It has been a rocky few days in the stock market. So far, though, we are nowhere near a stock market crash in the UK. That is sometimes defined as meaning the market has lost 20% or more of its value in a short period of time.

Still, a crash could happen at some point. In fact, it will happen at some point – we just do not know when. It could come this week, or it may take decades.

Crashes can be sudden and sometimes short-lived, so it pays to be prepared.

Rather than focusing on when it might come, therefore, I am spending time getting ready to try and profit from it.

Could I double my money?

I reckon I might even be able to double my money.

That relies on two equally important elements. The first is that a stock market crash can often throw up a mismatch between the value of a share and its current price. The second is that I am a long-term investor.

My approach

So my plan is to build a watchlist now of income shares I would love to own if I could buy them at the right price. I would then be ready to pounce if a crash pushes them down enough.

I specifically want to buy shares in great businesses at a markedly lower price than I think they are worth.

Hopefully over time that could reward me in two ways: share price growth and also a higher dividend yield than buying the same shares at a higher price.

Putting the theory into practice

To illustrate, consider a share I own: Legal & General (LSE: LGEN).

I like its strong brand, large customer base, and proven business model. As the interim results released today (7 August) show, the business remains in good shape.

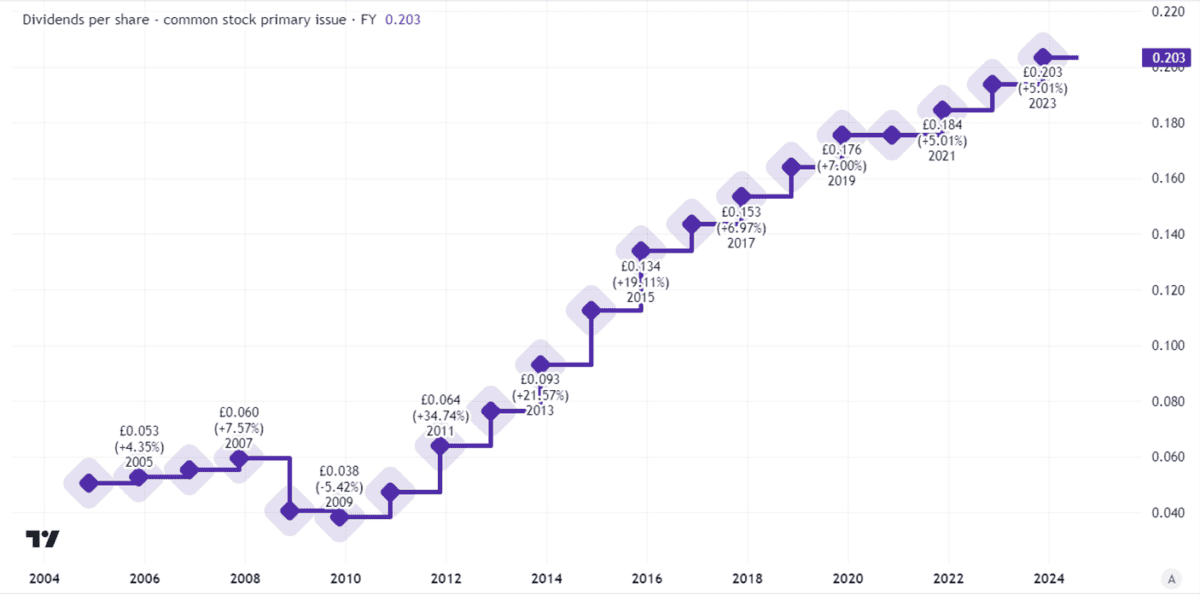

Indeed, the interim dividend was increased 5%, although smaller rises are expected from next year onwards. Legal & General’s dividend history over the past couple of decades has been impressive.

Created using TradingView

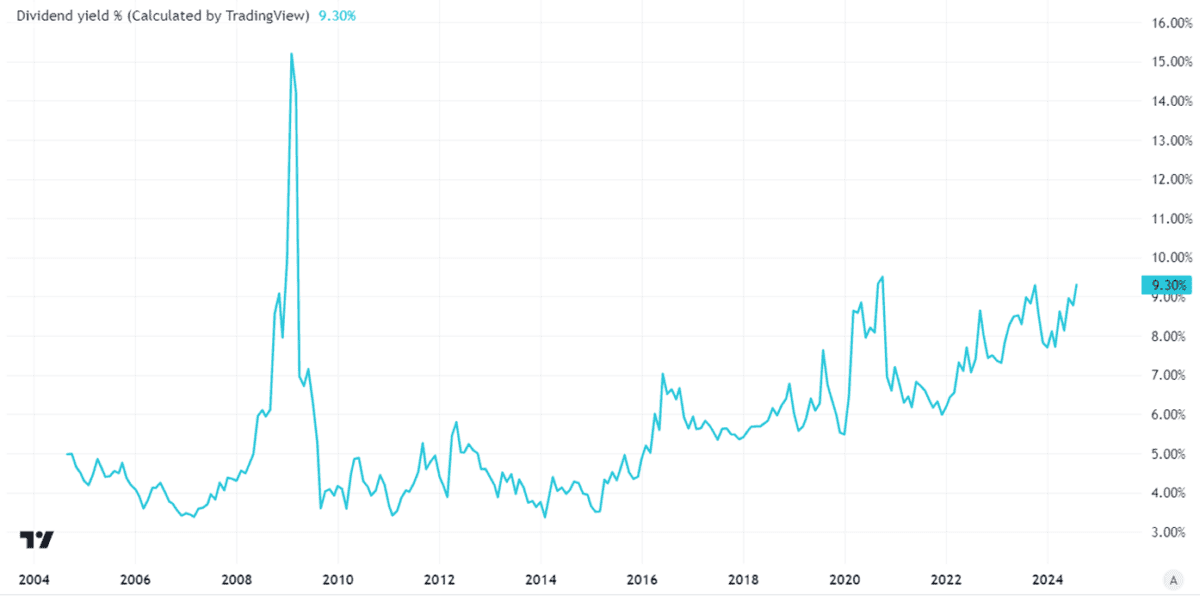

Still, the share already yields 9.3%. If I simply compounded my portfolio value at 9.3% annually by reinvesting dividends, I would already have doubled its value in eight years. That presumes that the share price is flat and dividends maintained at the current level.

That is never guaranteed: as the chart above shows, the payout per share was cut following the financial crisis in 2008. If there another stock market crash leads clients to pull out funds, we could see another cut.

But what if I had bought the shares during the 2020 crash?

My purchase price would have been lower than it had been before the crash. Over five years, the Legal & General share price is down 8% — but it is up 39% from its March 2020 low.

Not only that, but buying at a lower price would have meant I subsequently earned a higher dividend yield.

Notice in the chart below how the dividend yield jumped as the price crashed in March 2020 (and in 2009).

Created using TradingView

By buying carefully selected great shares cheaply during the next stock market crash, I believe I could realistically aim to double my money over the long term!