Many of the holdings in my Stocks and Shares ISA have been doing really well this year. And I’m not just talking about AI high-flyers like ASML (up 40% year to date) and Taiwan Semiconductor Manufacturing (up 77%). FTSE 100 stocks like Rolls-Royce (50%) and Pershing Square Holdings (16.7%) are also flying.

But there’s always one or two stinking the portfolio out. For some time, this has been Diageo (LSE: DGE). The stock is down 11% year to date and 25% across five years. Since the New Year celebrations that ushered in 2022, it’s fallen 37%. Not great.

Fortunately, my winners are far outpacing underperformers like this. But it does present a bit of a headache because there is the opportunity cost associated with hanging onto losers for too long.

Should I call time on this one? Or perhaps order in another round of shares while they’re down? Here’s my view.

What’s gone wrong?

In the 10 years to the end of 2021, the Diageo share price rose around 200%. This incredible performance mirrored the firm’s growing sales and profits, driven by its portfolio of timeless brands. These include Guinness, Smirnoff, Johnnie Walker, and Tanqueray gin.

However, due to the challenging consumer backdrop, sales have gone into reverse recently. For this financial year (which ended in June), revenue is expected to decline slightly to around $20.4bn.

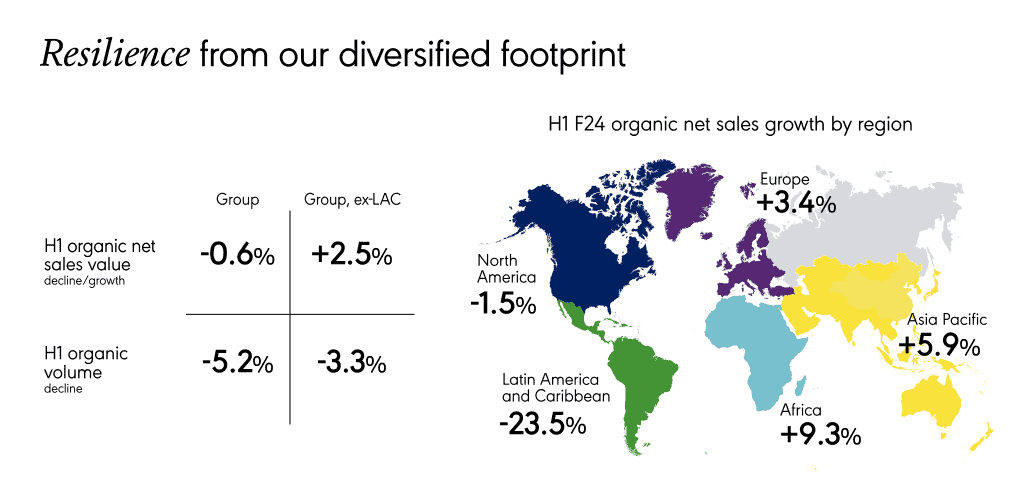

Its key US market, which accounts for around 35% of sales, continues to be sluggish. And sales have recently fallen off a cliff in its Latin America and Caribbean market.

Balancing this, there’s been resilience elsewhere, notably in Asia Pacific and Africa. However, there’s no getting away from the fact that trading is tough right now and any recovery might take a while.

Here was the geographic breakdown for the first half.

Generational shift?

One risk that might be hanging over the stock is a potential shift away from consuming alcohol among younger generations. This is particularly noticeable in the West.

Indeed, we recently saw Carlsberg snap up UK soft-drinks maker Britvic (owner of Tango and Robinsons) for £3.3bn. Is this a sign of things to come from? Might we see Diageo follow suit into soft drinks? It’s too early to say, but it’s worth keeping an eye on.

Another potential issue on the horizon is the rise of GLP-1 weight-loss drugs. These can reduce cravings, including the urge to drink alcohol, according to some reports. So this could also begin to weigh on the share price moving forward.

Overall, there’s a lot of uncertainty surrounding Diageo’s growth story right now (perhaps more than ever).

My decision

On the other hand, history tells us that times of uncertainty can be the best times to invest. So, is this an opportunity? To be honest, I’m torn.

The forward dividend yield is now above 3% and I like the long-term prospects for income growth (Diageo is a Dividend Aristocrat).

Plus, the consensus price target among brokers is 2,836p. That’s 11.75% higher than the current price.

Diageo is due to release its annual results on 30 July. I’m going to wait till then to see what management says before making a decision. My inclination is to keep holding the shares of a high-quality firm like this.