The FTSE 100‘s packed with high-yield dividend stocks. At the moment, there are 21 companies offering forward yields above 5%. And Legal & General Group‘s (LSE:LGEN) one the index’s best, in my opinion.

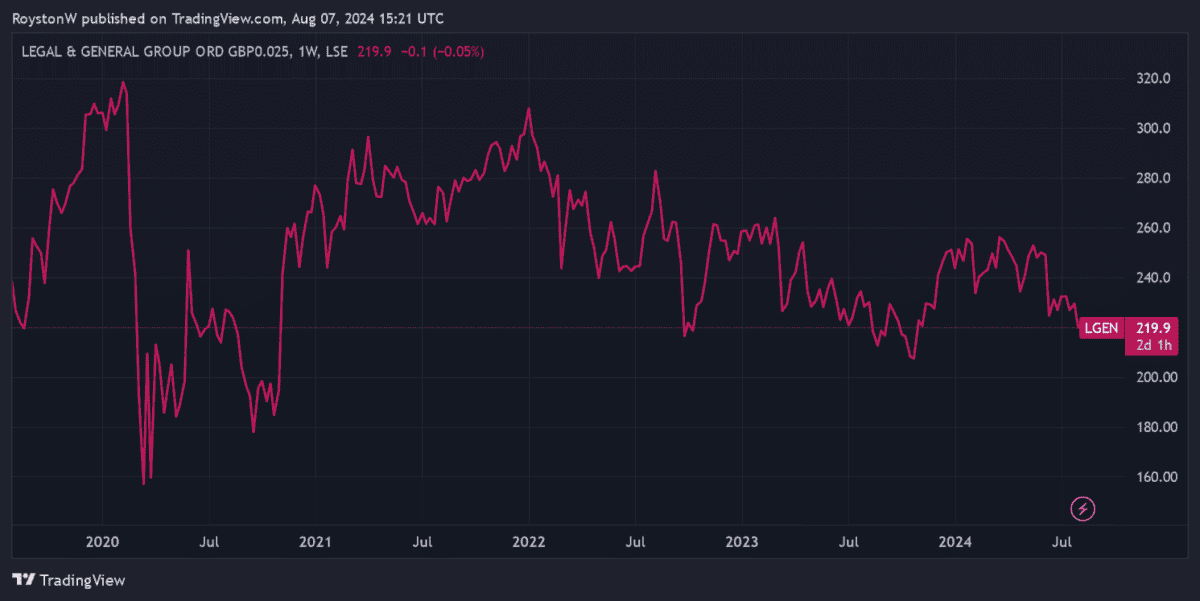

I already own it in my Self-Invested Personal Pension (SIPP) for passive income. And following recent share price weakness, I’m considering buying more.

Dividend growth

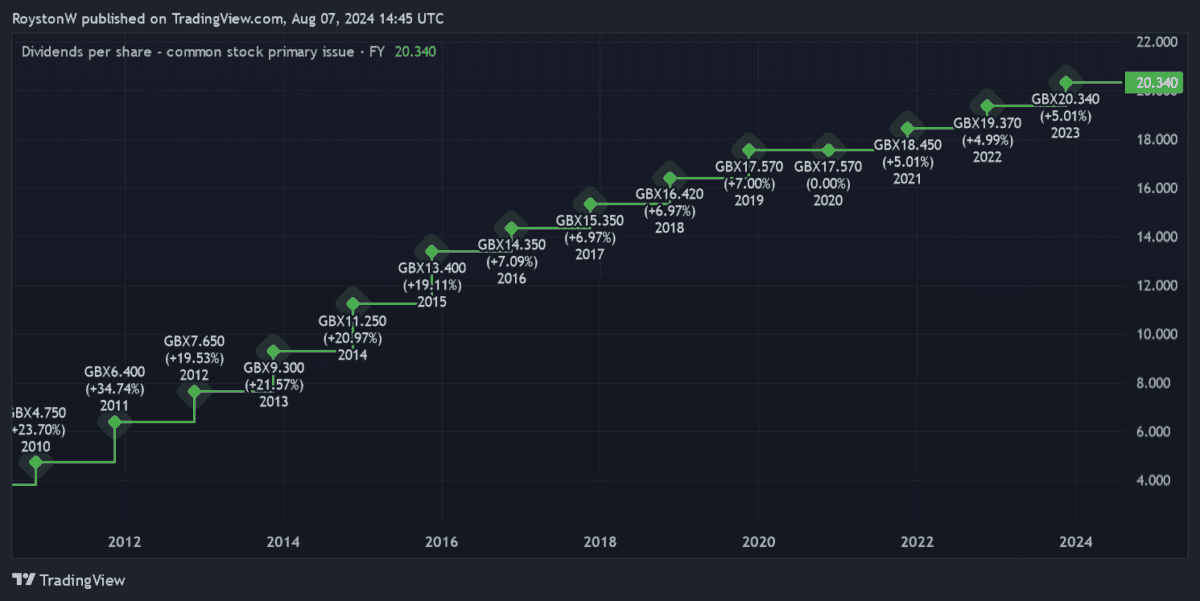

At 219.9p per share, Legal & General shares carry a mighty 9.7% dividend yield. As the chart below shows, the financial services giant has an exceptional record of lifting shareholder payouts every year.

The Footsie company’s able to consistently pay a large and growing dividend for a variety of reasons:

- Its diversified business model (across life and general insurance, investment management, and pensions) helps shrink profits shocks and provides a consistent flow of cash

- Strong brand power reduces the threat from competitors like Aviva and Aegon

- Demographic changes are steadily increasing demand for retirement, wealth, and protection products, and therefore revenues

- Highly regulated operations ensure that the firm maintains a strong balance sheet

- Its experienced management team makes sound strategic decisions and is committed to regular dividend growth

Solid trading update

Legal & General’s latest financials on Wednesday (7 August) underlined the robustness of its its operations, even in tough times.

Thanks to strong sales of its annuities products, core operating profit rose 1% in the first half, to £849m. This was slightly above what City analysts had been forecasting.

The company maintained its target of growing core operating profit by “mid single-digits” for the full year, raised the interim dividend 5% year on year, and affirmed plans to repurchase £200m of its shares.

A strong balance sheet’s enabling Legal & General to continue returning stacks of cash to its investors. Its Solvency II capital ratio stood a formidable 223% as of June.

The Footsie firm isn’t without its risks, of course. It warned that “the global economic outlook remains uncertain with the potential for external shocks to knock economies and markets off course“.

But, on balance, things are looking pretty good at the financial services giant.

A £2,490 passive income

So as I say, I’m thinking about buying more Legal & General shares for my portfolio. It’s a decision that could give my passive income a significant boost in the near term and beyond.

Let’s say I bought 2,273 shares in the company today for a total cost of just under £5,000. With a 9.7% yield, I’d receive a passive income of just under £485 this year, if dividend forecasts prove accurate.

Now let’s assume I reinvest any dividends I receive, and that the shareholder payout remains stable over time. We’ll also say that the share price fails to grow.

After 25 years, my £5k could turn into £34,512. With an extra £200 each month spent on Legal & General shares, I could increase this to £308,132. This would then throw off around £2,490 a month in dividends.

However, I think both the share price and dividends may grow strongly over time. If I’m right, I could make a significantly better monthly income than that £2,490.

While it’s not without risk, I believe Legal & General’s one of the FTSE 100’s best dividend shares.