 times forecast earnings — a premium to the market.

That said, Games Workshop deserves its premium, in my opinion. And I’d feel comfortable buying more shares with spare cash today to hold for the long run.

Axon Enterprise

The second stock I aim to hold forever is Axon Enterprise (NASDAQ: AXON). Over the last decade, it’s skyrocketed by 2,290%!

Today, the stock’s trading at 76 times forecast earnings, a nosebleed valuation that suggests most of Axon’s projected growth’s already priced in. Another risk is that over 2bn evidence files have now been loaded into Axon’s platform, so a data breach could have serious consequences.

Still, I’d buy the stock immediately on any significant dip. That’s because Axon’s high-growth business model’s incredibly powerful.

How so? Well, its products include body and vehicle cameras, TASER devices, and cloud-based evidence management software. They work together and this integration creates high switching costs for law enforcement customers, as moving to a competitor would require replacing the entire ecosystem.

Moreover, when newer TASERs are used this automatically activates Axon bodycams worn by officers to capture evidence and enhance accountability. All footage is sent directly to Axon Cloud. I doubt these products will be jettisoned or disrupted anytime soon.

Meanwhile, the company’s recurring revenue comes from bundled hardware/software subscriptions. It has 17,000+ customers and a 122% net revenue retention, meaning existing customers are spending 22% more compared to the previous year.

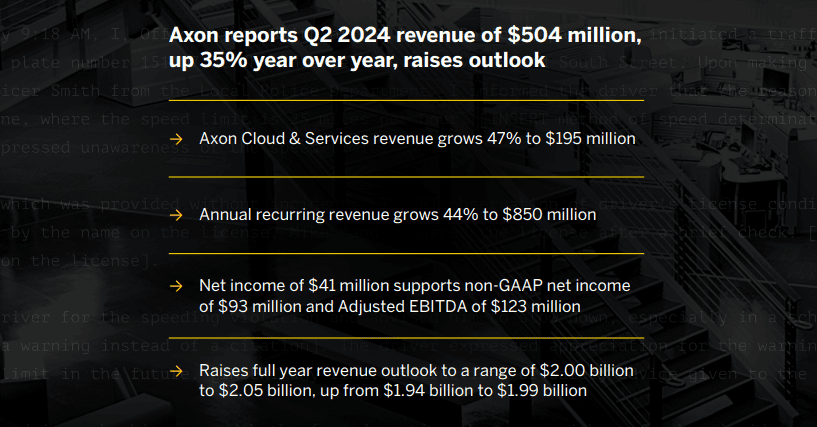

Axon Enterprise Q2 2024

In April, the firm launched Draft One, a powerful new AI service that writes the first draft of a police report extracted directly from Axon bodycam recordings. The time saved writing reports is in excess of 50%.

CEO Rick Smith said the response to Draft One was “better than anything I’ve ever seen“. Axon’s perfectly positioned to deliver more powerful AI applications.