I’ve seen a few growth stocks rip higher in my Stocks and Shares ISA in 2024. These include The Trade Desk, Axon Enterprise, Intuitive Surgical, and MercadoLibre, all of which I bought years ago at much lower valuations.

Now I’m wondering if one 10p penny stock listed in the UK could be another gem.

Investing in pizza

I’m referring to DP Poland (LSE: DPP). The share price has surged around 57% over the past year, giving the firm a market capitalisation of just £97m. This makes it a tiddler in stock market terms.

Should you invest £1,000 in Dunelm right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Dunelm made the list?

For those unfamiliar, the DP in the firm’s name stands for Domino’s Pizza. The company has the exclusive rights to operate and sub-franchise the chain in Poland and, more recently, Croatia.

Founded in 2010, the group now has 111 stores and restaurants in the two nations. It aims to have 500 locations by 2030.

At first glance, the investment case here appeals to me. Pizza’s one of the most universally liked foods and Domino’s is a well-established global brand. Meanwhile, disposable incomes are set to rise in both Poland and Croatia, giving the firm a potentially long runway of growth as it expands.

Looking under the toppings

So why is the share price down 80% since 2010? Well, despite its obvious potential, the firm’s struggled to turn a profit. Last year, it reported a post-tax loss of £3.5m on revenue of almost £45m.

Since the war in Ukraine started, the business has been impacted by rising food, labour and energy costs. And while inflation appears to be easing, another sudden spike remains a risk.

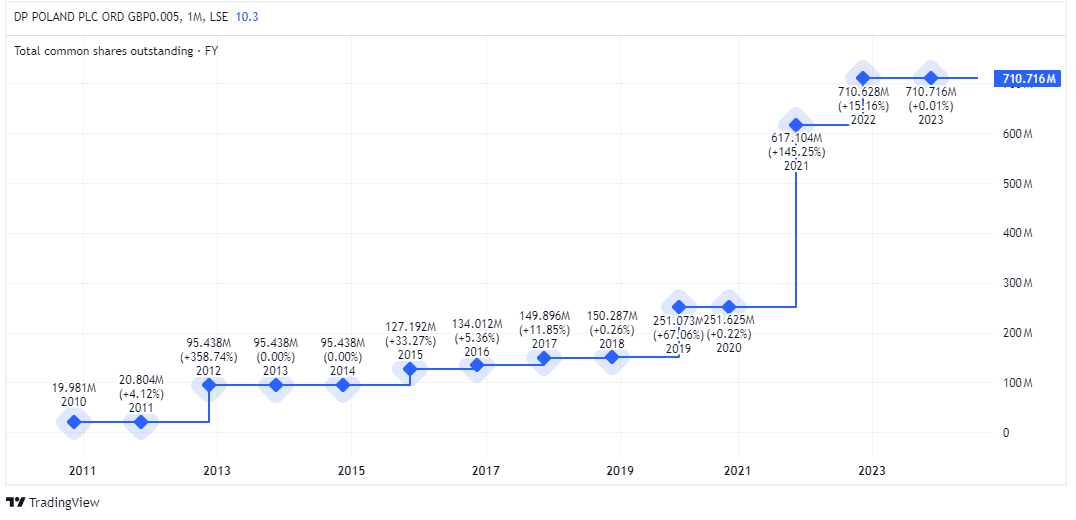

Meanwhile, lots more shares have been issued over the years. In April, for example, the firm tapped shareholders for £20.5m to fund new stores, pay down debt, and support the transition to a sub-franchisee model.

More shares in circulation dilutes earnings per share (EPS), a key metric used to assess a company’s profitability. Below, we can see how the share count has risen sharply.

Attractive growth

Despite these issues, I reckon there’s a lot to like here. The Polish business is one of the fastest growing Domino’s markets globally. This is placing the firm’s revenue on a clear upwards trajectory.

In H1, like-for-like sales jumped 26.5% year on year. And over the next two years, analysts see revenue increasing by 41%.

| Year | Revenue |

|---|---|

| 2025 (forecast) | £63m |

| 2024 (forecast) | £53m |

| 2023 | £45m |

Plus, the planned transition to a sub-franchisee model involves shifting from primarily operating outlets directly to allowing local operators to run them. This should reduce capital costs while still generating revenue through franchise fees.

The improved store economics enable us to move to a sub-franchise model… This will accelerate growth and ultimately improve returns…These are exciting times for DPP.

DP Poland 2023 annual report

Should I invest some dough?

The Polish fast-food market’s very competitive. When I’m in Poland, I love a zapiekanka, a popular street food that’s like a pizza made on a baguette. For me, it beats a Domino’s hands-down and is far cheaper.

Yet Domino’s offers the convenience of fast home delivery. Meanwhile, with just five locations in Croatia, that market has loads of growth potential.

This penny stock may indeed be a gem and I’ve put it on my watchlist.