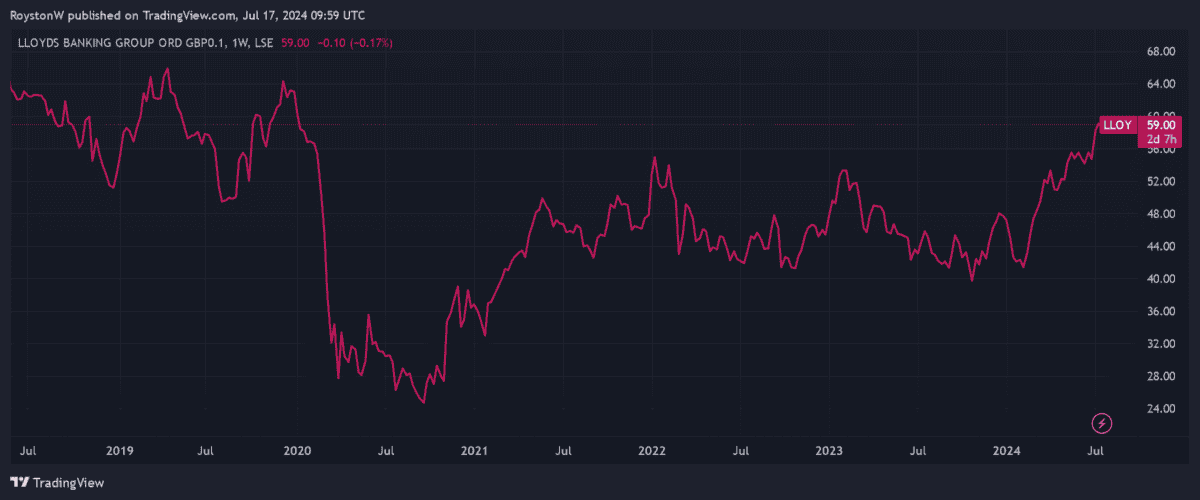

We could be forgiven for thinking that Lloyds Banking Group (LSE:LLOY) is one of the FTSE 100‘s greatest bargains.

At 59p per share, the Black Horse Bank looks cheap across a variety of metrics. For 2024, it trades on a price-to-earnings (P/E) ratio of 9.2 times. It also packs a Footsie-busting 5.5% forward dividend yield.

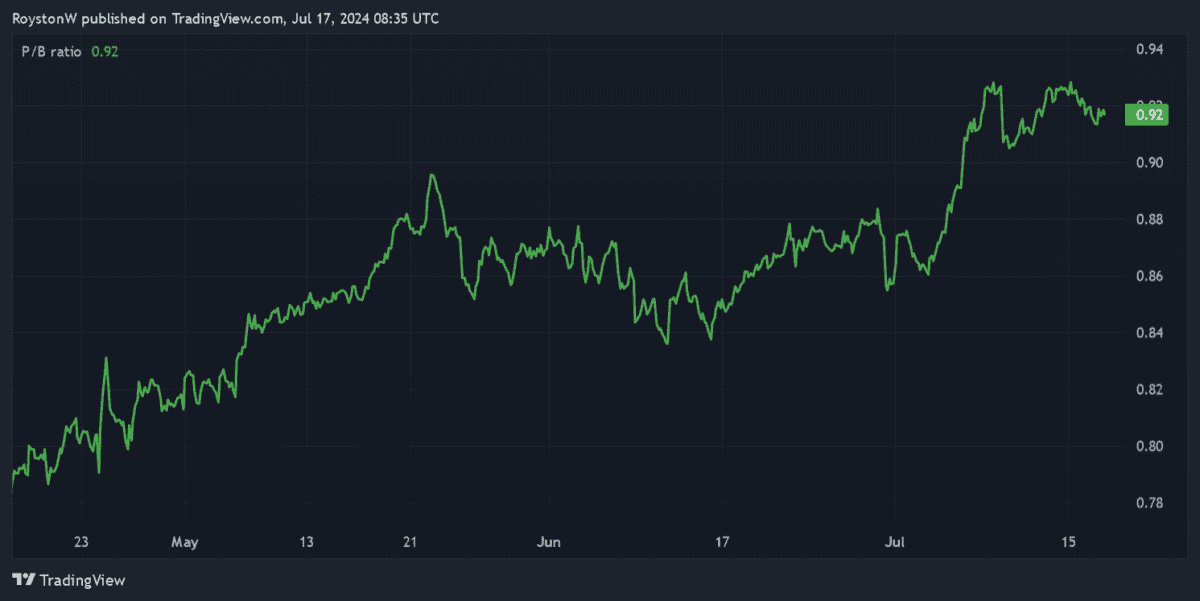

Finally, a price-to-book (P/B) value of 0.9 indicates that the company trades at a discount to the value of its assets.

However, while its future could be bright, it’s my opinion that Lloyds shares could be a classic ‘value trap.’ Here are three reasons why I’m avoiding the business today.

1. Interest rate uncertainty

Hopes of interest rate cuts have propelled bank share prices skywards this year. But I think the Bank of England (BoE) may fail to slash rates as extensively as the market predicts, leaving the banks in danger of sharp reversals.

On the one hand, higher rates would be good for banks by boosting their net asset margins (NIMs). The difference between the interest they charge borrowers and what they offer savers widens at times like this.

Yet higher interest rates also weigh on loan growth at banks and push impairment levels higher. The problem is especially bad for Lloyds given its position as the UK’s biggest mortgage provider.

With inflation data on Wednesday (17 July) coming in hotter than expected, economists are predicting the first rate cuts to noe happen in September, later than previously expected. It’s a trend that could continue as wage growth continues to boom.

2. Growing competition

Rising competition’s a longer term problem for established banks like Lloyds. Indeed, the pace at which this threat is accelerating was underlined by Moneyfacts data this week.

It showed the number of savings products on the market shoot through 2,000. This is the highest level since May 2012, and reflects a rise in the number of savings providers to record peaks.

Lloyds’ strong brand power is helping it perform better than many other traditional banks. But I fear that the business is increasingly swimming against the tide. Several challenger banks are set to launch IPOs to turbocharge their growth plans. Revolut is also pushing hard to acquire a banking licence to substantially expand its product range.

3. Better banks to buy?

Finally, I believe that there are much better banking stocks for me to buy today than Lloyds. Take HSBC and Santander, for example. These UK shares also trade on rock-bottom P/E ratios, of 6.9 times and 6 times respectively. In fact, these readings beat Lloyds which sits above 9 times.

On the downside, they face the same problems of rising competition and persistently high interest rates. But they also have terrific growth potential, thanks to their huge emerging market exposure.

HSBC, for instance, thinks markets like China and Hong Kong will help it to achieve double-digit profit growth. Lloyds has less opportunity to achieve such results, given its focus on the mature UK retail market.

There are many top FTSE 100 value stocks to choose from today. So I see no reason to invest my cash in high-risk Lloyds.