The London stock market is a great place to discover top dividend shares. It’s packed with companies with strong records of dividend growth. What’s more, years of share price underperformance also mean many of these offer some staggeringly high dividend yields.

The following three FTSE 250 shares have grabbed my attention. Their tantalising dividend forecasts and yields can be seen in the table below.

| Company | Predicted dividend per share | Dividend yield |

|---|---|---|

| Greencoat UK Wind (LSE:UKW) | 10p | 7.2% |

| TBC Bank Group (LSE:TBCG) | 217p | 7.4% |

| Urban Logistics REIT (LSE:SHED) | 7.75p | 6.5% |

Dividends are never guaranteed. But if broker forecasts are correct, a £25,000 lump sum invested equally across them would provide me with a £1,750 second income over the next 12 months.

I’m confident too these high-yield shares will steadily increase shareholder payouts over the long term. Here’s why I think they might be great buys for dividend investors.

Wind warrior

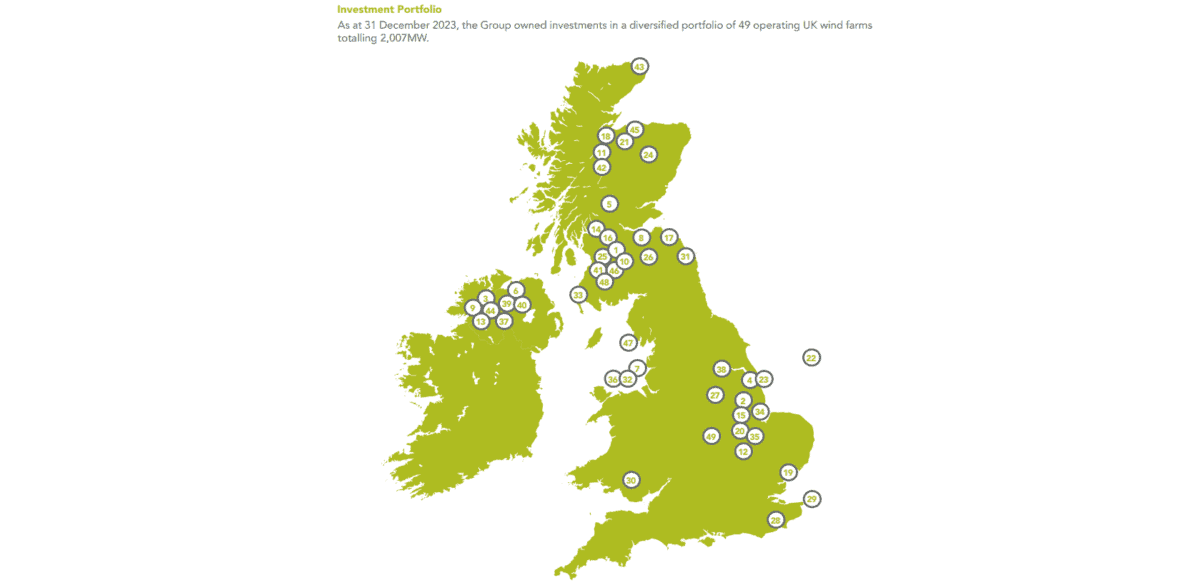

Renewable energy stocks like Greencoat UK Wind have significant earnings potential for long-term investors.

Adverse weather conditions can impact power generation from time to time, putting a drag on revenues. But over an extended time horizon, wind farm operators could enjoy exceptional growth as the world switches from fossil fuels to cleaner energy sources.

Labour’s plan to lift the onshore windfarm ban should also boost UK operators like this. On top of this, there’s a chance the government will classify large-scale farms as nationally significant infrastructure, thus eliminating the possibility of local authorities vetoing their construction.

Property giant

Real estate investment trusts (REITs) can also be a great way to source an income over the long term. They are required to pay a minimum of 90% of their annual rental profits out to shareholders.

Urban Logistics REIT is one I expect to thrive as e-commerce steadily grows. As an operator of storage and distribution hubs, it provides an essential service that allows manufacturers, retailers and delivery companies to get product to online consumers.

In fact, this part of the property market is experiencing a huge shortage. And so like-for-like rents (which grew 19% here last year) look set to continue growing strongly.

High interest rates pose an ongoing problem for its net asset values (NAVs). But on balance, I think Urban Logistics is worth a close look.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

A riskier pick

Growing political and social turbulence in Georgia threatens to derail the country’s banks like TBC Bank Group.

Financial product penetration’s low in the Eurasian country. And it’s been soaring in recent years as the economy there has boomed.

TBC’s own profits have jumped 111% over the past five years. But it’s performance could slow sharply if turbulence in Georgia continues.

However, I believe this threat is reflected in the company’s rock-bottom valuation. Following a recent share price slump, it now trades on a forward price-to-earnings (P/E) ratio of just 4.5 times.

I think it might be a top stock to buy for contrarian investors.