The Rolls-Royce (LSE:RR.) share price has been the standout performer among FTSE 100 stocks over the past two years, rising nearly 400%. What a remarkable turnaround it’s been since Covid-19 nearly destroyed the business.

So, what factors underpin the aerospace and defence stock’s incredible performance? And can the growth trajectory continue?

Here’s what the charts say!

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Expanding margins

CEO Tufan Erginbilgiç’s tenure has been characterised by strategic initiatives and a cost efficiency drive. Soon after taking the job at the start of 2023, he derided the firm as a “burning platform” that was underperforming competitors.

Since those comments, the company’s undergone successive rounds of job cuts and adopted a more streamlined business model. These changes have paid off handsomely.

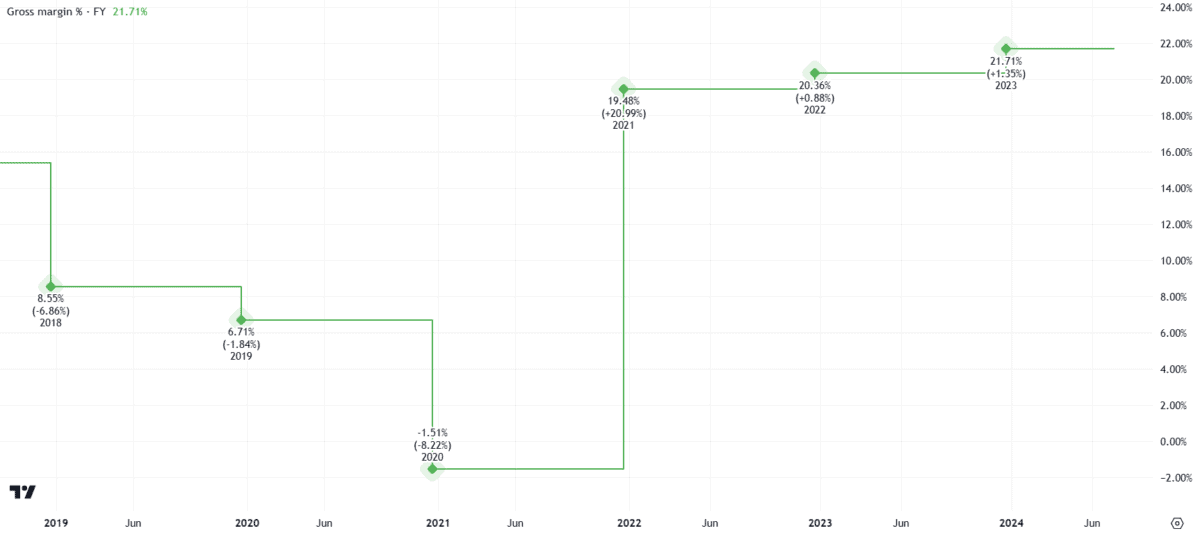

Rolls-Royce’s underlying operating margin more than doubled in FY23 to 10.3%. Moreover, the gross margin of 21.7% is at a five-year high.

These figures are a window into the financial health of the business, with implications for pricing strategies, efficiency, and growth potential.

There’s little doubt a strong margins recovery has been a significant factor in the Rolls-Royce share price surge.

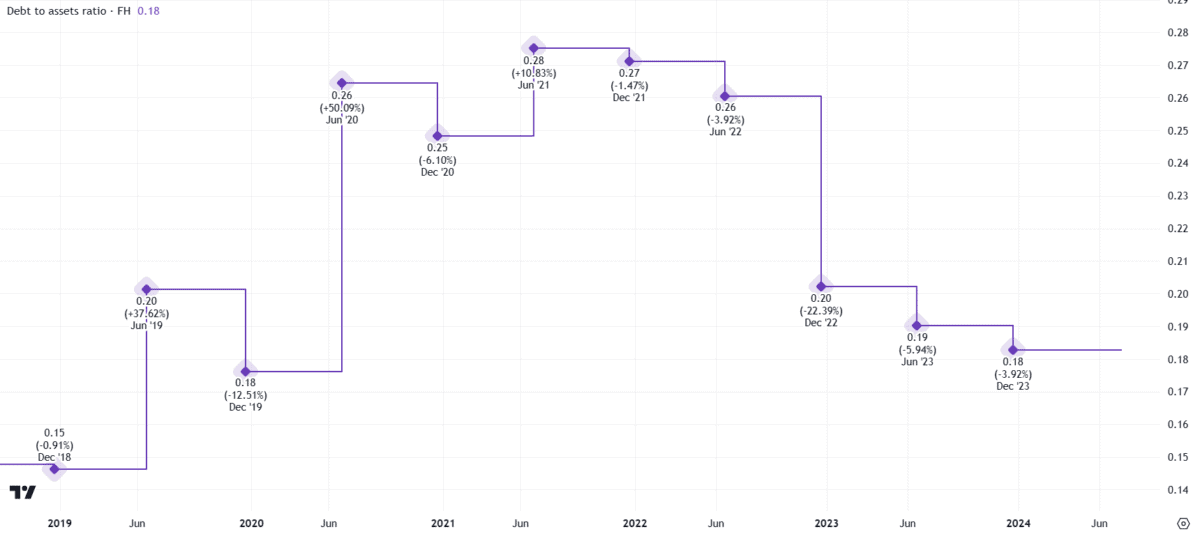

Debt reduction

So too has the substantial balance sheet improvement.

For context, Rolls-Royce was forced to raise £7.3bn in debt and equity at the height of the pandemic. At this time, the business was burning through cash to stay afloat while aircraft fleets remained grounded.

The outlook’s changed dramatically. Rolls-Royce has regained an investment-grade credit rating from all major agencies. Net debt’s fallen to £2bn, down from £3.3bn at the end of FY22.

Crucially, the debt-to-assets ratio has plummeted to just 0.18. Consequently, the balance sheet looks considerably healthier today.

Valuation

However, the company now has a higher valuation.

Traditionally, a price-to-sales (P/S) ratio between one and two is desirable from an investor’s perspective. For Rolls-Royce, that multiple’s now eclipsed this upper limit. The P/S ratio is currently 2.22.

This means the Rolls-Royce share price is no longer the bargain it was during the pandemic. A higher valuation poses risks to future returns.

I wouldn’t be surprised if the company’s stock market performance over the coming years isn’t as stellar as it’s been in recent years.

Rolls-Royce shares could have further room to run if future earnings are good, but they’re probably closer to being fairly valued than undervalued today.

Future targets

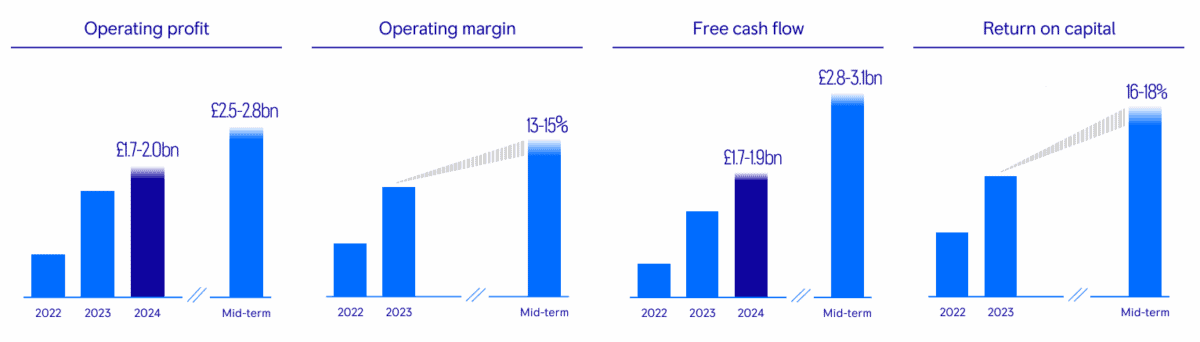

Nonetheless, Erginbilgiç doesn’t lack ambition. Mid-term targets spanning a range of metrics suggest there’s potential for further improvements in line with a 2027 timeframe.

The group’s indicated these advances will be “progressive, but not necessarily linear“. Accordingly, investors should anticipate share price volatility along the way.

But, the big picture’s broadly encouraging. The Civil Aerospace division should continue to benefit from an ongoing recovery in large engine flying hours. Plus, the Defence arm has several potential growth opportunities, such as the deployment of micro-reactor nuclear technologies in submarine fleets.

On balance, I think the Rolls-Royce share price growth story remains intact, but we’ve probably seen the lion’s share of the gains already. I’ll continue to hold my shares for now.

Investors who are keen to enter a position could consider pound-cost averaging their share purchases to capitalise on any potential dips over the coming quarters.