I sold my BT Group (LSE: BT) shares last month despite the share price climbing 16% this year. While I don’t necessarily regret the sale, I’m now wondering if I should have held on to them.

One major company thinks so: Bharti Global recently announced plans to buy a 24.5% stake in BT. The Indian multinational conglomerate is a parent company of Bharti Airtel, the majority owner of the UK-listed telecoms company Airtel Africa.

My sale was part of a strategy to reduce my number of holdings and rebalance the capital into defensive stocks. While it helped to lower my risk score, it also reduced my average dividend by stripping out BT’s decent 5.5% yield.

So on reflection, was it the right choice?

Digital delays

My foremost concern about BT is the risk it poses with its weighty debt load. Years of investment into the group’s plans for a fully digital UK network have left it in a deep hole. The effort has been further delayed by disruptions, prompting the group to extend its expected completion date to the end of January 2027.

How much more debt will that add to its current sum of £18.5bn?

The figure is already considerably higher than its £14.3bn market cap. Of course, I’m not worried that a company as established as BT will fail. But in my experience, debt and dividends don’t play well together.

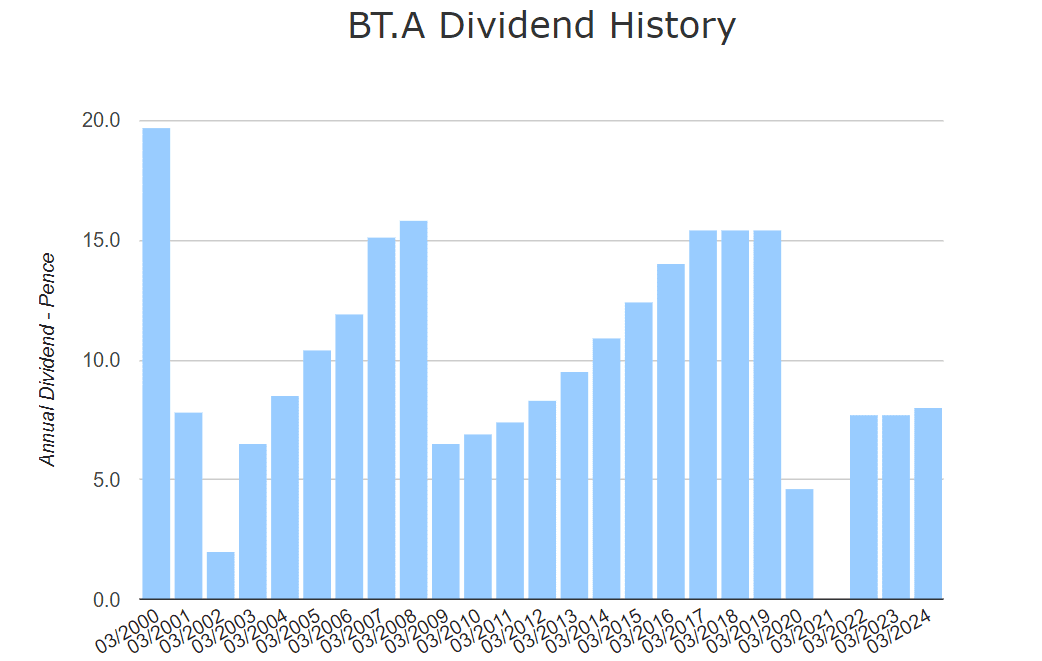

How long before it starts cutting dividends to meet debt obligations? It wouldn’t be the first time — BT has cut, reduced, or paused dividends nine times since the millennium began.

Keeping afloat

For now, things look okay. Operating income (EBIT) is sufficient to cover interest payments by 3.7 times and the group’s annual 8p dividend per share is just below earnings per share (EPS).

There’s no immediate reason to think things will turn south.

One promising metric is BT’s high earnings growth potential. Future cash flow estimates put the share price at 73% below fair value. With earnings expected to increase 68% in the coming 12 months, the group’s forward price-to-earnings (P/E) ratio is 10.3. Even its trailing P/E ratio of 16.7 is below the industry average.

The valuation is similar to that of competitor Vodafone, with a P/E ratio of 19.2 and a share price undervalued by 69%. And once Vodafone slashes its dividend to 5% next year, the two companies will be very well matched (barring the high debt-to-equity ratio).

The bottom line

From a risk-averse point of view, I don’t feel I was too hasty selling my BT shares. If everything goes smoothly with the digital upgrade, I may come to regret the decision. BT appears to have decent growth potential so if it can avoid further disruption, I think a 12-month price target of 200p is not unrealistic.

That said, it may be a while before I’m tempted to buy back into the stock. Until it shows signs of making serious inroads to reducing its debt, I’m choosing to err on the side of caution.