The Chief Technology Officer (Hardware) of Raspberry Pi (LSE:RPI), and three people closely connected with him, think the company’s stock offers good value at the moment.

How do I know this?

Well, recent stock exchange filings show that, during the first two days of August, the four of them bought 32,474 shares at an average price of 375.73p.

Spending £122,014 on the stock tells me that they have confidence in the long-term potential of the low-cost computer manufacturer.

And judging by the success of the company’s June IPO, others appear to agree.

Raspberry Pi’s shares were initially offered to the public at 280p each. On debut, they soared in value and closed their first day of trading at 385p — a premium of 37.5%.

They’ve since traded in a range of 326p-550p. Last week (15 August) the stock closed at the same price as it did after the first day’s trading.

A track record of growth

Raspberry PI is a British success story.

It has an excellent reputation for quality and its products are championed by a community of enthusiasts. But it’s a misconception that its core market is providing computers to hobbyists. In fact, the majority of its sales are made to industry and commerce.

This has helped it grow rapidly in recent years.

For the year ended 31 December 2023 (FY23), it recorded a profit after tax of $31.6m (£24.4m). This was an increase of 85% on FY22.

| Measure | FY21 | FY22 | FY23 |

|---|---|---|---|

| Revenue ($’000) | 149,587 | 187,859 | 265,797 |

| Gross profit ($’000) | 41,917 | 42,280 | 65,955 |

| Gross profit percentage (%) | 28.0 | 22.5 | 24.8 |

| Profit after tax ($’000) | 14,851 | 17,067 | 31,572 |

However, there are no clues as to how the company will perform in 2024.

I expect we’ll soon see interim accounts for the first six months of 2024. However, until then, a lot of guess work is required to assess whether the stock is fairly valued.

An optimistic assessment

But Peel Hunt and Jefferies, brokers who’ve recently started covering the stock, have crunched some numbers. They have price targets of 439p and 448p, respectively.

Peel Hunt argues that as the cost of computing falls and artificial intelligence machine learning applications continue to take hold, the ‘fourth industrial revolution’ will happen. It says Raspberry Pi is well placed to take advantage as its computers can be placed close to where data is actioned or created.

The broker optimistically suggests that it could be a new technology giant — a tech superpower, something akin to the current members of the so-called Magnificent Seven.

But at the moment, the company is tiny — it has a market cap of just £737m. Nvidia, for example, is worth over 3,000 times more.

Yet this still means Raspberry Pi is valued at a hefty 30.2 times its historical price-to-earnings (P/E) ratio.

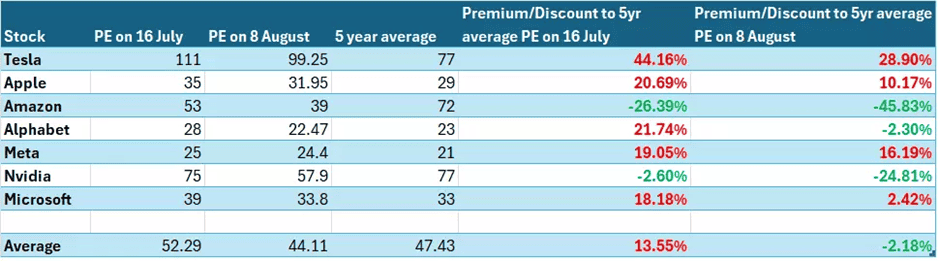

Although high, that’s not unusual for the sector. According to IG, the average P/E ratio of the Magnificent Seven is 44, even after the recent sell-off.

Not for me

However, although I admire the company and what it’s achieved, I think there’s a danger of getting carried away with some of the hype.

Investing now would be a little too speculative for me. I don’t know how it’s performing and — I believe — the technology industry is full of examples of over-inflated valuations.

I’m going to wait until the next trading update before revisiting the investment case and deciding whether Raspberry Pi offers value for money.