While many people’s minds drift to sunny summer fun in August, the stock market remains open for business. Here are three FTSE 100 shares, each yielding at least 8%, that I would consider buying for my portfolio next month if I had spare cash to invest.

M&G

I already own shares in asset manager M&G (LSE: MNG). But as the share price continues to go nowhere fast – it has fallen 4% since the start of the year – its yield remains attractive to me. Currently it sits at 9.2%.

The share price performance has long been weak – indeed, M&G shares today are 5% below the price at which the firm listed in 2019. But that has been more than made up for by dividends during that period. The company aims to grow or maintain its payout per share each year and so far has delivered on that.

Over the past couple of years, the business has published its interim results in either August or September, so we should have an update fairly soon on how the firm is performing. An ongoing risk is a weakening economic environment leading clients to pulling out funds, hurting profits.

So why would I consider adding to my M&G holdings?

With its strong brand, large customer base, and proven cash generation capacity, I see the income share as the sort of investment I am happy to hold in my portfolio for years to try and earn passive income.

Phoenix

Another financial services share, one that I do not hold, is Phoenix (LSE: PHNX).

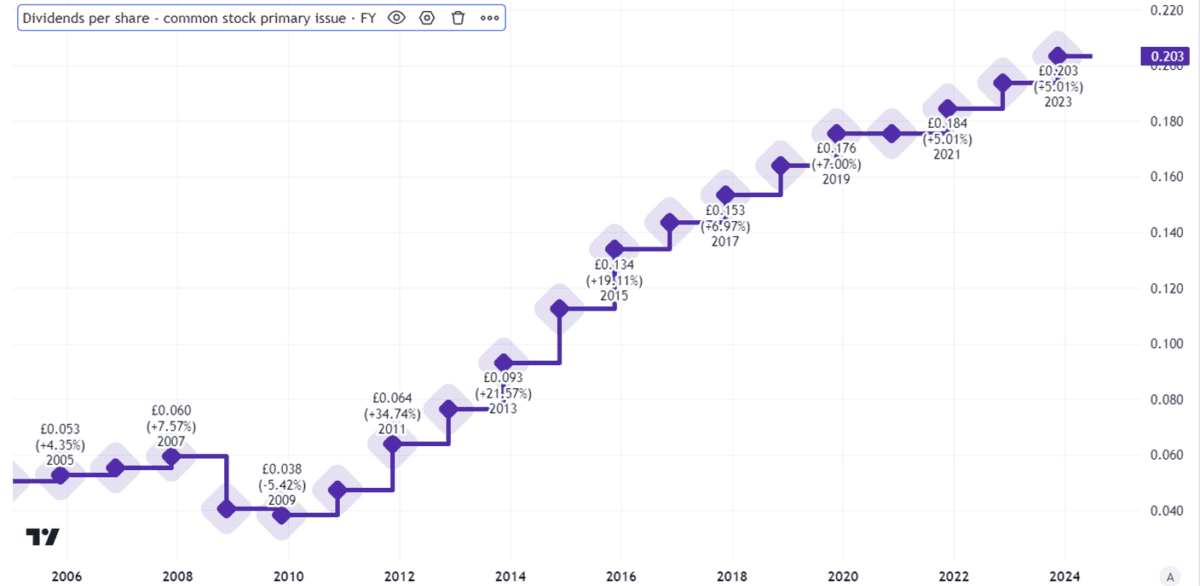

Like M&G, it has raised its dividend per share annually in recent years. Its yield is even higher, at 9.7%. That means it is one of the highest-yielding shares of the FTSE 100.

Like M&G again, Phoenix sometimes seems little loved by investors. Despite that strong dividend, its share price has fallen 19% in the past five years.

Partly I think that reflects the complexity of its business. Pricing liabilities on long-term financial products such as pensions can be a difficult thing to get right. If a financial downturn sends property values down, for example, Phoenix’s mortgage book could turn out to be worth less than it thinks now.

But the business has a huge customer base and I expect it to benefit from long-term insurance demand. Like M&G, it has proven cash generation potential on a large scale and again like M&G, it has consistently proven willing to use that spare cash to help fund large dividends.

Created using TradingView

Legal & General

As my portfolio is already diversified across business areas, I would be happy to add three shares from the financial services sector to it next month. Alongside M&G and Phoenix, the third would be one I have bought in recent months: Legal & General.

The attractions are similar: resilient long-term customer demand, a strong brand, and a large customer base. Legal & General has also been a solid dividend payer, with its last cut being back in 2008 amid the financial crisis.

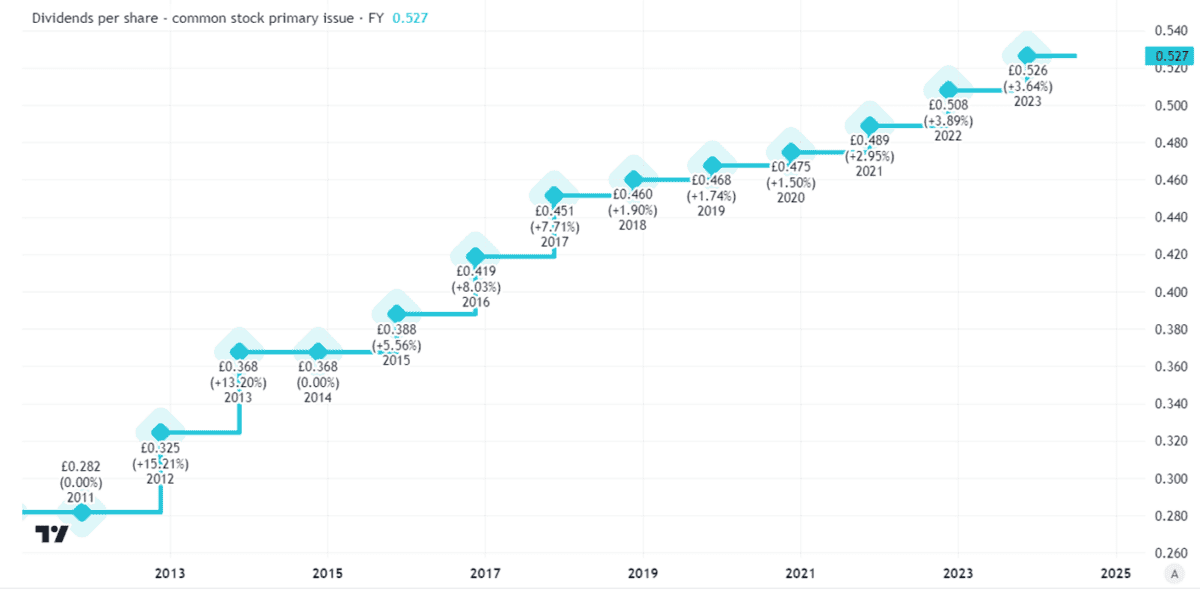

Created using TradingView

Profits fell sharply last year and another severe market drop could mean another dividend cut. As a long-term investor, though, I like the 8.7% yielding FTSE 100 share.