There are a number of FTSE 100 shares that yield 7%. But that is still well above the average dividend yield of the flagship London stock market index. At the moment, one such UK share has risen 17% in value over 12 months — yet it still yields 7%. On top of that, it has a price-to-earnings (P/E) ratio of less than 10.

Ought I to buy?

Low valuation

The share in question is tobacco company Imperial Brands (LSE: IMB).

Despite its recent share price performance, in five years it has gone nowhere, moving up by under 1%. While that P/E ratio indeed looks low, it is in fact higher than it was several years ago.

Created using TradingView

So, is the share a bargain?

I think the valuation reflects a number of factors. Cigarettes are seeing declining demand in many markets, something I expect to continue over time. But Imperial remains heavily dependent on them. Meanwhile a big dividend cut by the company in 2020 put many investors, including myself, off the shares.

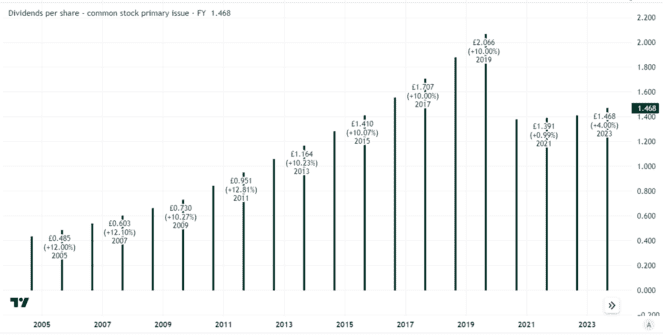

Growing dividend per share

Still, 7% is what I would regard as a high yield.

Imperial’s dividend cut was all but inevitable and allowed it to improve its balance sheet. It has been growing the dividend again regularly in recent years.

Created using TradingView

From a dividend perspective, I see both a pro and con to the investment case here. For a blue-chip UK share, 7% is a strong yield. It is not exceptional but it certainly sets Imperial apart from most of its peers. The business has a stable of strong brands.

Over time though, I fear the prospect of a further cut in the payout. Imperial’s strategy of squeezing the most out of the cigarette cash cow while it can is working for now.

But from a long-term perspective, I question whether it can replace the revenues and especially profits a smaller cigarettes business would likely mean. Imperial has made much less progress in developing a non-cigarettes business than some rivals.

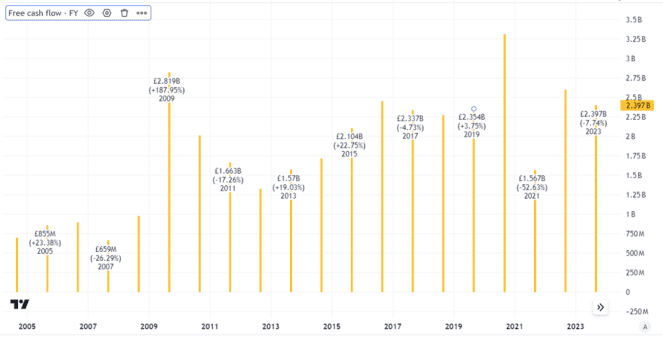

That could hurt free cash flows. Ultimately, it is free cash flows that fund dividends. The past few years have seen inconsistent free cash flows at Imperial and over time, as cigarette volumes decline, it may be harder to sustain current free cash flows even though cigarette makers including Imperial enjoy strong pricing power.

Created using TradingView

Is this a great share?

On balance, I think this is a decent UK share — but I am not convinced it is a great one.

The dividend history has been inconsistent and the company is heavily focused on a market that is seeing long-term sizeable declines in demand. That could eat into free cash flows, something that might not only lead to another dividend cut but could also mean the share price goes nowhere in the next five years, as it has in the past five – or declines.

So, I have no plans to add Imperial to my portfolio.