Compound interest can be a powerful force for investors seeking a second income. The results take time to develop, but they can be spectacular for those who are willing to be patient.

Compound returns

Turning a £1,000 monthly investment into a £171,523 second income isn’t easy. It involves compounding at 9.64% per year over 30 years.

I don’t how it’s possible to achieve that with cash. But 9.64% is the average annual return from a Stocks and Shares ISA over the last 10 years.

There’s no guarantee this will continue. But 6.89% per year – the average FTSE 100 return over the last 20 years – is enough to turn a £1,000 monthly investment into a £74,430 second income after 30 years.

That’s still a terrific result. So the next question is how to go about trying to achieve it.

Dividends?

Dividend stocks are an attractive choice for income investors. But I think looking for the best returns means trying to buy the best shares available, regardless of dividends.

Rolls-Royce is a good example – with no dividend, the stock is up 212% in the last 12 months. That would go a long way towards a 9.64% overall return and no UK dividend stock has produced a similar result.

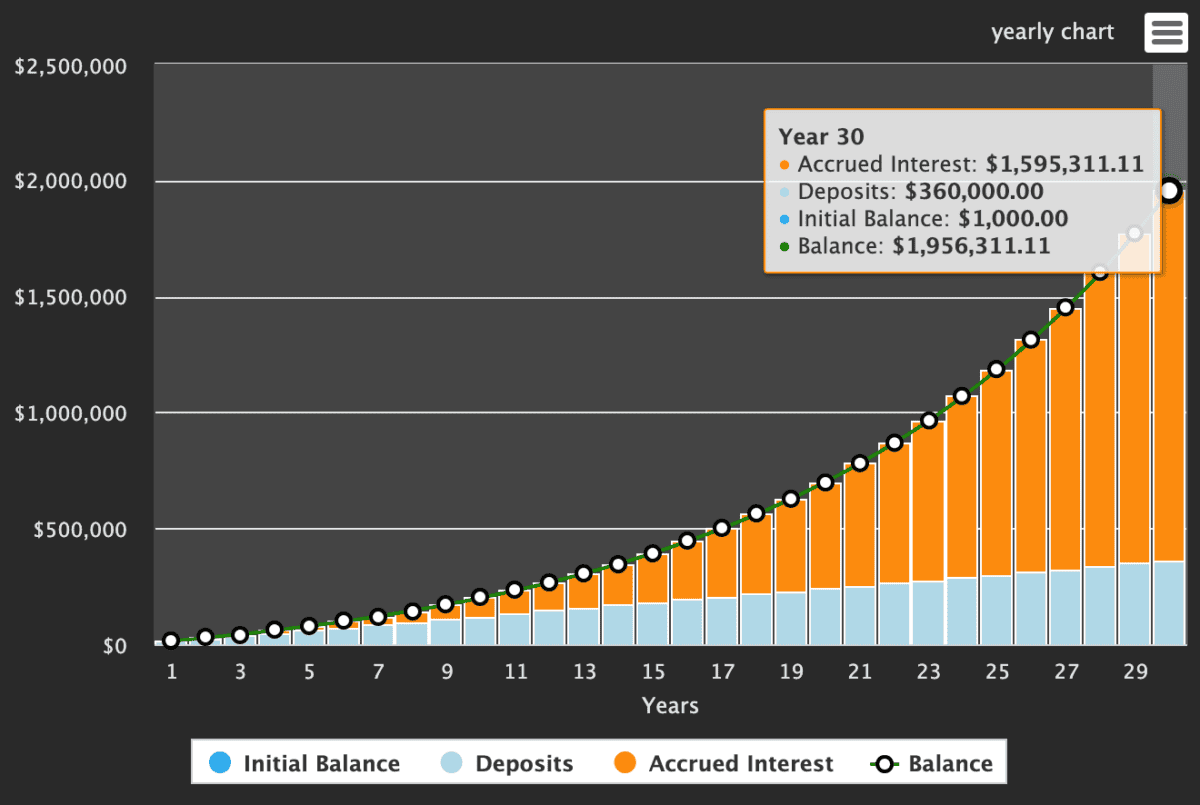

Even when the time comes to stop growing the portfolio and use it for a second income, I think this is still the best plan. After 30 years, compounding £1,000 per month at 9.64% results in an investment worth £1.96m.

Created at TheCalculatorSite.com

If it then grows at the same rate in the next year, the increase is £171,523. And an investor could sell part of the portfolio to take this out as a second income while leaving £1.96m of market value intact.

Getting started

With that in mind, it’s worth thinking about which stocks could be good to buy now. Halma and Rightmove are both good candidates, I feel. But with £1,000, I’d look to buy nine shares in Games Workshop (LSE:GAW).

After seeing Burberry, Nike, and Dr Martens struggle with reduced consumer spending, it would be reckless to ignore this risk with Games Workshop. But there’s also a lot to like about the business for the long term.

The most impressive thing about Games Workshop is it’s both a growth stock and a dividend stock. The firm has increased its operating profits tenfold over the last decade while distributing most of its cash to investors.

As a result, shareholders have had a double benefit. Higher earnings have taken the share price from £5.95 to £103.35, while a regular and growing dividend has allowed investors to increase the number of shares they own.

Exceptional returns

The way to aim for a 9.64% annual return is by focusing on the best opportunities available. That may or may not involve stocks with high dividend yields.

If it does, the cash will flow out automatically when the company pays its dividends. If not, investors looking for a second income can sell part of their portfolio as it grows each year.