Many penny stocks have done poorly since interest rates shot up in 2022. That makes sense, of course, as higher rates make borrowing more expensive and can increase the costs of servicing existing debt.

And even in the best of times, the companies behind penny shares aren’t known for flexing strong financial muscles! Moreover, investors can currently get very respectable returns from just holding cash.

Meanwhile, we still don’t know for sure when rates will start coming down. And even when they do, there’s no guarantee that small-cap stocks will automatically bounce back.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

All this raises the question of whether it’s even worth considering penny stocks at all.

Bottom-up versus top-down

Broadly, there are two distinct approaches to selecting stocks and constructing a portfolio. These are top-down and bottom-up investing.

The first looks at the big picture by considering macroeconomic trends and factors like GDP growth, interest rates, and inflation. Essentially, it’s about identifying which stocks and sectors are likely to benefit from the current and future economic environment.

The second method involves focusing on the fundamentals of an individual company, such as its financial health, competitive position, and growth prospects. This bottom-up stock-picking style can uncover hidden gems and opportunities in any market condition.

The first approach has its merits and can be successful. In practice, many investors actually use a combination of both. But I favour the latter approach.

It means that just because UK interest rates remain at a 16-year high, I’d still consider investing in the right penny stock.

Buying the fear

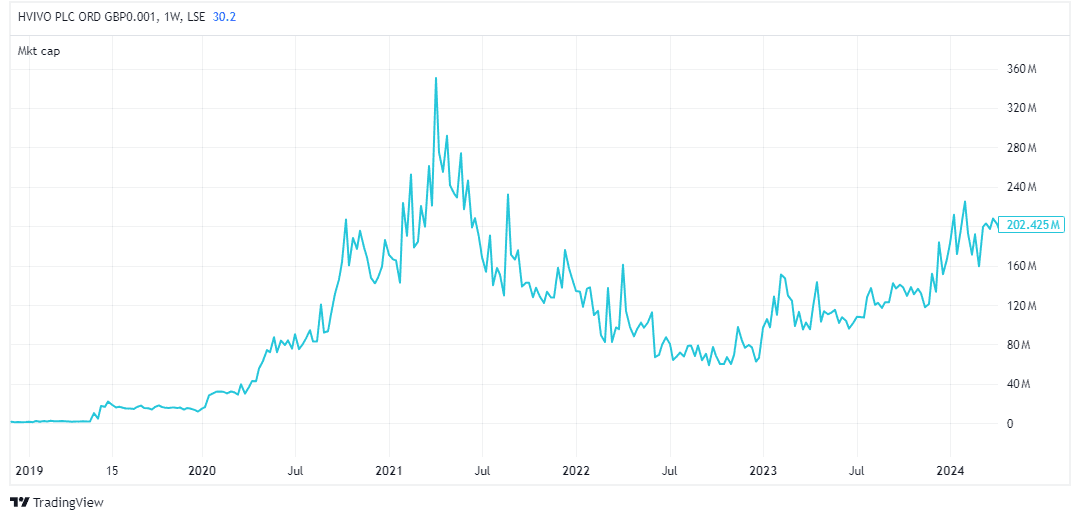

To give an example, I first invested in hVIVO (LSE: HVO) in late 2022 when it was a 12p penny stock with a market cap of £80m. The share price was down 50% year to date.

At the time, the Bank of England had just carried out its largest interest rate hike in 33 years. Consequently, it said the UK faced the longest recession since records began!

Rather than running for the hills, I invested in the small healthcare firm. That’s because I liked what I saw despite the wider economic doom and gloom.

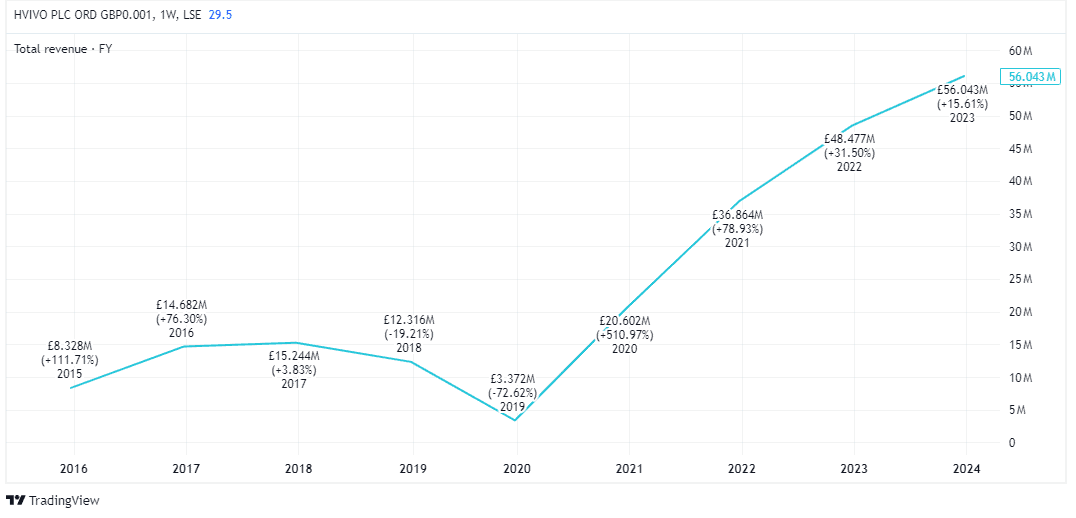

hVIVO is a niche leader in testing infectious and respiratory disease vaccines in human challenge trials. It was signing record contracts and both revenue and profits were heading in the right direction.

Importantly, it had no debt to worry about and was, I judged, being unfairly punished through no fault of its own. Fast-forward to today, the share price is 30p and the market cap, £202m.

Still worth a gander

Now, I should note that my portfolio also has its fair share of clangers. For example, a penny stock I hold called Agronomics is now down 40%!

Meanwhile, hVIVO still faces risks, notably competition and any sudden changes in the regulatory environment. It’s not a home run quite yet.

My purpose here is to show that a bottom-up approach to selecting stocks can be very fruitful. It works the same whether it’s a whale of a company or a relative stickleback.

But the potential gains from investing in the right penny stock can be much larger due to the firm’s smaller size. It’s still worth looking for small-cap stocks in 2024.