Declining prices have ramped up the dividend yields of smaller UK stocks in recent months. This pattern’s been particularly noticeable among energy stocks on the FTSE 250.

The windfall tax placed on energy producers in recent years has made it challenging for some of these companies to expand operations. When combined with stubbornly high interest rates, the result is a swathe of undervalued operators.

But many still exhibit great prospects and have done well to keep growing and paying dividends. One in particular that I like the look of is the London-based oil and gas outfit Energean (LSE: ENOG).

Risky region

One of the key regions that Energean operates in is the Middle East. This currently presents a significant risk to the company as ongoing conflicts in the area could disrupt operations.

Its flagship project, the Karish gas field, is located off the coast of Israel near Haifa – not far from the Lebanese border. The increased military action in this conflict zone threatens to disrupt its supply chain.

It’s also exploring potential energy reserves in Morocco, Italy and Greece, so profits are not entirely reliant on the Karish field.

Dividend gem

I believe Energean’s key value proposition is the dividend yield. At 10%, it’s higher than most other UK income stocks and considerably higher than the FTSE 250 average of 3.27%. Even if the share price were to fall slightly in the coming years, the dividend payments should make it more than worthwhile.

However, it has a slightly high payout ratio of 116%, which is a concern. This is because the current earnings per share (EPS) of £1.01 is slightly below the £1.20 annual dividend. If earnings improve this could decrease – but if not, dividends risk being reduced (or cut).

The share price is down 9% in five years but has done fairly well since the company’s IPO in March 2018. It’s currently trading at £9.22, up 111% since its starting price of £4.55. That’s an annualised gain of around 11.4%, which is impressive. Such high returns won’t necessarily continue but the price-to-earnings (P/E) ratio of 11.7 suggests there’s still some growth potential.

Treading water

Scientists believe climate change is responsible for rising temperatures around the world, with Europe experiencing its hottest summer on record last year. Evidence suggests the burning of fossil fuels like oil and gas can contribute to this rise.

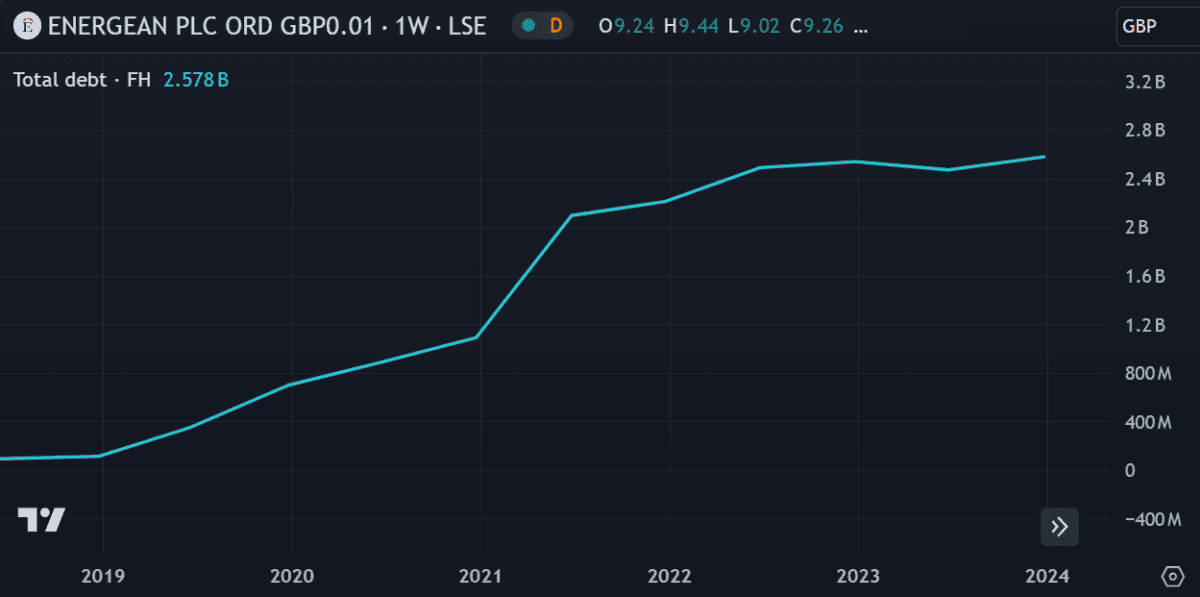

But it’s not just the mercury that’s rising – Energean’s debt load has also hit record highs. At $3.22bn, it far outweighs its equity and free cash flow. This not only puts the company at risk of defaulting but threatens its ability to continue paying dividends.

For now, it has sufficient operating income to cover interest payments by 3.2 times. But I think it’s still taking some risk with its debt.

My verdict

Like all stocks, Energean comes with some risk. But the 10% dividend yield gives it a strong argument for investment. Even after one year, if the share price holds, I could net me a decent bit of profit.

But I won’t buy the shares right now though. Rather, I’ll wait until just before the next ex-dividend date on 12 September this year. That gives me some time to see how things unfold in the Middle East.