The FTSE 250 continues to surge as interest in UK stocks more generally improves. This week, it barged through the 21,000-point marker for the first time, taking gains so far in 2024 to 8%.

The index is benefitting from improving economic news — along with signs of more political stability — in Britain. This is critical, as FTSE 250 shares make up to 60% of their earnings from within these shores.

However, better trading conditions are only half the story. Demand for value shares is also picking up across the globe. And the FTSE 250’s packed with brilliant bargains following years of underperformance.

Right now, these are two of my favourites. City analysts expect their share prices to soar during the next 12 months, as I’ll explain.

The Renewables Infrastructure Group

Higher interest rates have been created problems for utilities stocks like The Renewables Infrastructure Group (LSE:TRIG). So has a combination of mild weather and high gas stockpiles that have subdued power prices.

These remain dangers going forward. Yet I believe these threats are balanced by the low price of this company.

Renewables Infrastructure Group now trades at 101.4p per share. This is a massive 21% discount to its estimated net asset value (NAV) per share of 125p.

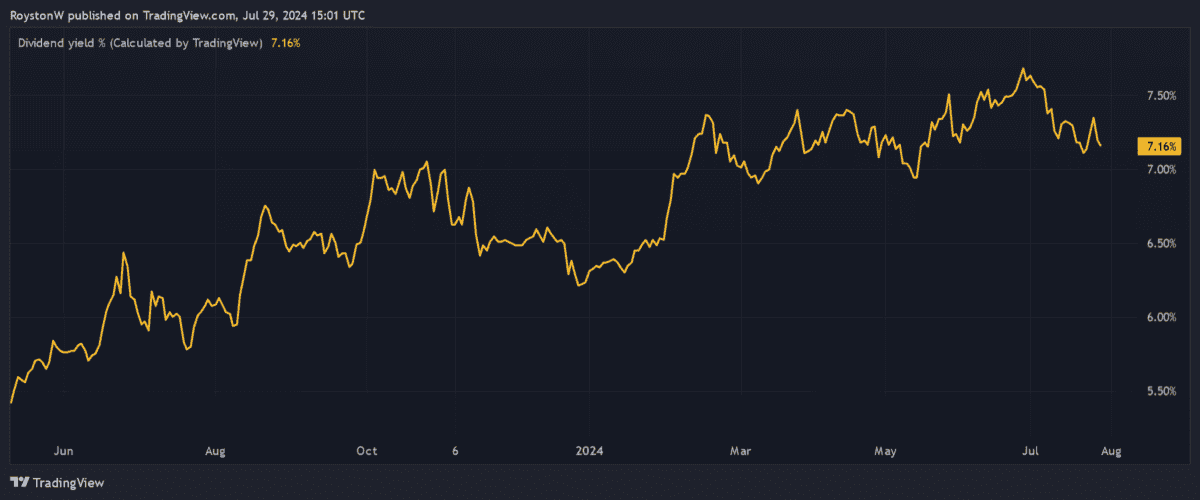

A hulking great forward dividend yield also gives value investors something to enjoy. This is around 7.2%, way ahead of the FTSE 250 average of 3.2%.

I think the company could be a shrewd long-term investment to consider as demand for green energy takes off. With the government also pledging to loosen planning rules for wind farms, I think the firm’s share price could rebound sharply.

City analysts certainly think so. The seven analysts with ratings on the company have attached a 12-month price target of 121.6p on Renewables Infrastructure Group shares. This represents potential price gains of 20%.

NCC Group

Investing in tech stocks could be a bumpy ride in the near term. As concerns over bloated valuations grow, there’s a possibility that share prices could plummet on both sides of the Atlantic. NCC Group’s (LSE:NCC) one that could reverse sharply following recent healthy price gains.

Having said that, the cybersecurity expert doesn’t actually look expensive right now. In fact, a price-to-earnings growth (PEG) ratio of 0.5 suggests the FTSE 250 company’s actually pretty cheap.

Any figure below 1 suggests a stock is undervalued.

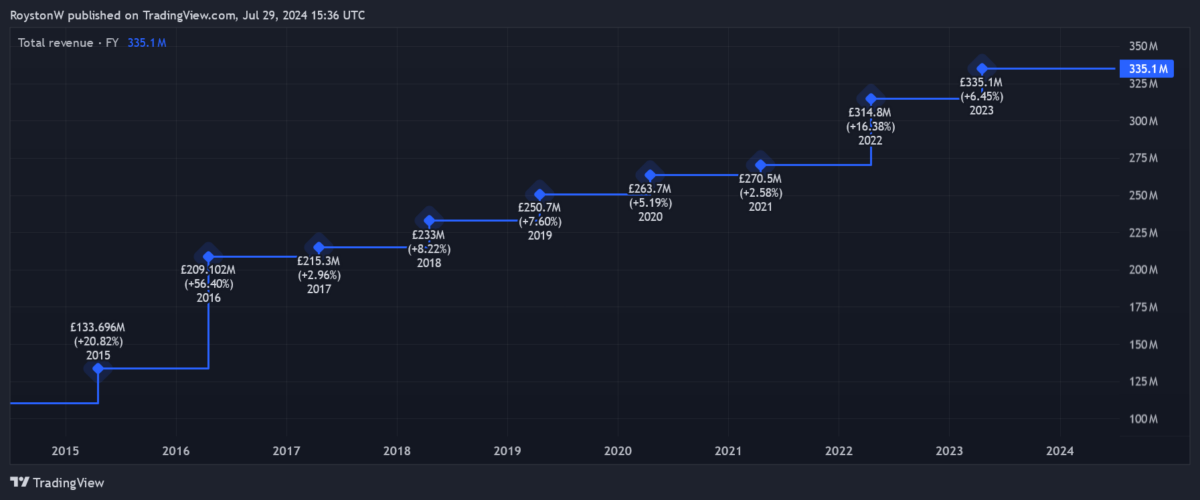

Artificial intelligence (AI) continues to be the tech world’s headline grabber. But the fight against cyber attacks is another product segment that has room for stratospheric growth. The chart above shows how strongly NCC’s own revenues have grown over the past decade.

Against this backdrop, analysts think NCC’s share price of 148p will rise 15% over the next 12 months. A target price of 169.6p is based on views from seven forecasters.