I believe the FTSE 100‘s stuffed full of bargains at the moment. I’ve picked the three I think currently offer the best value.

Out of fashion

Shares in JD Sports (LSE:JD.) currently (16 August) change hands for 28% less than the stock’s 52-week high.

It’s been caught in the crossfire following a downgrade in Nike’s sales forecast. The American sportswear giant is believed to account for 50% of JD Sports’ revenue so this isn’t surprising.

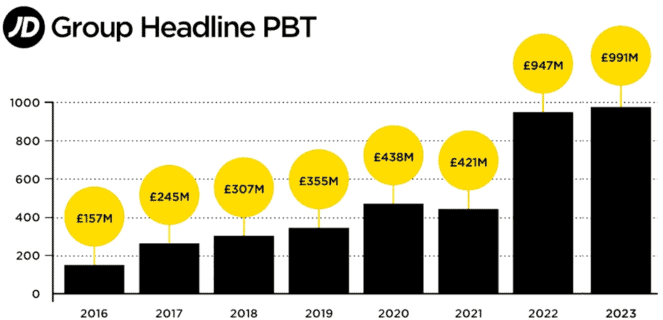

But the retailer sells multiple brands including some that are capitalising on Nike’s problems. And the company has an impressive track record of growing its earnings.

With a price-to-earnings (P/E) ratio of around 10 — half its average over the past decade — I recently decided to buy some stock.

Ringing the changes

On the back of stagnant revenue and falling earnings, Vodafone’s (LSE:VOD) shares appear to be stuck in the 65p-80p range. I suspect that’s why the company’s restructuring its operations and selling its under-performing divisions in Spain and Italy.

There’s no guarantee its turnaround plan will work — others have failed. And I’ve concerns about the company’s debt levels.

But I’ve confidence in its CEO. And the company’s recent trading update — for the first quarter of its March 2025 financial year — hinted at a recovery under way. I believe now could be a good entry point.

To consider the stock’s potential, I’ve been looking at Deutsche Telekom, Europe’s largest telecoms company. If the same earnings multiple (13.7) was applied to Vodafone, its shares would be 46% higher.

Ready for take-off

International Consolidated Airlines Group (LSE:IAG) shares are currently trading 9% below their 52-week high. Analysts are expecting earnings per share of 40.97 euro cents (35.18p) in 2024. If correct, this implies a P/E ratio of 4.8.

This looks cheap compared to easyJet — the only other airline in the FTSE 100 — which has a forward earnings multiple of 6.9. If the same valuation was applied to IAG, its stock would be 43% higher (243p).

The pandemic reminded us of the risks associated with the airline industry. Also, IAG’s profits have been impacted by inflation. Fuel costs are largely out of its control. And a tight labour market’s putting pressure on salaries. In August last year, British Airways agreed a 13% pay rise (over 18 months) with its 24,000 staff.

During 2023, these two expense headings accounted for exactly 50% of its operating expenditure.

But I think now could be a good time to consider it. Passenger numbers are increasing once more, net debt’s falling, its dividend has been reinstated (albeit a modest one) and many are expecting oil prices to fall over the next 12 months.

Brokers appear to agree with my assessment. Of the 16 analysts covering the stock, 11 give it a Buy rating and five are Neutral.

Bank of America and RBC Capital Markets both have a price target of 230p. Of course, there’s no guarantee the share price will reach this level but it illustrates that some rate the stock highly.

League table

I already own two of these shares. And if I had some spare cash, I’d add IAG to my portfolio. However, ranking them in ascending order I’d put Vodafone third (cheap), followed by IAG (cheaper) and JD Sports (cheapest).