Today (11 July), Rosebank Industries (LSE: ROSE) is listing on the London Stock Exchange’s Alternative Investment Market (AIM) via an Initial Public Offering (IPO). This is a newly-incorporated company led by some talented individuals who were previously part of the senior management team at FTSE 100 company Melrose Industries. Should I scramble to buy Rosebank shares after the IPO? Let’s discuss.

‘Buy, Improve, Sell’

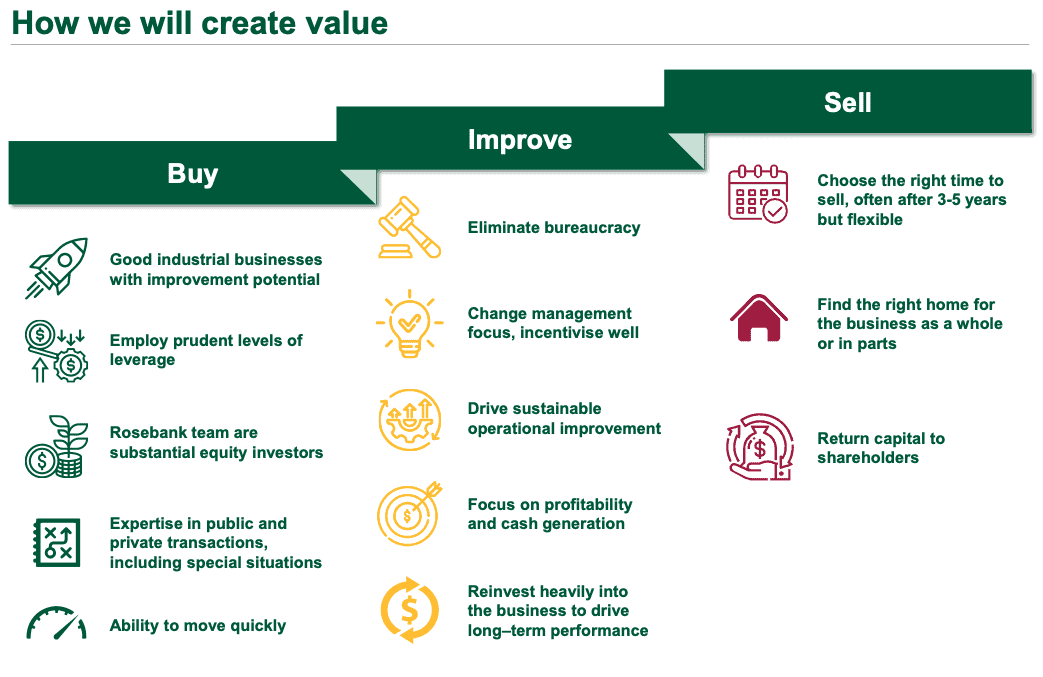

Rosebank has an interesting business model. Its aim is to acquire small- and medium-sized industrial and manufacturing businesses, improve them (by working with management), and then sell them for a higher price to create shareholder value.

It calls this blueprint (which is very similar to the strategy that private equity firms pursue) a ‘Buy, Improve, Sell’ strategy.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

Previously, its founders have had a lot of success with this business model at Melrose. And they reckon that their experience will enable them to quickly identify attractive acquisition opportunities.

The Rosebank team will look to acquire undervalued and underperforming companies with strong underlying fundamentals but scope for operational improvement and work alongside management teams of target companies to drive sustainable long-term performance for the benefit of all the Company’s stakeholders.

Rosebank management

Excellent track record

Now, the track record of the leadership team is what stands out to me here. One thing that’s really struck me in recent years as I’ve become a more experienced investor is that when you invest in a company for the long term, you’re essentially handing the management of the company your capital and saying ‘go and make me some money’.

And this can go both ways. If we invest with the right people, the results can be incredible. Just ask any long-term investor in Nvidia, which is led by visionary CEO Jensen Huang. Over the last five years, he has turned $10,000 of investor money into around $320,000.

On the other hand, if we invest with the wrong management team, the results can be disastrous. Just ask anyone who put money into online fashion retailer ASOS five years ago. A £10,000 investment there would now be worth around £1,500.

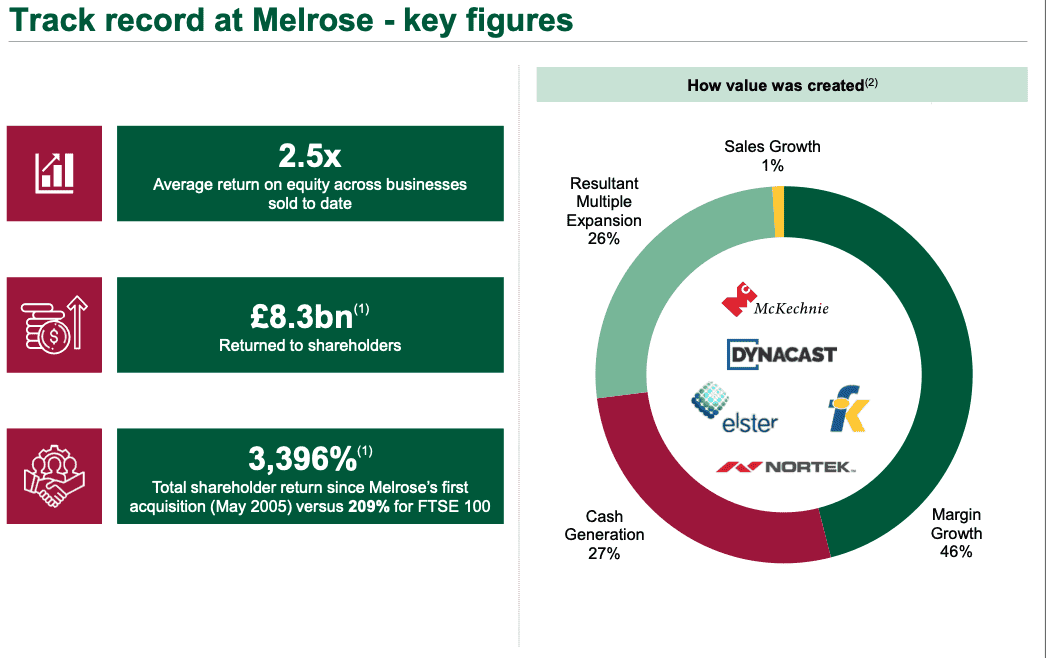

Looking at this management team’s track record (which consists of two of the three original Melrose co-founders and four other members of its senior management team), it’s impressive.

During their time at the FTSE 100 company, they created more than £6bn of shareholder value. This is very encouraging. Given this record, I’m tempted to back them.

No guarantees

Of course, there are no guarantees they will have the same level of success at Rosebank. This business model requires several things to go right. Not only will Rosebank’s management team have to identify attractive opportunities but they’ll also have to negotiate company acquisitions, improve the underlying businesses, and then sell these companies at a good price.

Another risk to consider is that to acquire businesses, the company may have to raise additional capital from investors. This dilution could send the share price down.

Finally, it’s worth pointing out this is a very small company. It’s starting off with a market-cap of just £50m. So I expect the share price to be volatile.

Given the risk factors, I’m going to watch the stock from the sidelines for now. I do think it has plenty of potential. All things considered however, I think there are safer growth stocks to buy for my portfolio today.