In some ways, it feels illogical to compare the FTSE 100 to the S&P 500. The factors that affect markets locally and abroad differ greatly. While the US is saturated with fast-moving tech hatchlings, the UK is weighed down by centuries-old financial dinosaurs.

Investor habits differ too. The British exhibit a tendency towards slow-and-steady income investing, whereas the US is famous for its high-growth stocks. This is reflected in the average dividend yield — 3.5% here vs 1.3% across the pond.

But there are some areas where the two markets overlap. In fact, almost 75% of companies listed on the Footise actually receive their revenue in dollars but report profits in sterling. Presumably, they have found this way of operating most beneficial.

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

So what stocks get the best of both worlds? I think I’ve found one.

3i Group

3i Group (LSE: III) is a London-based private equity and venture capital company on the FTSE 100. Most of its holdings are in private equity such as European non-food retailer Action and US travel technology company Arrivia. It also has its own infrastructure arm focusing on transport, logistics and utilities companies in Europe and America.

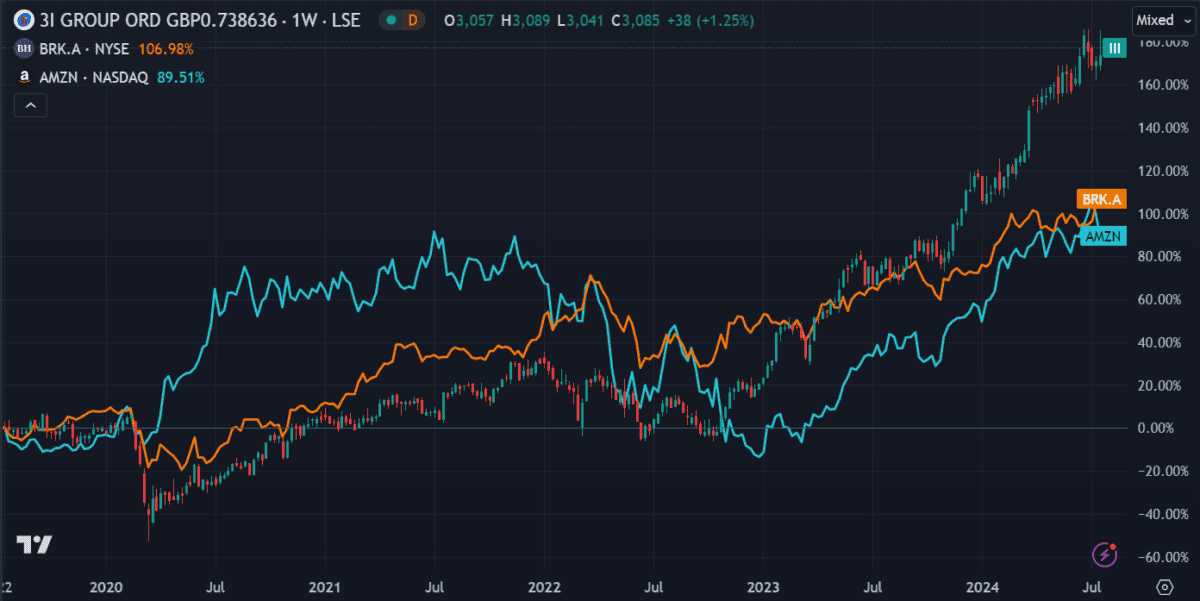

Aside from Action, many of its holdings don’t appear to be well-known companies. Still, its performance speaks for itself. The price is up 56% in the past year and 177% over five years. That’s more than double the S&P 500 and 20 times the FTSE 100. It’s also outperformed some leading US shares like Berkshire Hathaway and Amazon.

As such, it acts more like a US growth share than most UK listings. It also benefits from investments that are diversified across several regions.

Valuation

Using a discounted cash flow model, analysts estimate the shares to be undervalued by more than 60%. And with earnings increasing faster than the share price, its price-to-earnings growth (PEG) ratio’s only 0.7. So it looks undervalued.

However, with funds like 3i, the price may not accurately reflect the underlying value of the assets. This can make the valuation less reliable than normal stocks so it’s important to also evaluate the fund’s holdings.

Risks

Private equity is inherently less transparent and liquid than publicly traded stocks. This can make it harder to value and requires more trust in the fund managers.

Since 3i Group has an 80% stake in Action, any issues with the retailer could hurt its share price. This also increases its exposure to risks in the European retail sector.

So while it has a promising track record, there’s no guarantee this will continue. Depending on their investment strategy and risk appetite, some investors may prefer selecting individual stocks they can assess themselves.

A long-term consideration

There’s a lot of great value in both the S&P 500 and the FTSE 100. Both offer unique value propositions that appeal to different investors.

3i Group is just one example of a FTSE stock that exhibits US-style growth combined with the stability typical of European stocks. It’s the kind of stock I’d feel happy to invest in for the long term, so I plan to buy the shares next month.