When it comes to the best UK stock to buy now, AG Barr (LSE:BAG) probably isn’t the first name that comes to mind. But I think might be a better candidate than it seems.

The stock trades at an unusually low price-to-earnings (P/E) ratio and looks set for some significant growth in profits. That’s a combination investors ought to pay attention to.

Valuation

Let’s start with valuation. Shares in AG Barr currently trade at a P/E ratio of around 18, but this is unusually low – the stock has typically traded at around 20 times earnings over the last decade.

AG Barr P/E ratio 2014-24

Created at TradingView

This means the share price could increase by around 11% if the stock can just get back to its average over the last 10 years. But things aren’t quite so simple.

Without earnings growth, the stock’s unlikely to trade at 20 times earnings. I wouldn’t pay that for a stagnant business and I wouldn’t expect anyone else to.

Fortunately, it looks like AG Barr’s earnings are going to increase over the next couple of years. And this makes the P/E ratio returning to its recent average much more likely.

Earnings growth

AG Barr’s biggest product is Irn Bru, which accounts for around 33% of total sales. It’s a curious product – virtually impossible to disrupt in Scotland, but equally hard to export anywhere else.

That doesn’t usually make for strong growth prospects. But it’s not increased sales volumes that are likely to boost the company’s profits going forward – it’s wider margins.

AG Barr Operating Margin 2014-24

Created at TradingView

Back in 2022, AG Barr acquired BOOST Drinks Holdings to, um, boost its revenues. In the short term, this has had a negative effect on profitability, but the effects seem to be wearing off.

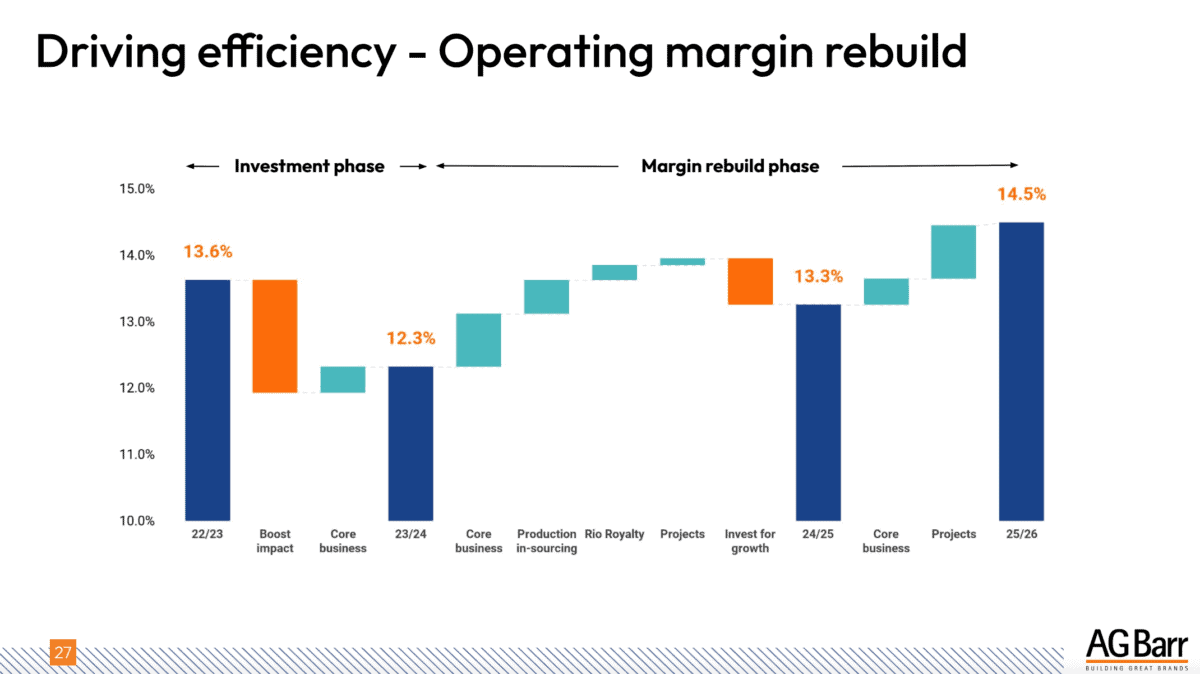

Source: AG Barr 2023/24 results presentation

The firm is expecting operating margins to expand from 12.3% in 2023/24 to 14.5% by the end of 2026. That doesn’t sound like a lot, but it amounts to an 18% increase in profits.

A 30% return?

In short, I think the shares could go from a P/E ratio of 18 with 12.3% margins to a P/E ratio of 20 with 14.5% margins by 2026. Together, that makes a 30% increase within a couple of years.

Obviously, there are no guarantees. For example, if inflation picks up, the company’s margins might not grow as expected.

Another issue is interest rates. If these stay higher for longer than investors are expecting, it’s less likely the P/E ratio will expand in the way I’m anticipating.

These could cause returns to come in lower than investors might hope. And there’s not a lot AG Barr (or its shareholders) can do about either.

A stock to buy?

It’s worth noting though, that the assumptions behind the 30% figure have some margin of safety built in. For example, the dividend isn’t included nothing in the way of revenue growth is factored in.

Furthermore, even if things go slightly worse than expected, even a 20% return over the next couple of years is hardly a bad result. As a result, I’m looking to buy for my portfolio.