Now’s a great time to go hunting for cheap UK stocks to buy. Both the FTSE 100 and FTSE 250 indices are packed with top shares that, following years of underperformance, are maybe too cheap to miss.

I’ve searched the Footsie for some of the best bargains and have come up with two exceptional picks: HSBC Holdings (LSE:HSBA) and Phoenix Group Holdings (LSE:PHNX).

Both of these blue-chip shares have gigantic dividend yields north of 9%. This is critical during times of market volatility like today, as the passive income they may provide could make me a decent return even if their share prices fail to rise.

Here’s why I’d buy them today if I had spare cash to invest.

Bargain bank

At 671p per share, I think HSBC could be a contender for the FTSE 100’s greatest value share. It trades on a forward price-to-earnings (P/E) ratio of 6.9 times. Meanwhile, its price-to-earnings growth (PEG) multiple stands at 0.8.

Any reading below 1 suggests that a share is undervalued relative to predicted earnings.

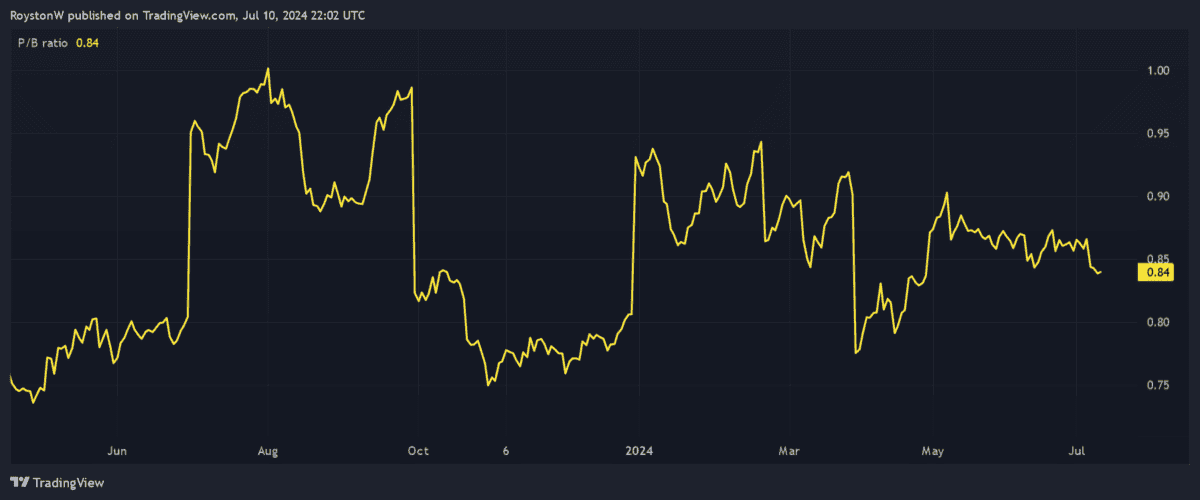

On top of this, the bank’s price-to-book (P/B) ratio stands at around the same level, suggesting it’s trading at a discount to the value of its assets. This is shown below.

Finally, the dividend yield on HSBC shares stands at 9.2%. If broker forecasts are correct, the bank looks likely to be one of the FTSE 100’s top five biggest dividend payers this year.

I’d buy the bank to cash in on Asia’s rising wealth and booming populations. HSBC is pivoting more closely to these emerging markets and it’s no surprise. Around 60% of the continent’s people remain ‘unbanked’, providing financial services companies there with significant growth opportunities.

On the downside, current turbulence in China’s economy poses a threat to earnings. Yet HSBC’s solid balance sheet should still give it scope to keep paying huge dividends in the near term.

Its CET1 capital ratio rose to 15.2% as of March.

9.7% dividend yield

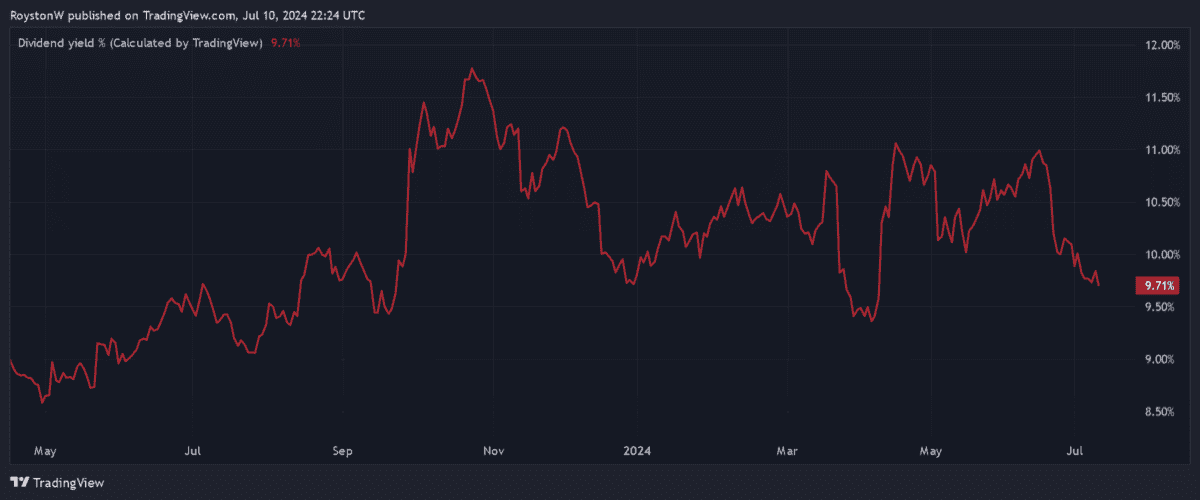

Phoenix Group’s also predicted to be an outstanding dividend provider in 2024. In fact its yield for this year falls just fractionally short of 10%, as the chart below shows.

The financial services giant also looks like excellent value when it comes to predicted earnings. Its PEG ratio is just 0.2, based on a current share price of 543p.

Like HSBC, Phoenix has the opportunity to tap into a rapidly growing industry, albeit one that’s closer to home. It provides pensions, life insurance and savings products to around 12m in the UK. This number has the potential to surge as the country’s older population rapidly expands.

I’m also a fan because of the company’s stunning cash generation (this stood at a forecast-topping £2bn in 2023). This gives it the ammunition to invest heavily for growth as well as continue paying vast dividends.

Phoenix operates in a highly competitive industry and this is a risk. Yet I still think it’s a top value stock to consider today.