Concerns over a potential US recession have plunged stock markets into turmoil. Many FTSE 100 and FTSE 250 shares source significant portions of their earnings from the world’s biggest economy. What’s more, trouble in the US will have huge ramifications across the globe.

This means that investors who rely on dividend income for their investing strategy or everyday expenses should be cautious about which stocks they invest in.

In this landscape, it could be a good idea to invest in companies that have strong balance sheets, operate in non-cyclical industries, and enjoy market-leading positions and multiple revenue streams.

A top FTSE 250 stock

This list doesn’t restrict me to a narrow selection of UK shares, however. The FTSE 250 alone is packed with stocks that meet several or even all of the above criteria.

Here’s one I’d buy for my own portfolio if I had spare cash to invest.

Property powerhouse

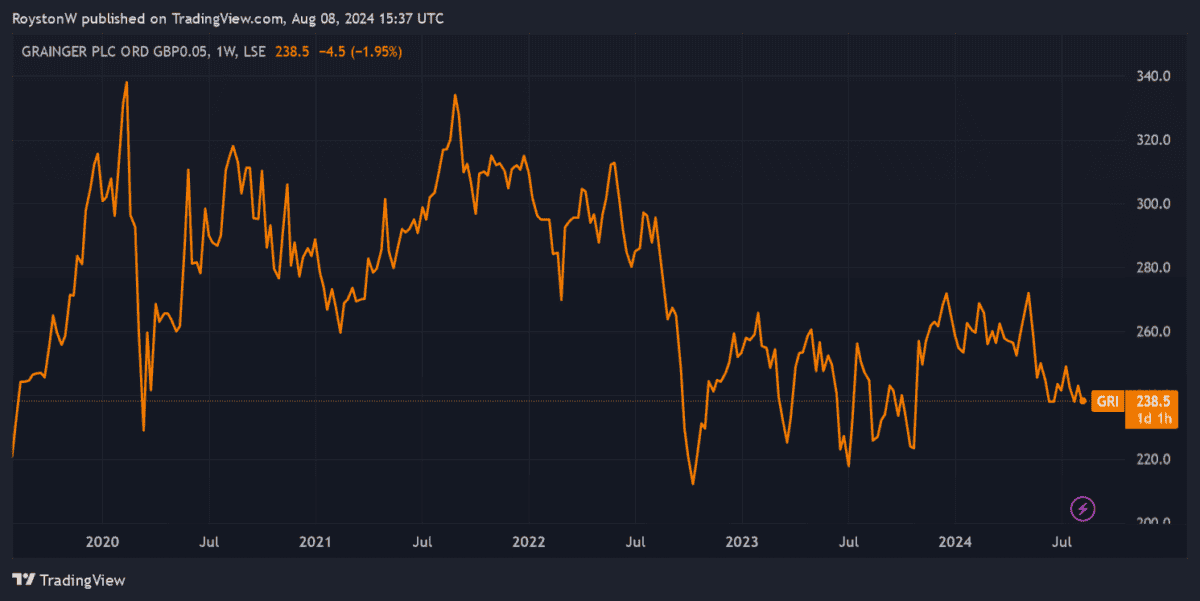

As I mentioned, buying shares that operate in defensive sectors can be a great idea during recessions. In this respect, Grainger (LSE:GRI) could be one of the best the London stock market has to offer today.

Shelter and food are two things humans simply cannot do without. And as a residential property landlord, this FTSE 250 company can expect a steady flow of income at all points of the economic cycle. Latest financials showed its property occupancy at a high 97.7% as of March, despite the ongoing cost-of-living crisis.

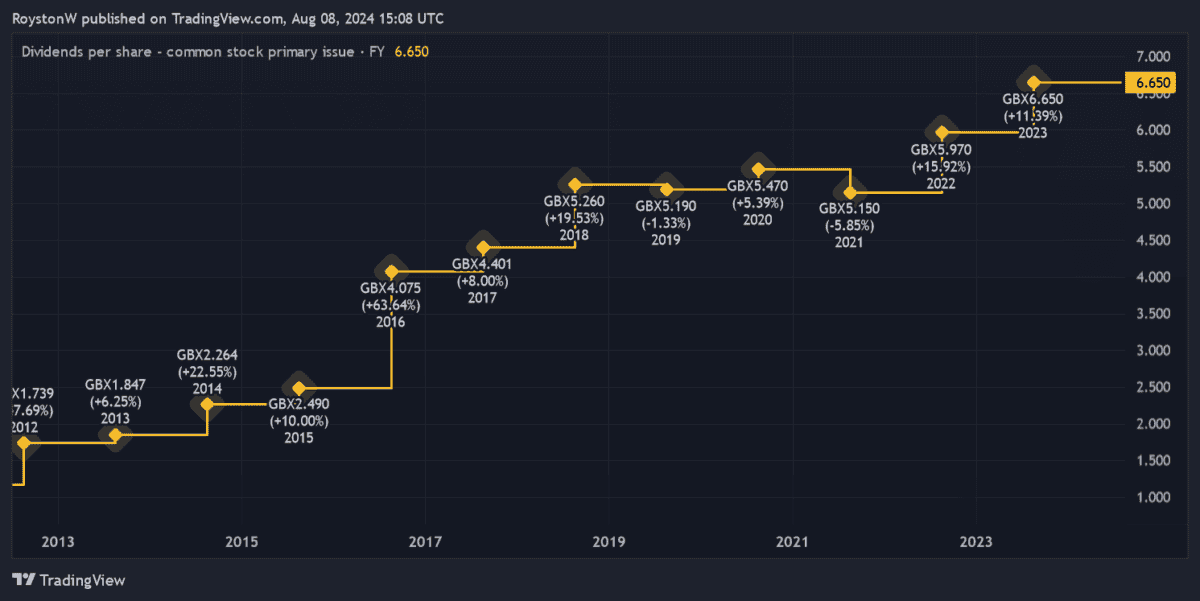

This stability has allowed it to — with the exception of 2019 and 2021 — grow dividends for more than a decade. Indeed, shareholder payouts have ballooned as rental growth in the UK has soared.

Like-for-like private rents soared 8.1% in the first half of Grainger’s financial half. This in turn encouraged the firm to raise the interim dividend by 11% year on year, to 2.54p per share.

Dividend growth

The lack of available rental properties, which is pushing rents higher, is expected to persist for several more years at least. And so City analysts expect Grainger’s dividends to continue swiftly rising for the next three financial periods, as illustrated below.

| Financial year* | Dividend per share | Dividend yield |

|---|---|---|

| 2024 | 7.29p | 3.1% |

| 2025 | 8.24p | 3.5% |

| 2026 | 9.11p | 3.9% |

The property giant is quickly expanding to capitalise on these fertile conditions too. As of March it had around 5,000 new rental homes in its development pipeline to add to its existing portfolio of just over 11,000.

This could provide the foundations for steady profit (and thus dividend) growth beyond the next few years. Furthermore, Grainger’s growth strategy should receive a boost from Labour’s pledge to slim down planning regulations.

Having said this, future dividends aren’t completely immune to risk. One worry I have is the company’s net debt pile, which rose 6% year on year to £1.5bn as of March. This could compromise payout growth as the company also invests heavily in its property portfolio.

On balance however, I still believe Grainger remains one of the best dividend stocks for me to consider in these uncertain times.