It’s always a bit surreal when a company in your Stocks and Shares ISA starts trending big-time across the world. That’s what happened to me recently with cybersecurity firm CrowdStrike (NASDAQ: CRWD).

This is the type of company that I want operating behind the scenes, keeping its customers safe from cyber threats with its cloud-native Falcon platform. If its name is suddenly on everyone’s lips, then I’d assume a massive cyberattack has taken place.

As we know though, that’s not what happened a few days ago. A faulty software update crashed 8.5m Microsoft Windows computers, disrupting flights, banks, TV channels, and hospitals around the world. It was the biggest IT outage in history.

Following this, the CrowdStrike share price has dropped 23%. Is this a chance for me to buy more shares?

A household name (for the wrong reason)

The first thing to note is that there will obviously be meaningful claims from this epic failure. Delta Air Lines, for example, has had to cancel more than 4,000 flights.

This event even caused volatility among the largest cyber underwriters across the primary and reinsurance markets. Barclays said: “At present, due to the short duration of the accident and the non-malicious nature of it, we would expect [insurance] industry impact of $1bn or less.”

As disruptive as this was, and certainly embarrassing for CrowdStrike, a large-scale cyberattack would have been worse. That would have destroyed trust in the company’s defensive capabilities.

Then again, there’s still the unquantifiable reputational damage. That will take time to measure.

What we do know is that Elon Musk has said that Tesla has already deleted CrowdStrike from its systems. Others may yet follow and that would obviously impact the company’s growth prospects.

An important platform

Stepping back though, the widespread impact of this event highlights how important the company’s endpoint security platform has become. It now serves 538 of the Fortune 1000 companies, while its artificial intelligence (AI) technology gets smarter as it consumes more data.

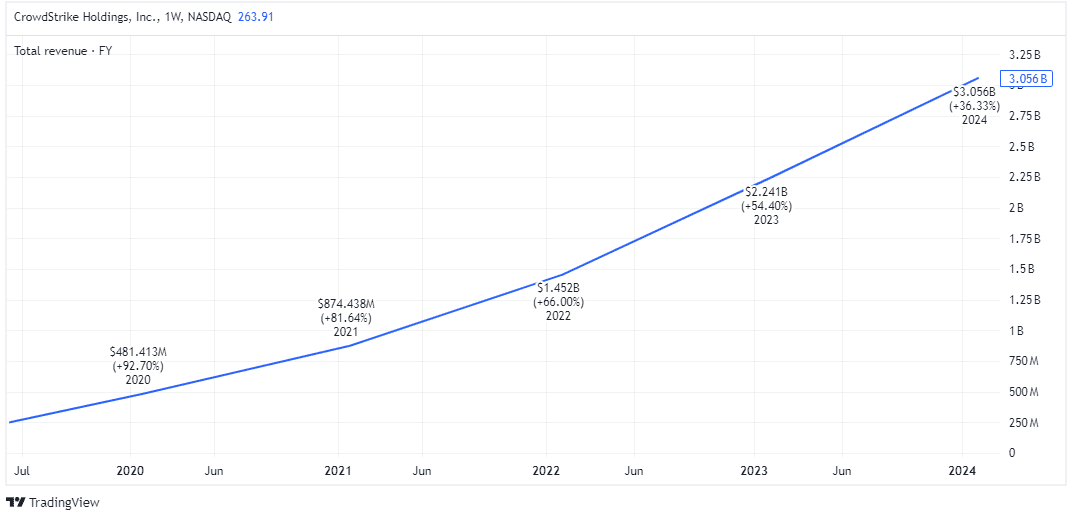

Between FY19 and FY24 (which ended in January), revenue grew by more than 10 times.

In Q1 FY25, the company generated record free cash flow of $322m, up from $227m a year ago. That was 35% of its $921m in revenue, which grew 33%.

It’s been rolling out more AI features, with 28% of its customers adopting seven or more of its 28 cloud modules, up from 23% a year earlier.

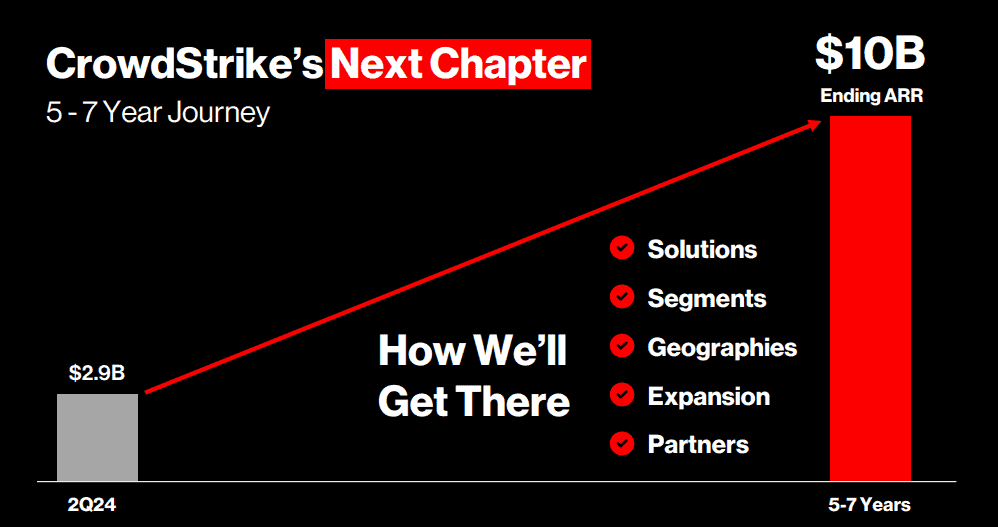

Looking ahead, the firm is targeting $10bn in annual recurring revenue (ARR) over the next five to seven years. At the end of Q1, ARR stood at $3.65bn.

Of course, this target was made before the software update debacle.

My move

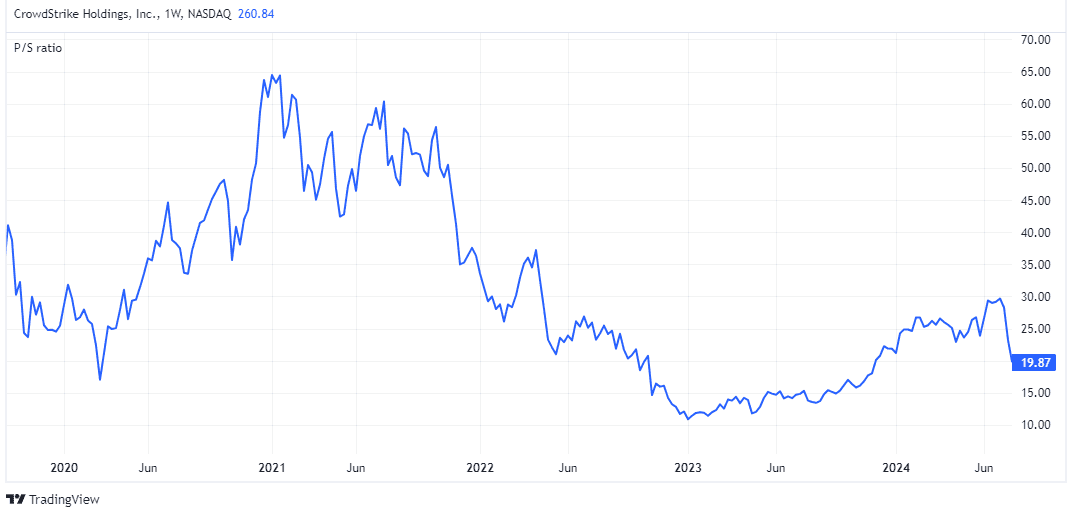

CrowdStrike is trading at around 20 times sales, even after the 23% drop. So this remains a very expensive stock — one priced for perfection.

However, things aren’t perfect. Growth rates could drop off if there are issues with renewals and attracting new customers. Meanwhile, the firm may have to offer some price concessions or redesign how its software interacts with devices, putting pressure on near-term profitability.

Nevertheless, this remains a best-in-breed cybersecurity stock. If it keeps on falling, I’ll consider investing more money. But I’d prefer to wait for Q2 in August to hear management speak.