Demand for FTSE 100 stocks continues to heat up this summer. The UK’s premier share index hit new all-time peaks above 8,300 points this week, taking total gains in 2024 to 8%.

But investor appetite hasn’t been spread equally across the Footsie. Indeed, there are plenty of blue-chip shares that remain incredibly cheap following years of underperformance.

Here are two of my favourites right now. As I’ll explain, City analysts expect their share prices to rocket in the next 12 months.

Should you invest £1,000 in Aviva right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva made the list?

Aviva

At 496p per share, Aviva (LSE:AV.) offers brilliant value in terms of predicted earnings and expected dividends.

Okay, its forward price-to-earnings (P/E) multiple sits close to the FTSE 100 average, at 10.7 times. However, its price-to-earnings growth (PEG) ratio stands at a rock-bottom 0.5. A reminder that any reading below 1 indicates that a share’s undervalued relative to predicted profits.

On top of this, the forward yield on Aviva shares is 7.1%. This is more than double the Footsie average of 3.5%.

So what are the drawbacks of investing today? One is the possibility that interest rates will remain around current highs, thus denting consumer spending. So is the threat posed by high competition across its markets.

Yet Aviva also has an opportunity to grow earnings significantly. It has one of the strongest brands in the financial services industry. It can use this — along with its cash-rich balance sheet — to capitalise on rapid growth in the pensions and retirement products segments.

In the meantime, 15 City brokers have slapped a 12-month target of 528.4p on Aviva shares. This represents potential price upside of 7%.

Vodafone Group

Investing in any telecoms stock can be risky due to the huge amounts they spend in infrastructure. Vodafone Group‘s (LSE:VOD) even had to cut the dividend for this year as it ramps up 5G-related spending.

But over the long term, companies like this also have significant long-term potential for investors. Demand for their services could grow significantly as our lives become increasingly digitalised.

It can be argued that Vodafone has particularly great growth opportunities too. This is thanks to its large exposure to Africa, where surging wealth levels and population sizes are driving product sales through the roof.

Vodafone — which has 157m customers across six African countries — reported organic service revenue growth of 9.2% last year.

At a current price of 73.5p, I think the potential rewards of owning Vodafone shares outweigh the risks. Its forward P/E ratio — like Aviva’s — is in line with that of the broader FTSE. Last year’s losses mean it doesn’t have a valid PEG ratio either.

But its dividend yield stands at an index-smashing 6.9%, even taking into account that upcoming dividend cut.

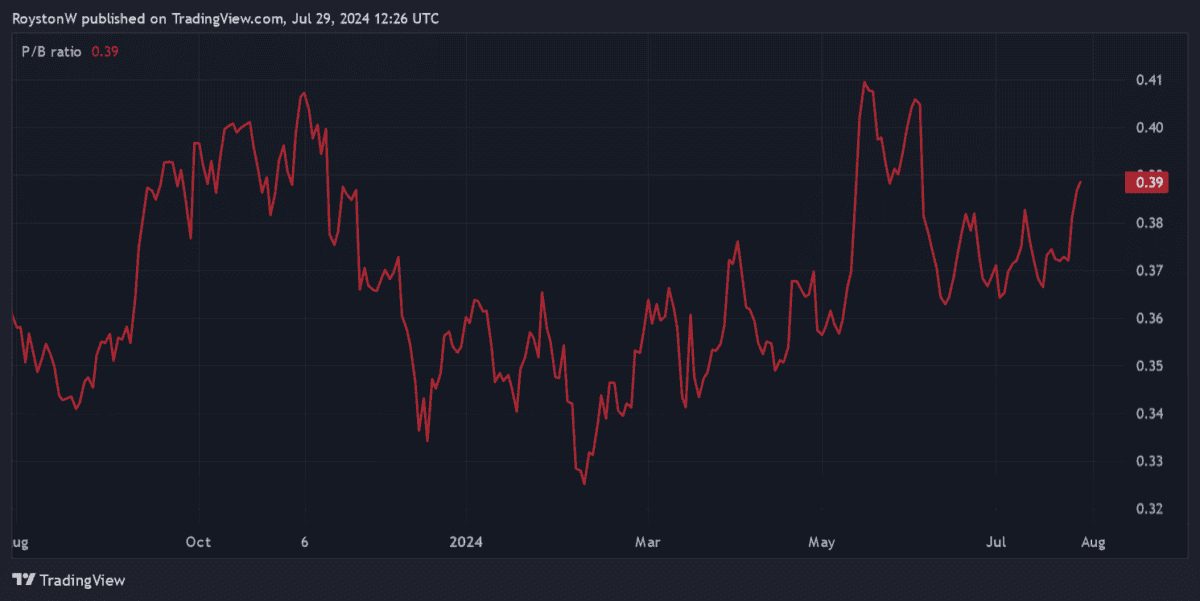

What’s more, its price-to-book (P/B) ratio sits below 0.4, as shown above. A reading below 1 suggests that a company trades at a discount to the value of its assets.

Fourteen analysts currently have ratings on Vodafone shares, creating a consensus target price of 96.2p. This implies the telecoms giant could rise 31% in value over the next 12 months.

Like Aviva, I think it could be one of the Footsie’s best bargain stocks to consider today.