The BT (LSE:BT.A) share price has risen 40% since I said I was looking to buy the stock. I went on holiday and missed the first tranche of growth.

The FTSE 100 stock rose again on 12 August after Bharti Enterprises bought a 24.5% stake in the company for around £3.2bn.

Bharti Enterprises — owned by Indian billionaire Sunil Bharti Mittal — bought the stake of French billionaire Patrick Drahi.

Drahi, who first took a position in BT Group in 2021, had reportedly been looking to sell his stake in order to pay down some of the debt accumulated by his telecoms company Altice.

And this speculation that he ‘wanted out’ only served to keep the share price low. So as Drahi exited the company, the stock surged 7.5%.

Still vastly undervalued, analysts say

According to analysts, BT Group stock’s still vastly undervalued, even at 140p. The average target price is currently 194.5p, suggesting the stock’s currently undervalued by as much as 37.4%.

In the last three months, nine analysts have given the stock a Buy rating, five analysts have an Outperform rating, two a Hold, one a Sell and one an Underperform. As such, the consensus is pretty strong.

As highlighted by the below chart, the average price target has jumped in 2024.

Value trap or value for money?

Of course, analysts can be way off with their forecasts, and that’s why we need to undertake our own research.

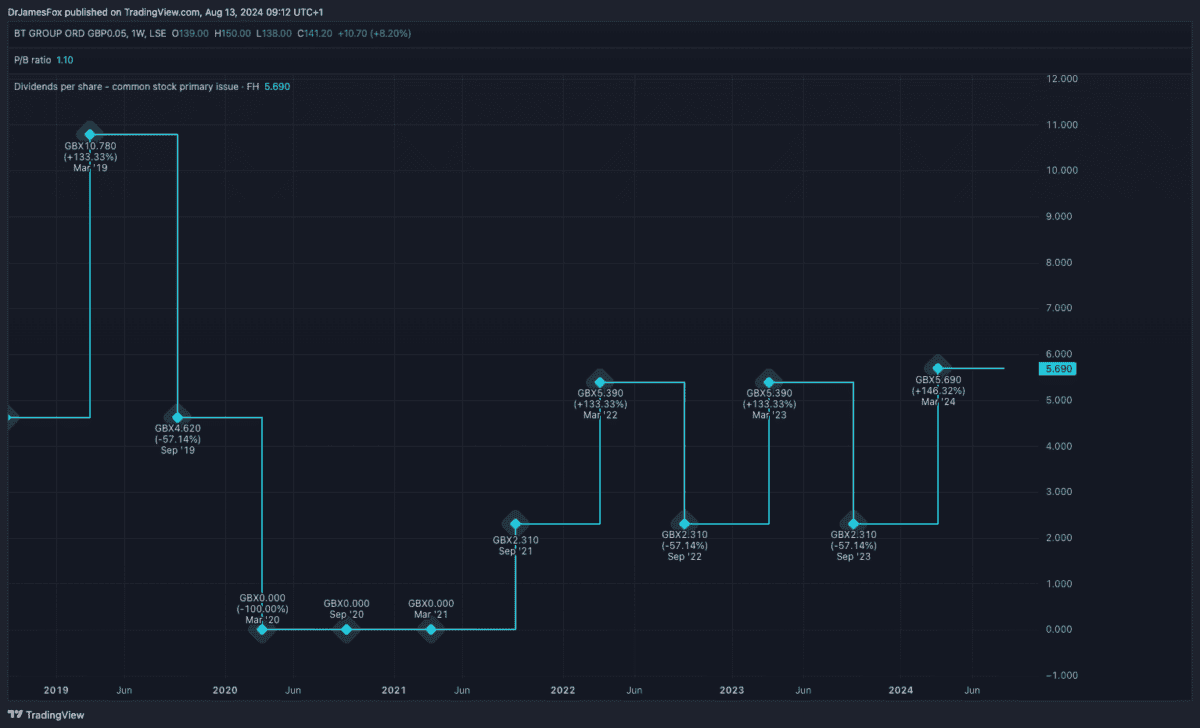

In recent years, the stock’s become something of a value trap. The share price has fallen, the business has suffered, and the dividend has dropped. Collectively, these factors have negatively impacted investor sentiment.

However, there’s renewed energy at BT Group. And this can partly be attributed to the plans recently laid out by new CEO Allison Kirkby.

Kirkby’s promised £3bn of savings every year through to the end of the decade. And this is important because the company’s revenues remain very consistent.

As the table below shows, the forecast indicates that revenues will remain largely flat while the net margin — a key indicator of profitability — improves throughout the medium term.

| Financial year (ending March) | Annual revenue | Net Margin |

| FY27 (forecast) | £21bn | 8.2% |

| FY26 (forecast) | £20.9bn | 7.6% |

| FY25 (forecast) | £20.8bn | 6.9% |

| FY24 | £20.6bn | 4.1% |

| FY23 | £20.7bn | 9.2% |

| FY22 | £20.8bn | 6.1% |

Of course, there are still risks facing BT Group. One is debt. With a net debt position just shy of £20bn, the company remains vulnerable to near-term shocks. Moreover, a sustained higher interest rate could eat into medium-term earnings.

It’s also worth recognising that BT’s rollout of fibre-to-the-premises (FTTP) is nowhere near finished. Yes, we may be past peak Capex, but the company’s aiming to reach around 10m more homes.

The bottom line

Personally, I still believe BT stock looks attractive with medium-term cost savings likely to make the business much more profitable. That’s why I’m continuing to look at adding this stock to my portfolio.

I also think the recent share purchases by Bharti Enterprises and Mexican billionaire Carlos Slim are a good sign. These telecoms giants probably know a good deal when they see one.