Conditions in the advertising market are highly cyclical. When economic conditions worsen, spending on marketing and communications can fall sharply. Yet despite such pressures, one FTSE 100 ad giant has an excellent track record of growing the annual dividend almost every year.

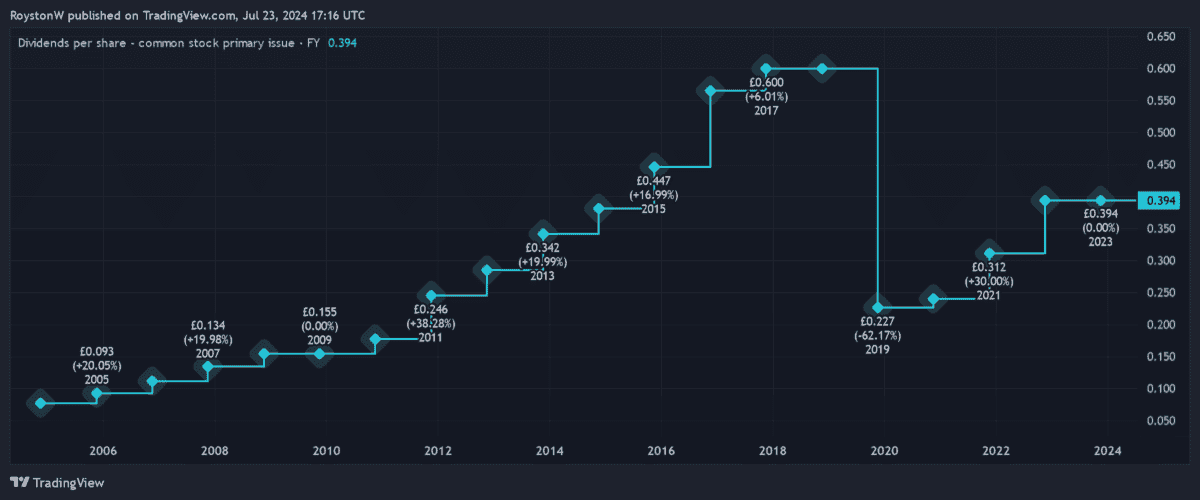

I’m talking about WPP (LSE:WPP). As the chart below shows, it has raised shareholder rewards almost every year since 2004. The only cut came in 2019 in response to the Covid-19 pandemic.

Dividends have improved from those levels, but are tipped to fall again in 2024 due to weakness in the global advertising market. Still, I think the Footsie company could be a great way to make a passive income now and in the future. Here’s why.

Dividend rebound

| Year | Total dividend per share |

|---|---|

| 2023 | 39.4p |

| 2024 | 38.4p (f) |

| 2025 | 40p (f) |

| 2026 | 41.6p (f) |

Last year, WPP froze the annual dividend in response to tough market conditions. And this year City analysts expect the full-year reward to fall, as companies continue to reduce their advertising budgets.

But as the table shows, the firm’s dividends are expected to begin rising again straight after this year’s cut. And there’s another important thing to consider. Dividend yields for the next three years sail above the 3.5% average for FTSE 100 shares.

WPP’s forward dividend yields stand at:

- 5.1% for 2024

- 5.3% for 2025

- 5.5% for 2026

Robust forecasts

Of course, it’s important to remember that dividends are never guaranteed. Whether it’s WPP or any other share, payouts can disappoint for a variety of company, industry, or macroeconomic factors.

However, in the case of WPP’s dividends, I think there’s a great chance that broker forecasts will prove accurate. This is thanks in part to the company’s excellent dividend cover. For the next three years, predicted payouts are covered around 2.3 times to 2.4 times by anticipated earnings. Any reading above 2 times provides a wide margin of error.

WPP also isn’t bogged down by debt, giving it extra scope to meet current dividend projections. Its net debt to EBITDA ratio was a healthy 1.8 times as of December.

A long-term buy?

As a long-term investor though, I’m not just interested in WPP’s dividend forecasts for the next three years. I’m hoping it can provide the same sort of impressive payout growth we’ve seen in the next two decades.

And in this regard, I’m hopeful it can hit this target. Significant exposure to fast-growing emerging markets will provide excellent opportunities to increase profits. So will its decision to double-down on the digital advertising sector, which is growing ahead of the broader market.

I also like the steps it’s taking to embrace the artificial intelligence (AI) revolution. It’s spending £250m a year on AI, data and technology. And in April, it announced a landmark tie-up with Google that will allow WPP Open — its AI-powered marketing operating system — to create more personalised and effective ad campaigns.

It isn’t without risk. But I believe WPP’s a great stock to consider following recent share price weakness.