The FTSE 100 contains some high-yield shares right now, from British American Tobacco to Aviva. But the FTSE 250 index of smaller and medium-sized companies also contains members with high figures.

In fact, one currently offers an 8.6% yield – higher than either British American Tobacco or Aviva at the moment.

Ought I to buy it for my portfolio?

Well-known name, of sorts

The company in question is Standard Life Aberdeen. Or at least it used to be, before losing its vowels to become abrdn (LSE: ABDN). It is not just the vowels that got lost – its shares have fallen close to 40% since that name change was announced in April 2021, and are down 26% over the past year alone.

But that period has been challenging for the investment industry in many ways. abrdn shares are down just 3% this year and have rallied an impressive 25% over the past three months. On top of that, the 8.6% dividend yield looks juicy to me.

So, could this be a stock worth adding to my portfolio?

Multiple challenges but long-term promise

The name change bothers me partly because a well-known and recognisable brand can be a valuable asset for a financial services company. Fortunately, abrdn does still have a variety of strong assets, from well-recognised operating brands to a sizeable customer base.

In the first quarter of this year, it reported assets under management and administration of over half a trillion pounds, an increase over the same quarter last year.

Last year the first quarter saw a sharp net outflow of funds. But this time around, that number was positive, meaning clients put in more funds than they withdrew.

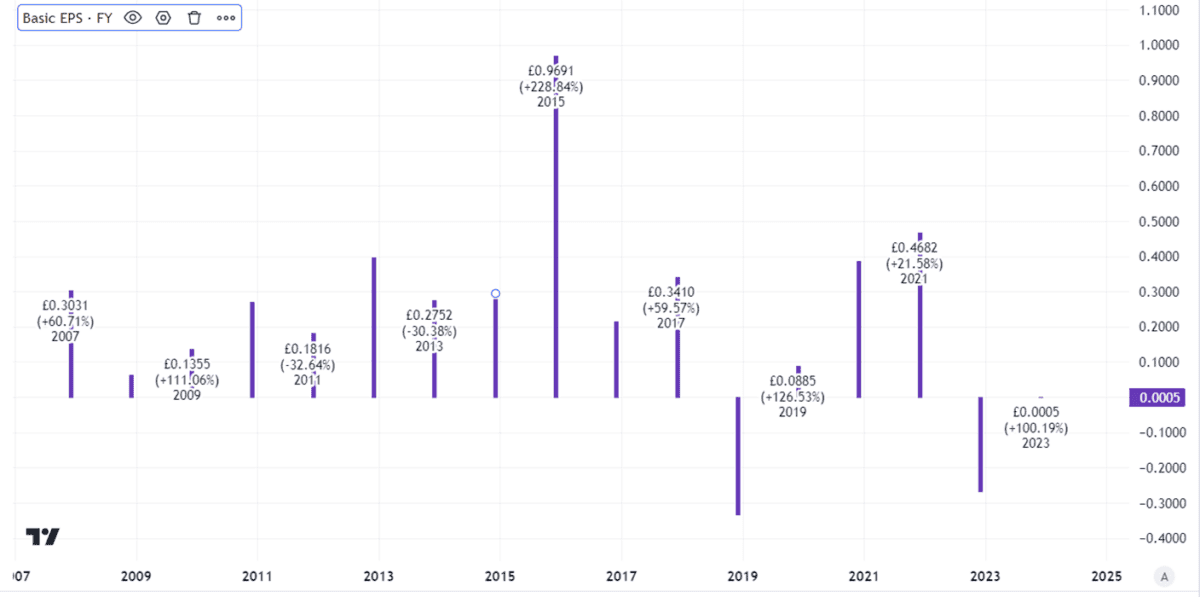

That sort of client base can be the basis of a profitable business. abrdn’s basic earnings per share have moved around a lot, including some losses. But over time the firm has demonstrated that its business does have the potential to generate sizeable profits when doing well.

Created using TradingView

Indeed, the current price-to-earnings ratio of 12 looks fairly cheap – but the company is trading on less than 4 times 2021 earnings. That means it could be a bargain if it can fix some of its recent challenges.

They include clients pulling funds out across the industry as a whole (a factor that affected abrdn last year) and achieving consistent profitability. A cost-cutting programme is in place to try and help with that – but, as always, cost-cutting can be a risky business if it upsets clients or staff.

High-yield dividend stock

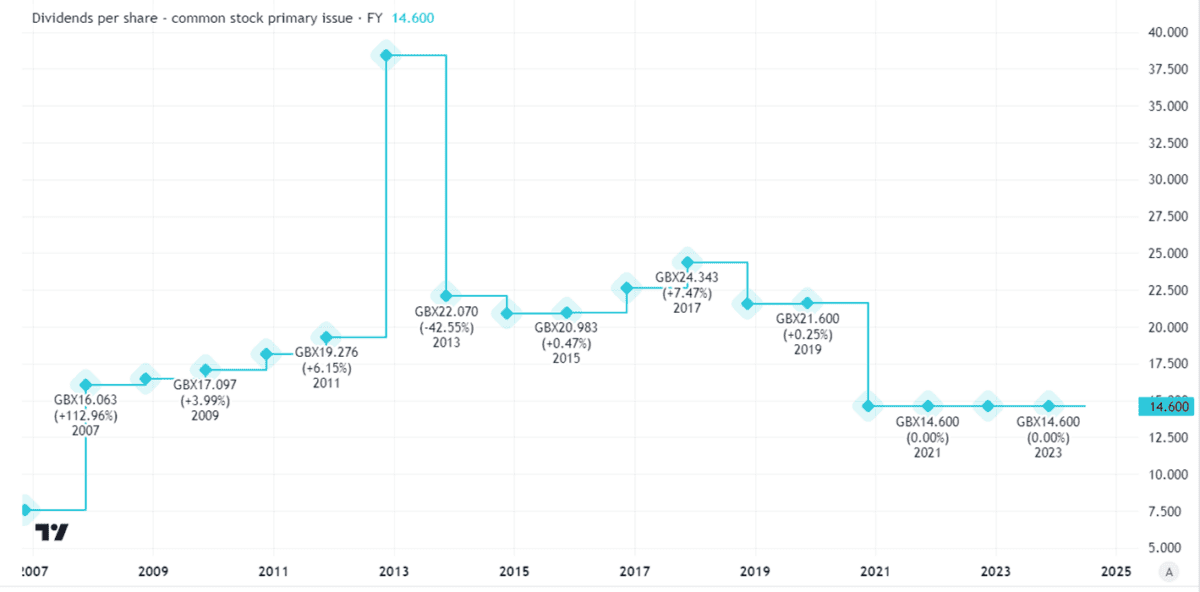

Those challenges have seen the FTSE 250 firm hold its dividend per share flat in recent years after a big cut in 2020.

Created using TradingView

Still, even if the dividend is held flat, that 8.6% yield looks attractive to me.

The concern I have is that the business has been an inconsistent performer over many years. There is a reason the dividend is smaller than it was over a decade ago.

I think there are ongoing risks, notably if an economic downturn hurts client demand, so for now I will not be investing.