At the start of the month, the boohoo (LSE:BOO) share price hit fresh 52-week lows at 26.5p. It has managed to rebound somewhat over the past couple of weeks. Yet at just above 28p, I’m wondering if the stock is still too cheap or if it’s actually a fair value right now.

Earnings falling with the share price

The 20% fall in the share price over the past year compounds the losses from previous years. In fact, over a three-year time horizon, the stock is down just shy of 90%.

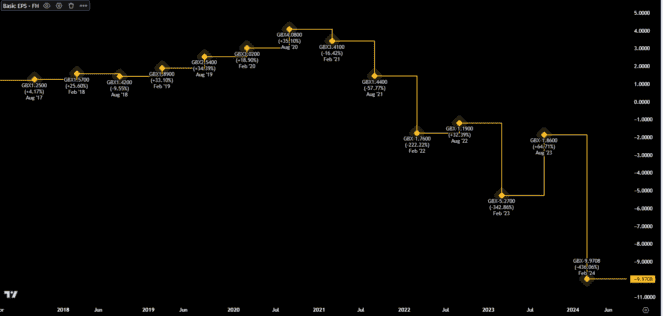

The firm’s poor finances have acted to reduce the value of the company over time. The below chart of basic earnings per share (EPS) is evidence of this. Up until 2021, the business was generating positive EPS. Yet the flip to posting losses has dragged the share price lower.

The negative EPS numbers — that is, losses — have been growing and are now at the lowest level since the firm went public.

Tying this back to the issue of the stock, it’s hard to make a case for it being undervalued when the business is losing more money each year. Logically, the share price should fall to reflect a company that’s worth less than it was the prior year. After all, the profitability of a company is one of the main ways investors put a value on a stock.

Pinning a fair value

Another factor to consider is the price-to-book (P/B) ratio. This metric looks at the share price and compares it to the book value of the firm. If the value is below 1, it’s generally considered to be a cheap stock. Below is the change in the P/B ratio for boohoo over the past few years.

What’s really interesting to note is that despite the sharp fall in the share price in recent years, the P/B ratio is still above 1 (1.17 to be specific). So when looking at this, I can’t really make the case for it being undervalued. Rather, when considering the fact that the ratio was well above 10 in 2020-2021, I think it was overvalued back then. The move lower in the stock is simply nudging it towards a fair value currently.

Demand still robust

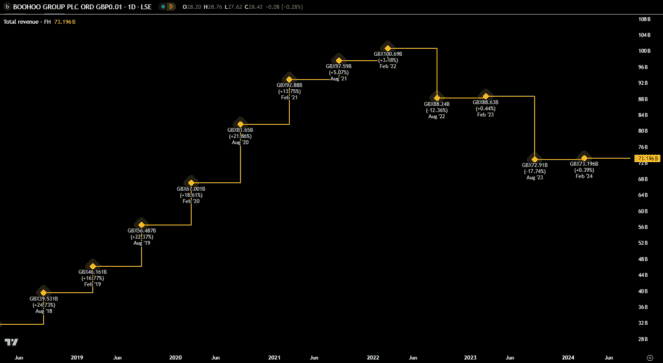

On the other hand, some investors will point to revenue at boohoo as a reason for buying the stock. Even though revenue has moved lower over the past couple of years, the latest reported annual figure was still above the pre-pandemic level (shown below).

This can be used to show that demand for the clothes and other products boohoo sells is still there. Even though sales might have moved a little lower, they don’t equate to the drop in earnings. This tells me that the problem with the business lies in costs and other expenses.

The management team is already focusing on streamlining costs, as mentioned in the latest annual report. Further, after some backlash, executive bonuses aren’t going to be paid, saving more money.

Therefore, if demand stays firm and costs fall, it could mean that the share price is currently fair value for the long term. Ultimately, I don’t feel that the stock is too low.