For many of us, a second income is financial freedom, offering the flexibility to pursue passions, enhance our lifestyles, or simply provide a safety net.

Investing is one of the most popular ways — and my opinion the best way — to achieve this. However, the path to successful investing can be daunting.

Getting to where we want to be requires patience, consistency, and a level head. Here’s how I could earn a second income worth £35,000.

Back to basics

Let’s imagine I have £5,000 in savings and I’m going to allocate that to a Stocks and Shares ISA. It’s a decent sum of money, but I’ve got to start by being realistic.

It’s not enough to earn a second income of more than £500 a year, and by itself, it will take a long time to become sizeable enough to earn a life-changing second income. At 10% annual growth, it’d take 30 years to reach £100k.

I need to be patient — taking a long-term approach — and look to contribute some of my salary to my portfolio. These are both simple, yet necessary things to do.

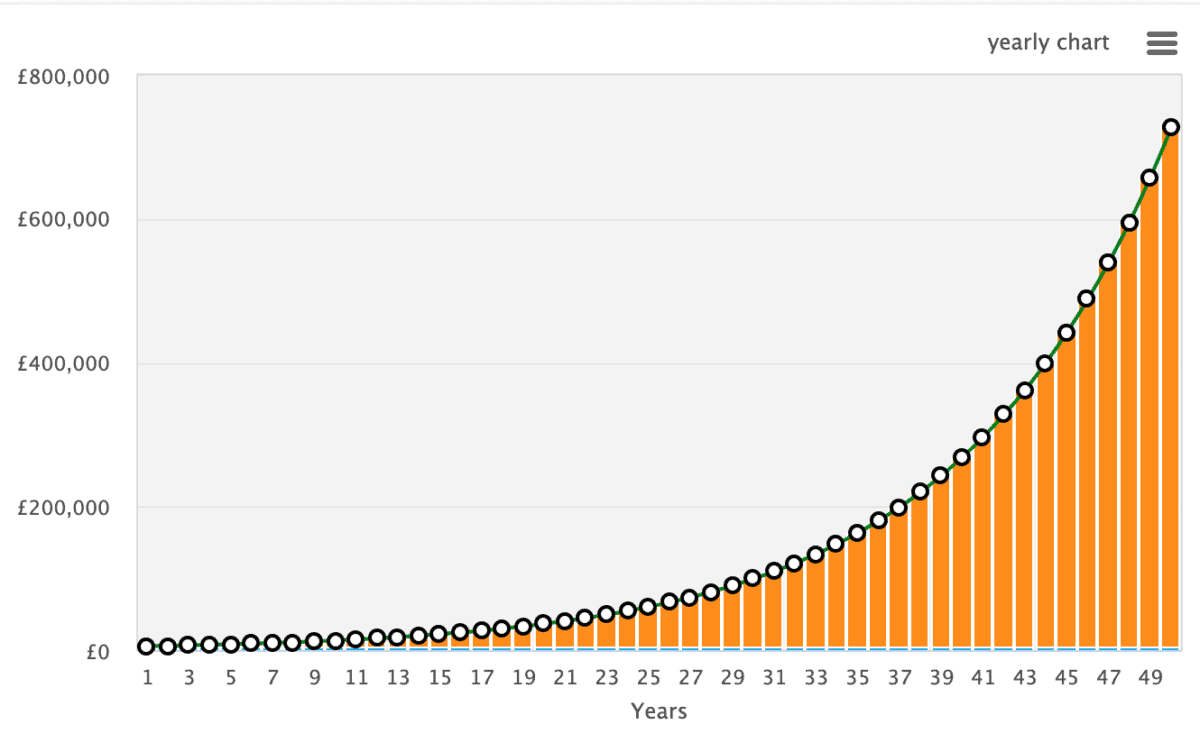

Finally, I need to appreciate the importance of compound returns. It’s like a snowball rolling down a hill, getting bigger and picking up more snow on its wider surface area as it does.

Compound returns is the reason why, in the below graph, my £5,000 looks like it’s growing faster every year, even though the return is fixed at 10%.

Investing for success

One of the biggest challenges is making the right investment decisions. Many novice investors make the wrong investment decisions, often based on imperfect analysis. And this means they often lose money.

So, we need to make sensible investment decisions and build a diverse portfolio. One way we can obtain diversification without doing endless research into different stocks is by investing in trackers or ETFs (exchange-traded funds) like Schwab US Large-Cap Growth ETF (NYSEMKT:SCHG).

With $30.7bn of assets under administration, the ETF “seeks to track as closely as possible, before fees and expenses, the total return of the Dow Jones US Large-Cap Growth Total Stock Market Index“.

Over the past five years, the ETF has surged 142%, reflecting the ongoing capacity of America’s biggest tech companies to generate market-beating returns.

Of course, some analysts are concerned that we’re in something of a tech bubble and that valuations may be peaking across the board.

However, that’s not my personal opinion, and the Schwab US Large-Cap Growth ETF could provide growth-focused investors with exposure to the tech sector while lowering risks associated with single-stock investments.

The end goal

If I were to start with £5,000, and add an extra £200 a month, while achieving a 10% annualised return by investing in stocks and ETFs as above, after 30 years I’d have £551,248.

That could be enough to sustainably generate around £35,000 annually as a second income.