Since 24 February 2022, the share price of BAE Systems (LSE:BA.), the FTSE 100 defence contractor, has more than doubled. That was the day Russia invaded Ukraine and reignited the debate over whether governments are spending enough on their militaries.

Defence of the realm

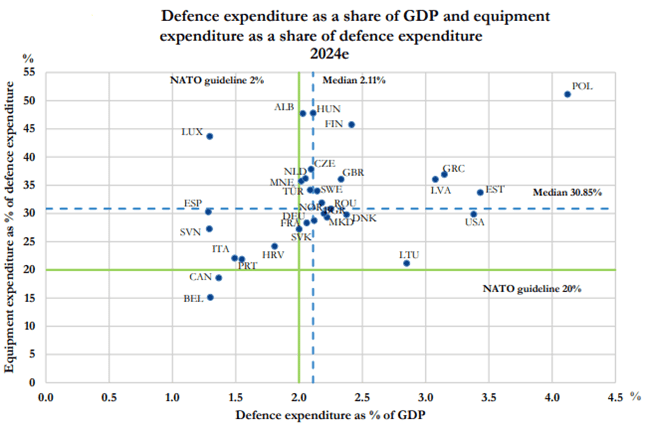

NATO encourages its members to spend at least 2% of their gross domestic product on defence. The figure for the UK is currently 2.3%. But during the recent general election campaign, both main political parties pledged to increase this to 2.5%.

The newly-elected Labour government hasn’t given a timescale for meeting this commitment. It has also cautioned that it will only reach the target if the economy grows.

But on 10 July, speaking on Times Radio, Luke Pollard, the Armed Forces Minister, reiterated the government’s intention to reach 2.5%. He also said it was important that any increased defence spending was “directed at British industry”.

This can only be good news for BAE Systems. Additional expenditure of 0.2% is equivalent to £23bn a year.

To put this in context, the UK’s largest defence contractor’s sales during the year ended 31 December 2023 (FY23) were £25.3bn.

| Financial year | Sales (£bn) | Underlying earnings before interest and tax (£bn) | Underlying earnings per share (pence) | Order book (£bn) |

|---|---|---|---|---|

| 2021 | 21.3 | 2.2 | 50.7 | 35.5 |

| 2022 | 23.3 | 2.5 | 55.5 | 48.9 |

| 2023 | 25.3 | 2.7 | 63.2 | 58.0 |

Of course, it’s highly unlikely that all of the extra spending would go to BAE Systems. I’m sure Rolls-Royce Holdings, Serco Group, Babcock International, and QinetiQ would all get their fair share. Not to mention a number of unlisted companies.

But even if BAE Systems received a small proportion, it could potentially transform its financial performance and drive its share price higher.

Timing

Whenever a stock has been on a good run, it’s sometimes easy to think that it’s too late to invest.

But a quality company will continue to deliver. Warren Buffett didn’t invest in Apple until after the launch of the ninth version of the iPhone. Yes, he ‘missed out’ on a six-fold increase in the stock price. However, it’s grown more than seven times since he first invested.

The BAE Systems share price has fallen 9% in six weeks. This could be an ideal opportunity to take a stake.

The shares currently trade on a historic price-to-earnings (P/E) ratio of 20 — twice the FTSE 100 average — so it can’t be described as a bargain. However, this does compare favourably with (say) Rolls-Royce, which trades on a multiple of 28 times earnings.

And the 75 largest US defence contractors have a combined P/E ratio of 47. Although stocks on the other side of the Atlantic attract higher multiples in most industries.

Unfortunately, we live in a dangerous world. The Doomsday Clock has never been closer to midnight and there are currently nearly 50 armed conflicts in the world. Therefore, the growth prospects for the defence sector appear to be good.

However, there’s the issue of ethics that needs to be addressed. Some won’t go near the sector. But in my opinion, the primary duty of a government it to keep its citizens safe so I wouldn’t rule out investing on grounds of morality.

But I would rule out investing in BAE Systems due to the miserly dividend.

The company paid 30p in FY23, which implies a current yield of 2.4%. There are many FTSE 100 stocks offering a far better return.

For this reason alone, I don’t want to take a position.