Many investors have their favourite holdings in their Stocks and Shares ISA portfolios. As things stand, I consider this pair of stocks untouchable (in a good way) in mine.

A FTSE 250 winner

The first is Games Workshop (LSE: GAW), the maker of popular tabletop battle games Warhammer 40,000 and Warhammer Age of Sigmar. It also holds licensing rights for tabletop games based on The Lord of the Rings and The Hobbit.

But, a cynic might say, this is just a niche market of self-confessed geeks buying tiny, overpriced plastic figurines. What’s so impressive about that?

Should you invest £1,000 in Topps Tiles right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Topps Tiles made the list?

Well, these games have a dedicated global fan base. And the firm enjoys incredibly high profit margins due to low capital requirements and the premium pricing of these products.

In fact, the company’s net profit margin is almost 30%!

The share price has risen by 120% over the past five years, while the dividend has grown at an impressive compound annual growth rate of 16.7% over this period.

The yield is currently 4.1%. This makes it both a growth and dividend stock — a rare beast.

One risk would be the loss of CEO Kevin Rountree, who’s been in charge since 2015. He’s been integral to the firm’s success in recent years. That net margin before and after his appointment proves the point.

We have a simple strategy at Games Workshop. We make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever.

Games Workshop

Looking ahead, the company still has growth opportunities from the licencing of its intellectual property. In particular, its collaboration with Amazon to make Warhammer content could bring in new fans.

An iconic luxury brand

The second untouchable stock in my portfolio is Ferrari (NYSE: RACE).

As mass-market carmakers continue slashing prices, the average cost of a Ferrari is now $380,000. Its first electric car due in late 2025 will apparently cost at least $535,000 before personalisations, according to Reuters.

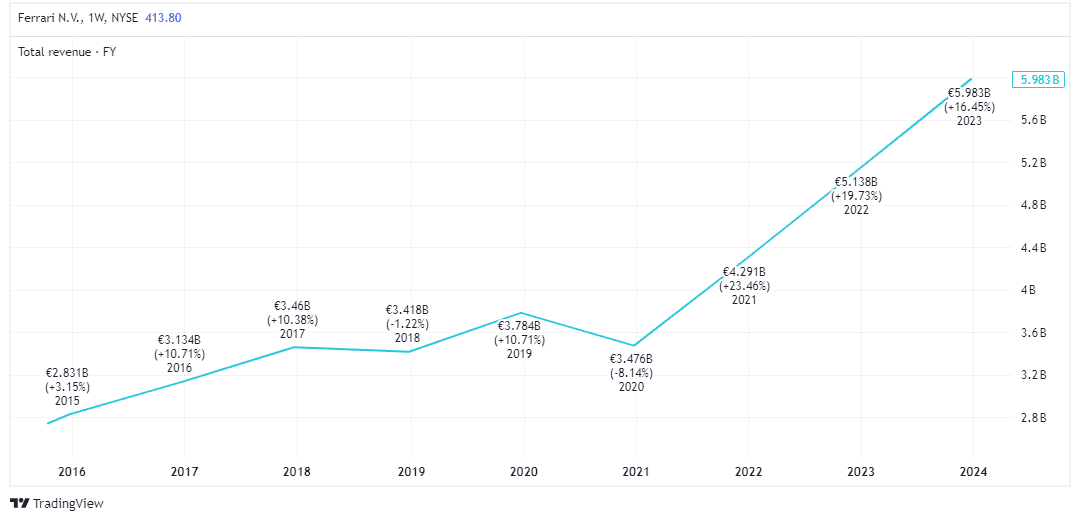

The firm’s revenue has grown tremendously over the last decade, with its net margin reaching 21%.

In 2023, Ferrari made 13,336 cars, almost three-quarters of which were sold to existing clients. The long-term strategy is to grow profits by double digits through making more on each car rather than more in total.

The CEO recently told CNBC that seeing a Ferrari on the road should like encountering a rare and exotic animal.

This strategy could be risky though. Waiting lists for newer models are longer than ever. This extreme exclusivity increases the allure of the brand, but it might also frustrate potential customers.

That said, the business has never been stronger. Along with Hermès, the brand occupies “the pinnacle of the pricing pyramid“, according to one luxury analyst.

This makes Ferrari uniquely positioned to benefit from the unstoppable rise in the global super-wealthy.

Key characteristics

Admittedly, Ferrari and Games Workshop are both expensive stocks. They’re trading at 48 and 22 times forward earnings, respectively, which adds risk.

But if I could tease out some other traits they share, they’d be:

- Unique brands

- Loyal customers

- Profitable niche market leaders

- Decisions focused on long-term success, not short-term gains

- Pricing power

These are some of the winning ingredients for stocks.