Burberry Group (LSE: BRBY) shares recently hit a 14-year low. They’re down 72% in 15 months! When FTSE 100 businesses are distressed like this, it’s always worth taking a look.

After all, Rolls-Royce stock had plummeted more than 80% prior to its turnaround, while Nvidia tumbled around 60% on the Nasdaq before ChatGPT was released.

So could Burberry shares now be in bargain-basement territory? Let’s take a look.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Worrying trends

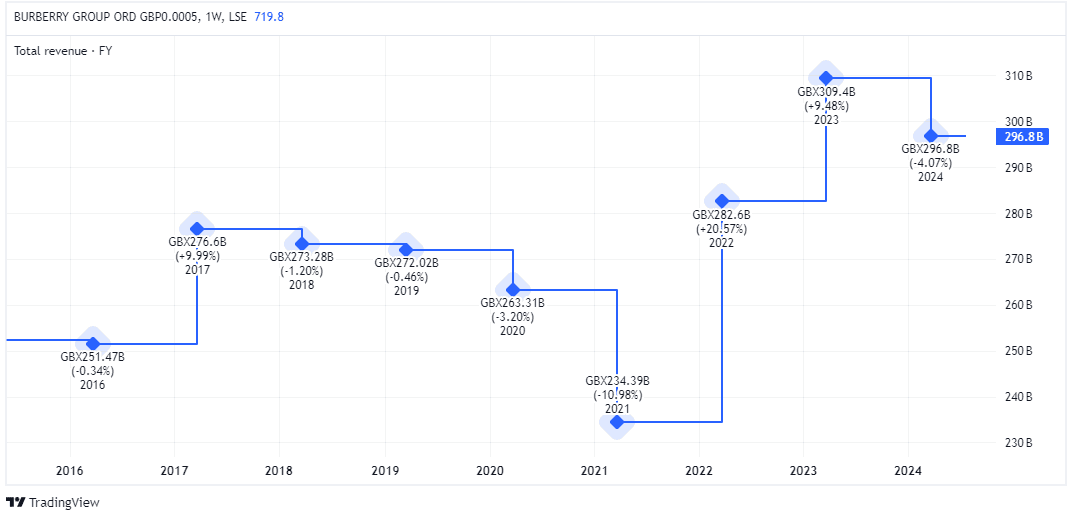

On 15 July, the luxury fashion house reported a terrible first quarter for the 13 weeks to 29 June. Retail revenue plunged 22% year on year to £458m, with comparable store sales down 21%.

It said the weakness had continued into July and if it persists, it could even result in a H1 operating loss.

Looking ahead, it expects wholesale revenue to decline by around 30% for the full year. Meanwhile, the dividend was axed and a fourth CEO in a decade has come in.

An aesthetic faux pas

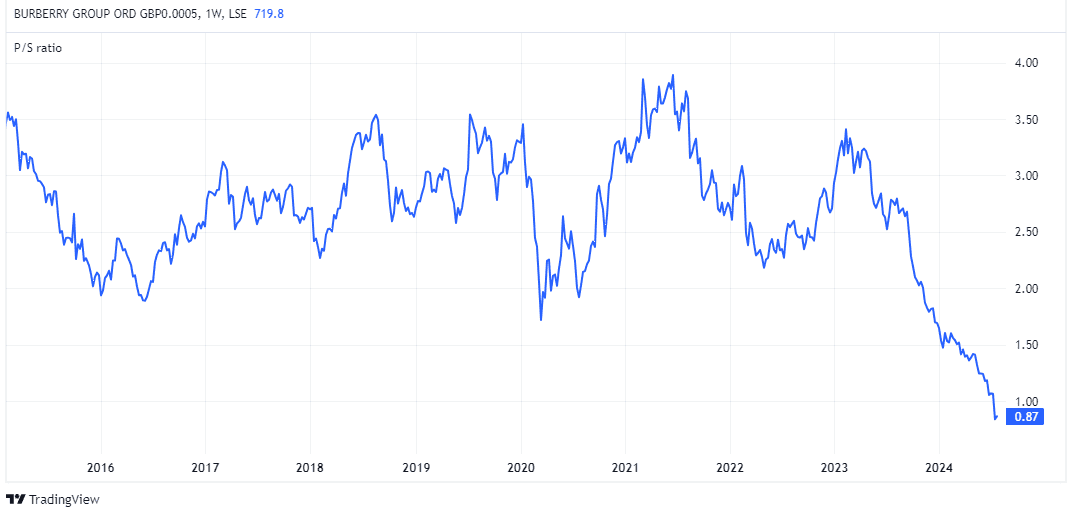

Currently, the stock’s trading on a price-to-sales (P/S) ratio of 0.87. That looks too low at first glance, even if annual sales are set to fall.

On the other hand, a couple of things worry me here. The first is that Q1 sales fell in every single market (except Japan) where Burberry operates. So this isn’t just a China issue.

| Location | Comparable store sales |

| Mainland China | -21% |

| South Asia Pacific | -38% |

| South Korea | -26% |

| Europe, Middle East, India, and Africa | -16% |

| Americas | -23% |

Second, Chairman Gerry Murphy said on the Q1 conference call that the firm had “perhaps moved too far too fast with a new aesthetic”. That is the brand’s move further upmarket with a new style under chief creative officer Daniel Lee during a luxury sector downturn hasn’t worked.

Yet he also said there will be no major strategy shift: “We’re trying to be a universal brand… we do need to reposition, I guess, back to our core, to some extent, but it’s an adjustment, not a reversal of strategy”.

In FY15, revenue was £2.52bn. In FY25, it’s forecast to be £2.61bn, down from £2.97bn last year. That’s disappointing growth for a global luxury fashion brand. I fear more than an adjustment may be needed.

My move

Wall Street legend Peter Lynch said: “Don’t buy ‘cheap’ stocks just because they’re cheap. Buy them because the fundamentals are improving.”

This is why I invested in Rolls-Royce shares at 149p despite them still being down a lot. I thought the company’s fundamentals were improving and this would ultimately drive the share price higher.

In other cases, I’ll invest in a company if the fundamentals aren’t necessarily improving but there’s substantial income on offer. For example, British American Tobacco stock’s dirt cheap as the firm deals with falling cigarette volumes. But the sweetener is the huge 9% dividend yield it carries.

In Burberry’s case, neither of these things apply. The company’s financial outlook is weakening while there’s no dividend to cushion the blow. And while the new CEO could pep things up, I find the high executive turnover a turnoff.

With its market-cap now at £2.77bn and heading for the FTSE 250, I think Burberry could become an acquisition target. However, I don’t invest hoping for takeover bids.

All things considered, I’d rather target other FTSE 100 stocks right now.