The London stock market’s a popular place for investors looking to make a large and lasting passive income. In my view, its appeal’s got even better in recent days, and so I’m compiling a list of the best dividend shares to buy.

You see, following the heavy drop in UK share prices, the dividend yields on many top stocks have got even better. The yields on these two, for instance, has risen even further above the 3.6% average for FTSE 100 shares. So I’m considering buying them for my own portfolio.

| Company | Predicted dividend per share | Dividend yield |

|---|---|---|

| Primary Health Properties (LSE:PHP) | 6.9p | 7.5% |

| Phoenix Group Holdings (LSE:PHNX) | 53.9p | 10.2% |

Dividends are never guaranteed. And many companies may struggle to pay those that brokers are projecting if a US recession emerges to derail the global economy, or interest rates remain around current levels.

But I think these particular dividend stocks look good to meet current forecasts. If they do, £20,000 invested equally across them would generate a brilliant £1,780 in passive income.

Here’s why I’d buy them if I had cash to invest today.

In good health

Primary Health Properties is a real estate investment trust (REIT). And so it’s required to pay at least 90% of annual rental profits out to investors every year.

This isn’t the only reason why it’s such a reliable dividend payer however. As its name implies, it specialises in building and letting out primary healthcare facilities like doctor surgeries and diagnostic centres.

Demand for this sort of real estate remains strong at all points of the economic cycle. And what’s more, the rents Primary Health Properties receive are effectively underpinned by government bodies.

As a result, rental income remains stable from one year to another, and so does its ability to pay a good dividend to its shareholders.

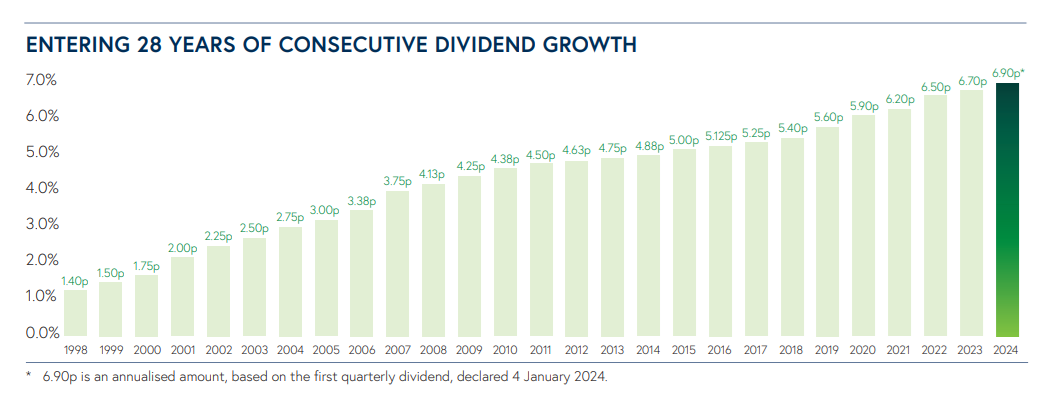

You’ll see from the graphic above that Primary Health Properties has an excellent track record of increasing the dividend. With its leases linked to inflation, and demand for healthcare services steadily rising, it looks in good shape to continue raising them too.

Be aware however, that any future changes to NHS policy could dent earnings and dividend growth later on.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Another dividend hero

Phoenix Group’s more sensitive to economic conditions than the REIT I’ve described. Its investment portfolio can underperform during downturns, for instance, which can impact profits.

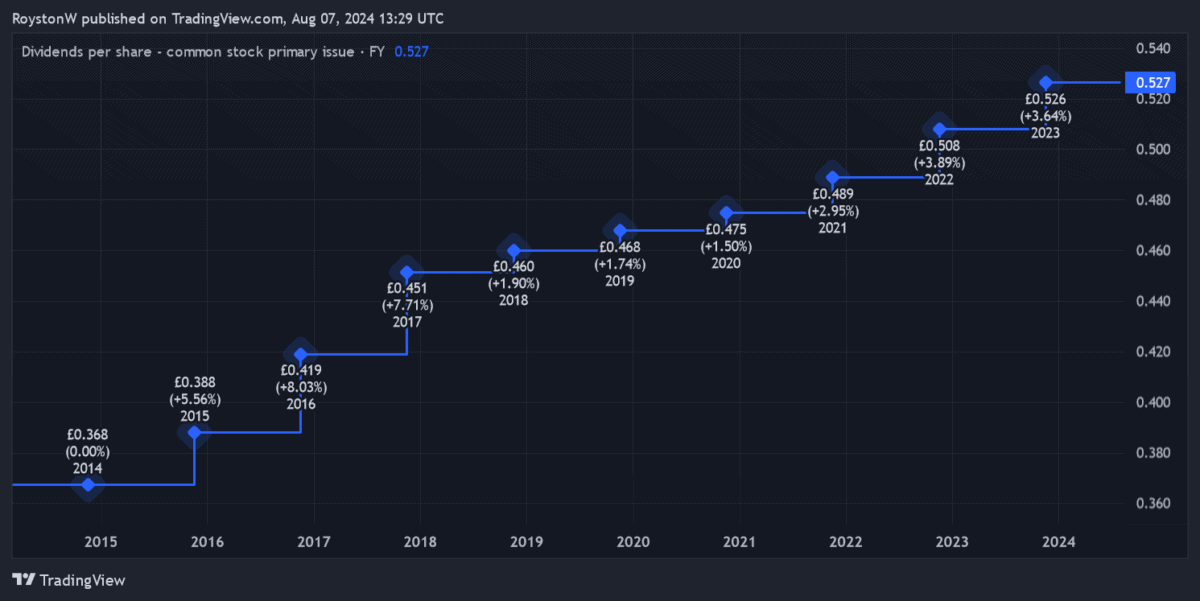

Yet as the chart below shows, the company — which is a large-cap life insurance and pensions consolidator — also has an exceptional record of raising dividends.

This is thanks to the steady stream of premiums it receives from customers under long-term contracts. It’s also because of the significant cash flows it receives from its asset portfolio.

The past is no guarantee of future returns, of course. But Phoenix looks in great shape to continue raising dividends. Its Solvency II capital capital was a rock-solid 176% at the start of 2024.

And like Primary Health Properties, it has an excellent chance to continue growing dividends over the long term as the number of elderly people in the UK steadily climbs, driving demand for its services.