Very few things sound sweeter than the words ‘passive income’. For me, the idea of earning money with minimal effort’s incredibly appealing.

Imagine having a steady stream of income flowing in while focusing on other pursuits, travelling the world, or simply enjoying more free time with family and friends.

In the UK, many people elect to invest in property as a way to earn a passive income. However, having owned a buy-to-let property, I don’t think it’s the most efficient way of doing things.

Instead, I invest in stocks and shares. And by doing so I’ve been able to average double-digit returns. With my portfolio growing, one day I can look to taking a significant passive income.

How to get started

There are lots of terminologies in investing — ISAs, ETFs, bonds, gilts, stocks — and it can be difficult to know where to start.

I’d begin by opening a Stocks and Shares ISA. This type of account allows investments to grow tax-free, which can significantly boost returns over time, and the all-important compounding process.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

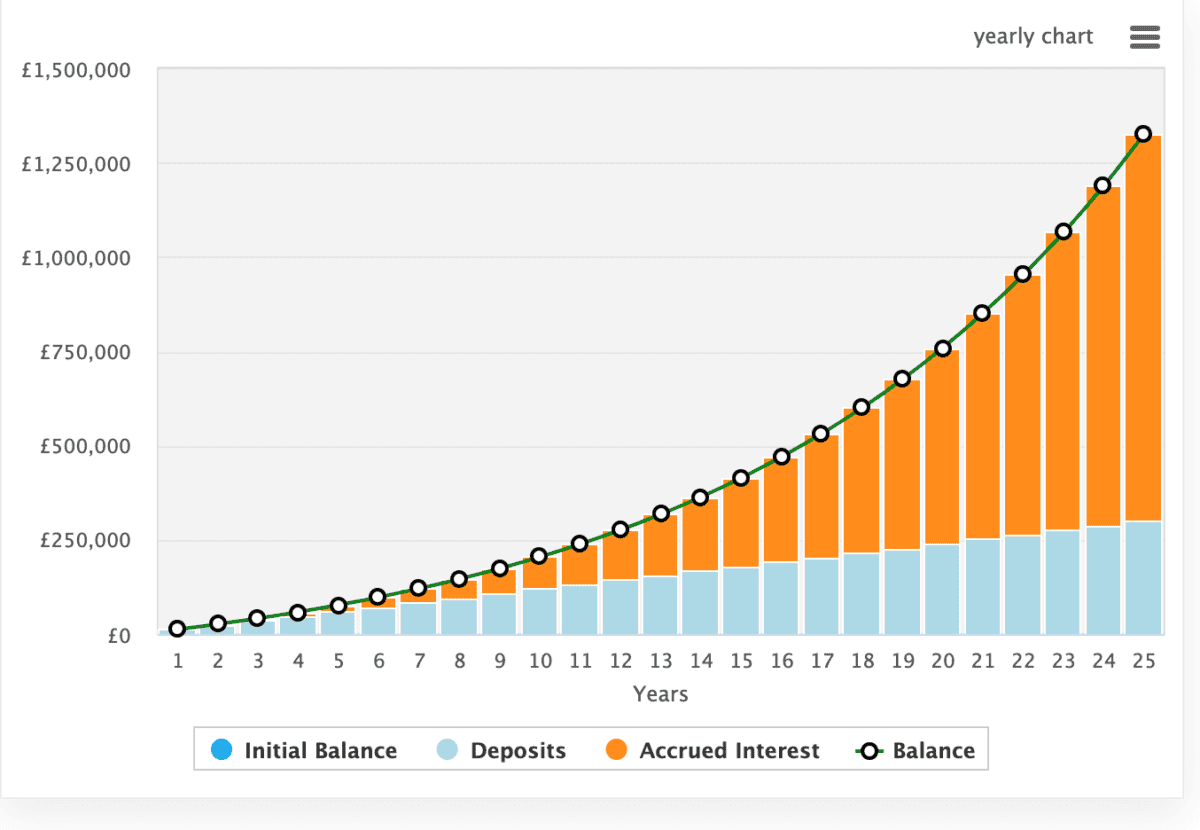

Compounding’s incredibly important, and sometimes we need to visualise it to see what it’s all about. Below, I’ve highlighted how £1,000 a month can compound at 10% annually. As we can see, our investments appear to grow quicker over time — that’s compounding.

Practically, this means we need to invest wisely, creating a diversified portfolio of good quality stocks, bonds, funds, and ETFs. Benefitting from compounding also means I need to reinvest my returns year after year.

Some companies — growth oriented ones — reinvest on my behalf. In other words, they don’t pay a dividend and instead invest in their own growth. Others pay a dividend and that I will need to reinvest.

Investing for success

There are lots of stocks I’d invest in right now, including CRISPR Therapeutics, AppLovin and Vertiv. But I believe it’s important investors do their own research before taking the plunge.

However, it can take time to thoroughly research stocks, and this is why many investors prefer funds or ETFs. One of the best performing ETFs over the long run in the UK is Scottish Mortgage Investment Trust (LSE:SMT).

A decade ago, shares in the growth-focused fund were changing hands for around 215p. Today, that figure’s 870p.

This extraordinary growth’s been achieved by investing in many of the next big winners — like Tesla and ASML — before they became household names.

There’s always an element of risk, even with ETFs. And I know some investors are concerned about the non-listed holdings of the trust. That’s because holdings like SpaceX aren’t required to publish information about their business.

There’s no guarantee the company will continue to pick winners. But with a team of experts and a broad mandate, it’s a stock I’m looking to buy more of.

The bottom line

The chart above shows how I could turn £1,000 a month into £1.32m in 25 years, just by achieving a 10% annualised growth rate. And with £1.32m in a Stocks and Shares ISA, I could easily earn £100,000 annually in the form of dividends.