London’s stock market’s a great place to find dividend stocks today. Years of share price underperformance allow investors to secure high dividend yields, potentially generating a substantial second income.

What’s more, the FTSE 100 and FTSE 250 indices are packed with top stocks with strong balance sheets and leading positions in mature or growing markets. This, in turn, puts them in good shape to provide a sustained and increasing income over time.

Dividends are never, ever guaranteed, of course. But based on broker forecasts, the following three stocks will provide a £1,700 passive income in the following 12 months.

| Stock | Forward dividend yield |

|---|---|

| Assura (LSE:AGR) | 8.1% |

| Supermarket Income REIT (LSE:SUPR) | 8.1% |

| M&G (LSE:MNG) | 9.4% |

This passive income figure is based on a £20,000 lump sum invested, spread equally across all three companies.

Here’s why I think these dividend giants are worth a close look today.

Assura

Assura’s a real estate investment trust (REIT). And, as such, it needs to pay at least 90% of annual rental profits out in dividends.

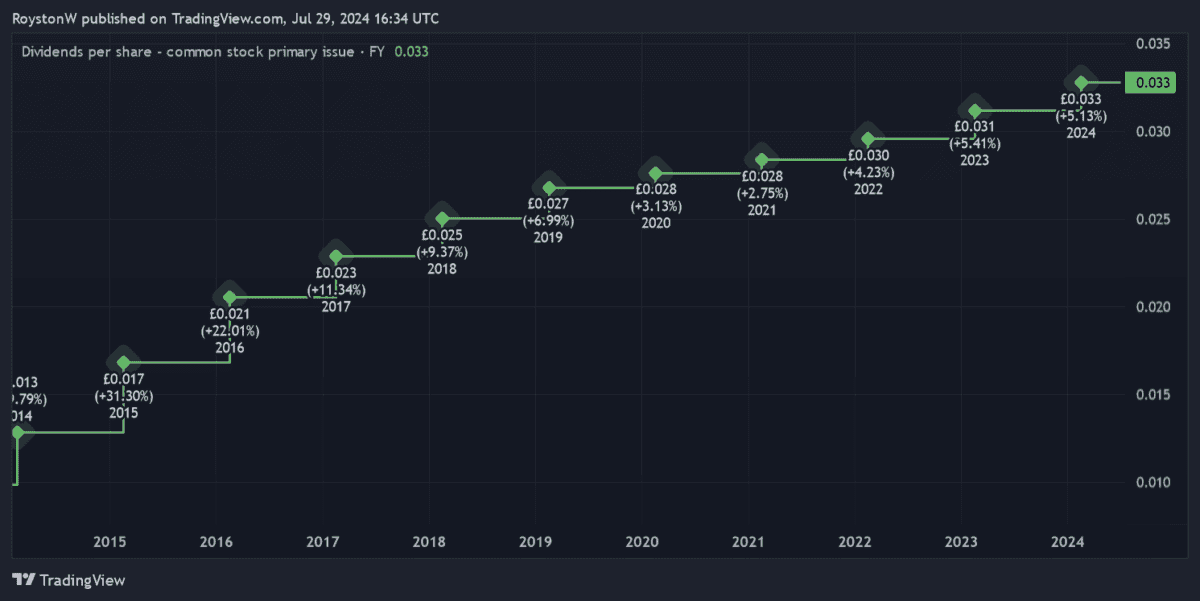

With earnings steadily growing in recent years, this has provided the backbone for shareholder payouts to steadily expand. This is shown in the graphic below.

I believe Assura will have considerable scope to grow earnings (and thus dividends) in the years ahead too. Demand for healthcare infrastructure should rise strongly as the UK’s elderly population balloons.

I also like Assura because the rents it receives are essentially guaranteed by government bodies. That said, future changes to NHS policy could endanger earnings here.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Supermarket Income REIT

Supermarket Income REIT’s another huge-yielding property stock worth considering in August.

Like Assura, it operates in a highly defensive sector, in this case food retail. As a consequence, it can be expected to pay a decent dividend, even during economic downturns.

In fact, annual dividends here have grown each year since its shares began trading in 2017, even during the Covid-19 crisis.

As Britain’s population rapidly grows, Supermarket Income has a chance to steadily grow dividends as food sales inevitably rise. Remember though, its share price could remain under pressure if interest rates fail to fall meaningfully from current levels. This could offset the benefit of a large dividend.

M&G

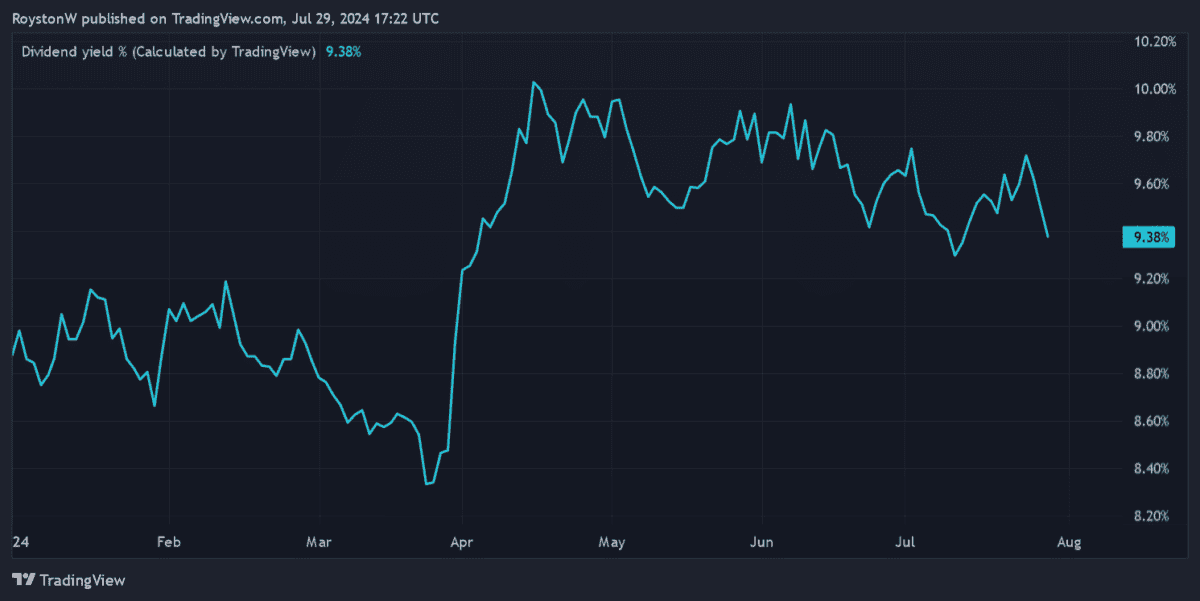

M&G shareholders don’t have the dividend guarantees that owners of REIT stocks have. However, City analysts are still predicting it to pay a large (and rising) dividend over the next few years, at least.

In fact, its 9.4% dividend yield’s one of the largest on the FTSE 100 today.

There’s good reason why forecasters are so bullish. Last year, M&G’s Solvency II capital ratio burst through the 200% mark (to 203%). This gives it plenty of cash to play around with for dividends, as well as to invest in its operations.

The financial services giant faces intense competition across its product lines. But favourable demographic trends mean it should (in my opinion) remain a great passive income provider.