For many of us, a second income’s about achieving financial stability and gaining peace of mind. It’s also something that could allow us to work less or put more money aside for things like holidays.

With an Individual Savings Account (ISA), UK residents can invest as little as £100 a month and set themselves on a path to potentially earning a substantial second income.

Personally, I believe there’s no better time to start than now, despite the FTSE 100 being at elevated levels.

Should you invest £1,000 in Supermarket Income Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Supermarket Income Reit Plc made the list?

Market conditions may fluctuate, but by investing strategically and with a long-term perspective, investors can navigate these ups and downs.

How should I invest £500 a month?

The more I can invest in a Stocks and Shares ISA monthly, the better chance I have of building a large portfolio that can deliver a life-changing passive income.

And consistency is important. By regularly putting £500 a month into a Stocks and Shares ISA, investors harness the power of compound returns, and this can be truly game changing.

Over time, the returns on my investments generate their own returns, accelerating my portfolio’s growth. Additionally, regular investments allow me to benefit from pound-cost averaging, smoothing out market volatility.

When it all goes to plan

When we invest wisely, we can achieve returns that are far in excess of what we may be able to achieve in a regular savings account.

Many investors will look to the benchmark of achieving at least 10% growth every year. Some of this will come in the form of dividends, and some in share price growth.

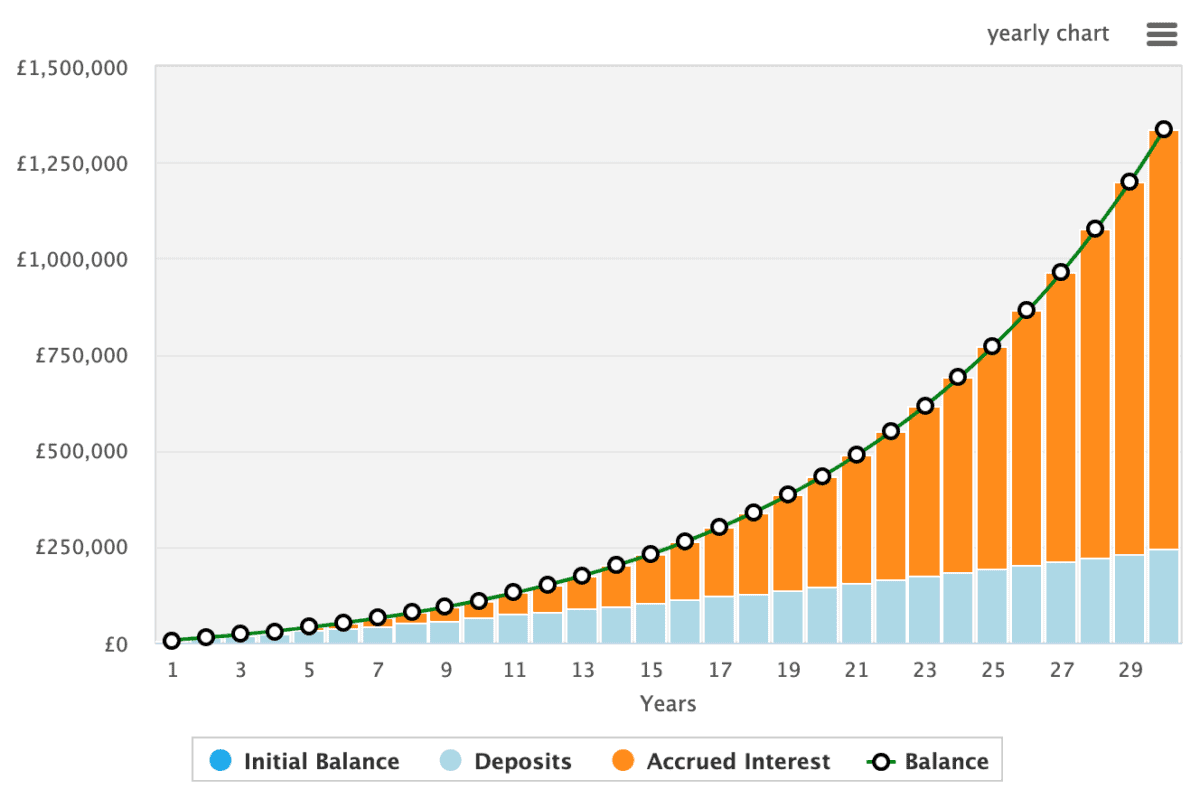

So this is how my £500 a month could grow if I achieved 10% annually. I’ve also assumed that the contributions could grow at 2% annually, in line with the Bank of England’s inflation target.

With £1.33m after 30 years, I could generate around £90,000 annually as a second income, noting the kind of dividend yields we see today.

Investing wisely

But if we invest poorly, we could lose money. That’s why I always invest in carefully-researched stocks and bonds, investments recommended by great stock pickers, or Exchange-Traded Funds (ETFs). Investors should also consider index tracker funds.

So what’s a wise investment? Well, as someone who has the time to research stocks, I tend to invest in individual companies I think have great potential, like Super Micro Computer, a leader in the artificial intelligence (AI) server and data centre segment.

However, investors with less time may prefer to invest in ETFs like iShares Semiconductor (NASDAQ:SOXX). This ETF seeks to track the investment results of an index composed of US-listed equities in the semiconductor sector.

Since its inception, it’s achieved annualised total returns of 12.05%. But it’s performance is even better in recent years, with annualised total returns of 25.4% over the last decade.

Some analysts may suggest that semiconductor stocks, like Nvidia, are getting a little expensive. But it’s equally the case that the market’s forecasting a long period of rapid and sustained growth.

Its top investments include Broadcom — an American chip designer and manufacturer — Nvidia, AMD, and Applied Materials. It also has holdings in semiconductor giant TSMC. I think it’s one to consider.