The Coca-Cola HBC (LSE: CCH) share price is up about 20% in the past six months. However, the FTSE 100 stock dropped 3% to 2,654p today (7 August) after the bottling firm posted its first-half earnings.

This one has been languishing on my buy list for months. Surely it’s time to put that right?

Strong performance

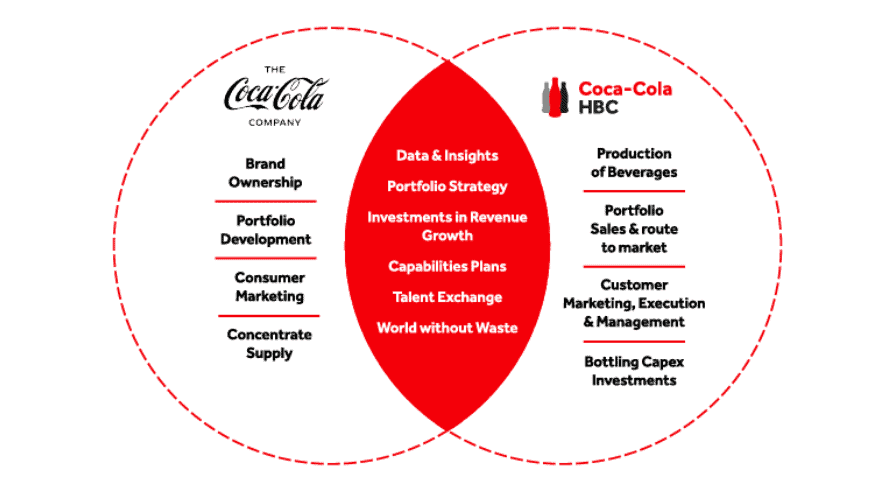

For those unfamiliar, this is a Switzerland-based bottler for The Coca-Cola Company. The US drinks giant has a 20%+ stake in the firm and remains in charge of branding and beverage formulas. Meanwhile, Coca-Cola HBC handles the bottling, distribution, and sales across 28 markets in Europe and Africa.

In the six months to 28 June, organic revenue grew 13.6% year on year to €5.18bn. Operating profit jumped 7.5% to €564m.

Organic volume increased by 3.1%, with growth in its three priority categories.

- In Sparkling, volumes grew 1% as it launched premium mixer brand Three Cents in a further nine markets.

- In Energy, volumes increased by 32.8% despite new regulation in Poland and Romania. There was strong growth of Predator in emerging markets like Egypt while Monster Energy Green Zero Sugar was launched in 16 countries.

- Coffee volumes grew 21.6%, with a strong start to the year from Costa Coffee.

Looking ahead to the full year, organic revenue is expected to rise 8%-12%, well ahead of the company’s previous mid-term target range of 6%-7%.

Meanwhile, it sees organic earnings before interest and taxes (EBIT) increasing 7%-12% rather than 3%-9%.

So why was the stock down?

These H1 results look very strong to me considering we’ve seen many other firms struggling to grow due to weak consumer spending.

However, there were negatives. Foreign-exchange effects in Nigeria and Egypt, caused by the depreciation of their currencies, offset the strong organic growth. As a result, net sales revenue only actually increased by 3.1%.

Plus, there was an earnings miss. It posted earnings per share (EPS) of €1.04, down 1.7%, versus a company-compiled consensus of $1.08. The firm said this was due to higher finance costs.

Management also expects the macroeconomic and geopolitical backdrop to remain challenging in the second half. And it anticipates that the cost of goods sold will increase in low-to-mid-single-digits in 2024 due to inflation and currency fluctuations.

These issues took the fizz out of an otherwise solid report.

Should I invest?

The numbers do highlight how the geographically diverse firm is beholden to things outside its control, like wild currency swings and regulation around sugary drinks. These are risks to consider.

Overall though, Coca-Cola HBC is performing very well despite the difficult economic environment. Recent price rises have been digested well by consumers and the raising of guidance tells its own story.

Meanwhile, the latest dividend was 19.2% higher. The well-supported forward yield is currently a respectable 3.1%.

The firm sells a great mix of brands (Coke, Fanta, Sprite, Monster, Costa, etc) across a number of categories in both developed and developing markets. It’s also got an eye for a smart acquisition, with its $220m purchase of the Finlandia vodka brand in 2023 working out well so far.

The forward-looking price-to-earnings (P/E) of 14.5 hardly seems stretched. I think the stock will finally make its way into my portfolio in the coming days.